Here’s where YC’s latest group of founders is placing fintech plays • TechCrunch

Y Combinator’s latest cohort of founders have opinions on the future of fintech. A fifth of the accelerator’s Summer 2022 batch, which spans 240 companies, is working on solving problems in the financial area. Tracks range from building the marketplace for micro-retailers in Latin America to creating a way to invest in your favorite athlete.

And while the trajectories are varied, some concentrations show important ways that a group of surveyed entrepreneurs think about the changing landscape in light of discerning risk markets, a downturn and some public market meltdowns. The most popular problem area among this batch’s fintech cohort has to do with payments, which is not surprising. The story actually begins with which focus came second: neobanks.

Thank you, Neobanks

This year’s cohort includes 11 neobanks, a trend we saw start to take off with YC’s W22 cohort which also included 18 such companies. That’s a significant increase from the 1-2 neobanks per batch that made the cut for YC in both 2020 and 2021, suggesting the accelerator is doubling down on founders aiming to build the next “one-stop-shop” for fintech -services .

The neobank entrepreneurs it has chosen to back this summer tend to have highly specialized knowledge of niche markets, giving them the potential to capture the full share of wallet of specific populations they know well rather than trying to cultivate a broader but perhaps smaller deep appeal. Almost half of the new banks in this group are based in the US, while the rest are spread across the UK, Switzerland, India, Nigeria, Senegal and other geographies.

Lagos, Nigeria-based Pivo is focused on freight carriers in Africa, Hostfi is looking to capture the short-term rental host market and Pana says it’s targeting the 62 million Latinos living in the US, just to name a few recent examples. The three companies are respectively founded by a Nigerian port operations manager, an Airbnb superhost and a LatAm-focused digital banking manager, showcasing the deeply focused approach of these founders on several niche segments of the market where they have previous experience.

YC’s concentration of neobanks feels somewhat at odds with the general fintech sentiment these days. There have been a number of examples of why neobanks – despite being low-cost, savvy banking solutions – do not work well: despite mega venture rounds, there are huge losses. Strong growth is possible, but often at the expense of increasing operating expenses.

Still, while some saw big losses in the sector like the end of neobanks, Chime offers hope. The well-known neobank turned EBITDA positive at the end of 2020, showing that the cohort can get to a place of financial health and shutting down some criticism. Still, the world of banking is an increasingly competitive space, as virtually every fintech company fights for consumer wallet share. Neobanks are unlikely to be a winner-take-all market – rather, more specialized upstarts may be better suited to address the specific needs of a given community in a holistic manner. And this batch supports this realization.

International fintech is still a central focus

India has always been Y Combinator’s favorite geography to invest in, outside of the US. Last time, YC’s India entrepreneurs seemed mostly concentrated in the financial sector, around 30% when you consider that out of 36 Indian startups, 11 were in the fintech world. That was a contrast from previous screenings, where most of India’s YC startups fell in the B2B services category.

While last year showed a greater focus on fintech, the courses turned slightly this year. Of the 21 startups YC backed in India, this cohort, roughly 40%, or 8 startups, are in the fintech category. Fintech remains a major area of focus, but B2B took the lead for geography: 47% of YC’s India startups are focused on the corporate world this year.

The slight shift away from Indian fintechs is not necessarily a sign that YC cares less about fintech startups globally. The accelerator backed eight fintech plays in Latin America, worth 57% of its total stakes in the region this season. Latin America’s fascination with fintech continues, it seems, perhaps supercharged by the success of high-profile Brazilian neobank Nubank, which went public and officially became Latin America’s most valuable listed bank late last year.

African fintech has a similar history, with five of the accelerator’s eight investments in the fintech space. There is Anchor, a remote banking-as-a-service platform that has already raised over $1 million for its platform, Bridgecard, a card issuer for Nigeria, and erad, a non-dilutive Middle Eastern startup funding platform.

