Here’s what could trigger the next parabolic Bitcoin (BTC) rally, according to Quant Analyst

A widely followed quant analyst reveals what he believes could be the catalyst that sparks the next parabolic rally for Bitcoin (BTC).

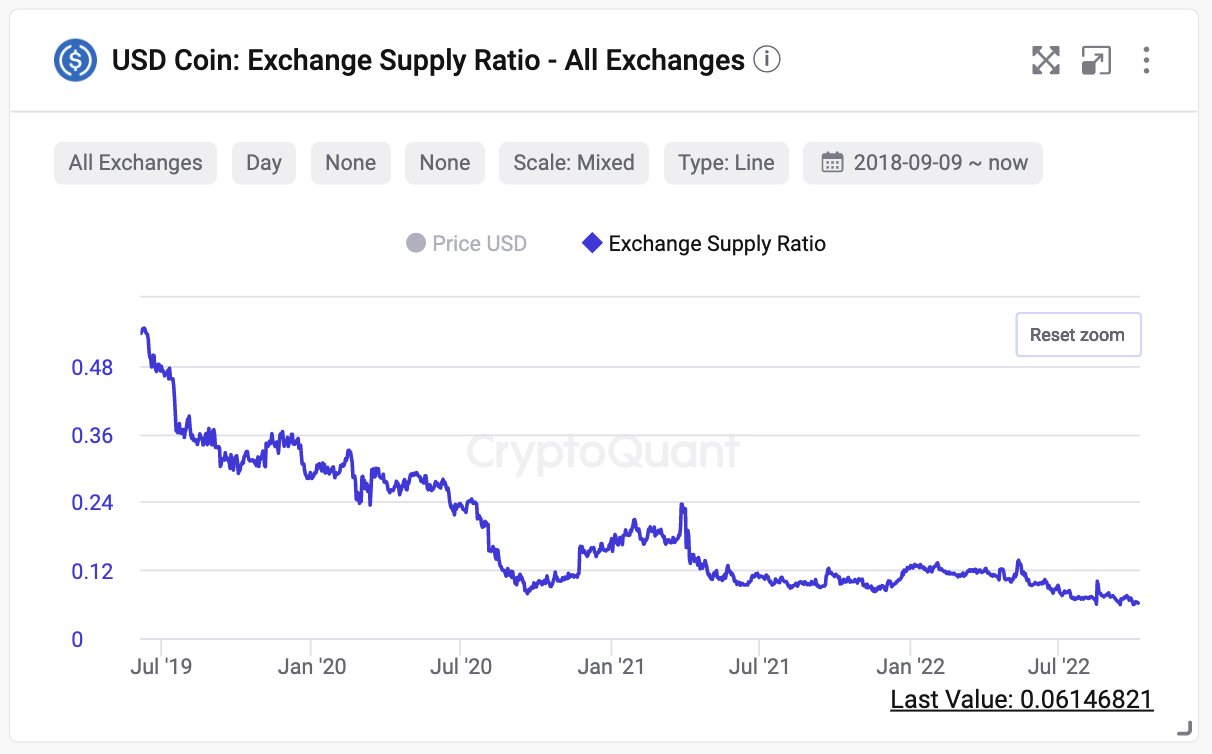

Crypto Quant CEO Ki Young Ju tells his 306,200 Twitter followers that the massive influx of stablecoin USD Coin (USDC) into crypto exchanges could signal the beginning of a new Bitcoin bull market.

“The next Bitcoin parabolic bull run may begin as massive USDC flows into exchanges.

Currently, 94% of the USDC supply is outside exchanges, some of which are owned by TradFis such as BlackRock, Fidelity, Goldman Sachs, etc.

They will move when they get orders from their customers.”