The future of friendly investment terms

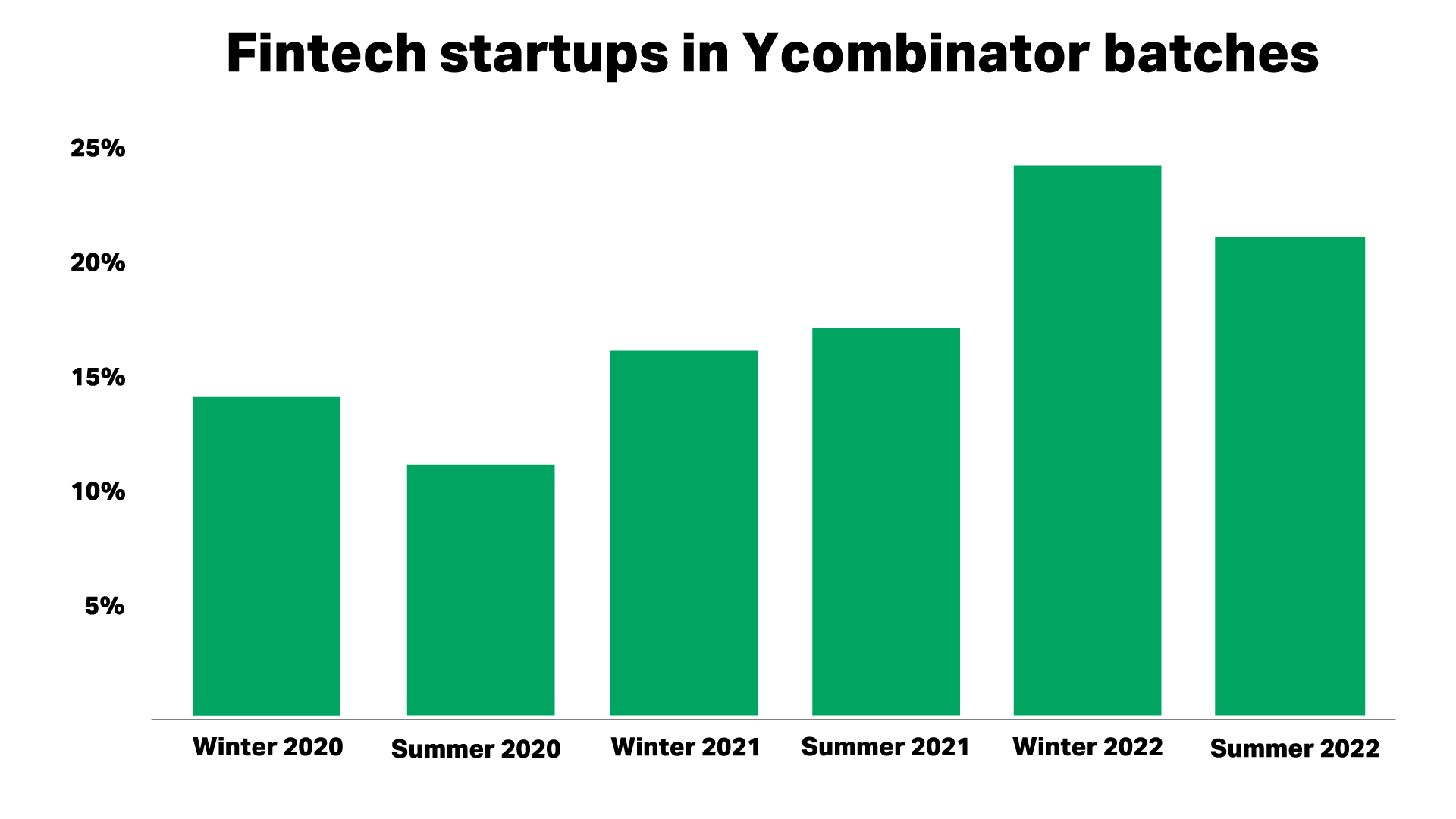

Despite a slight decline in fintech funding for private companies this year compared to the ultra-hot 2021 market, the sector remains much hotter than it was in the past, accounting for nearly 21% of total venture deals as of Q2 2022. YC follows the same trend, with pre-seed perhaps getting a boon in enthusiasm from the fact that late-stage businesses like Stripe or publicly traded fintechs like Robinhood and Affirm don’t exactly feel stable right now.

Here is an overview of the percentage of fintech companies in the accelerator’s latest batches:

As with any sector, we could see competitive tensions within the accelerator itself begin to grow depending on where startups go from here. Crypto startups Eco and Pebble, both YC participants, had a feud earlier this year when Eco’s CEO made accusations against the Pebble founders of “copy and pasting” significant parts of his company.

The overall fintech space is a bloodbath right now as the market has become saturated with companies all playing in similar spaces trying to fight for the same sets of customers. YC’s startups are no exception – only time will tell if their approach of focusing on international companies operating in niche markets will pay off, or if consolidation in the sector has already gone too far for new upstarts to see success.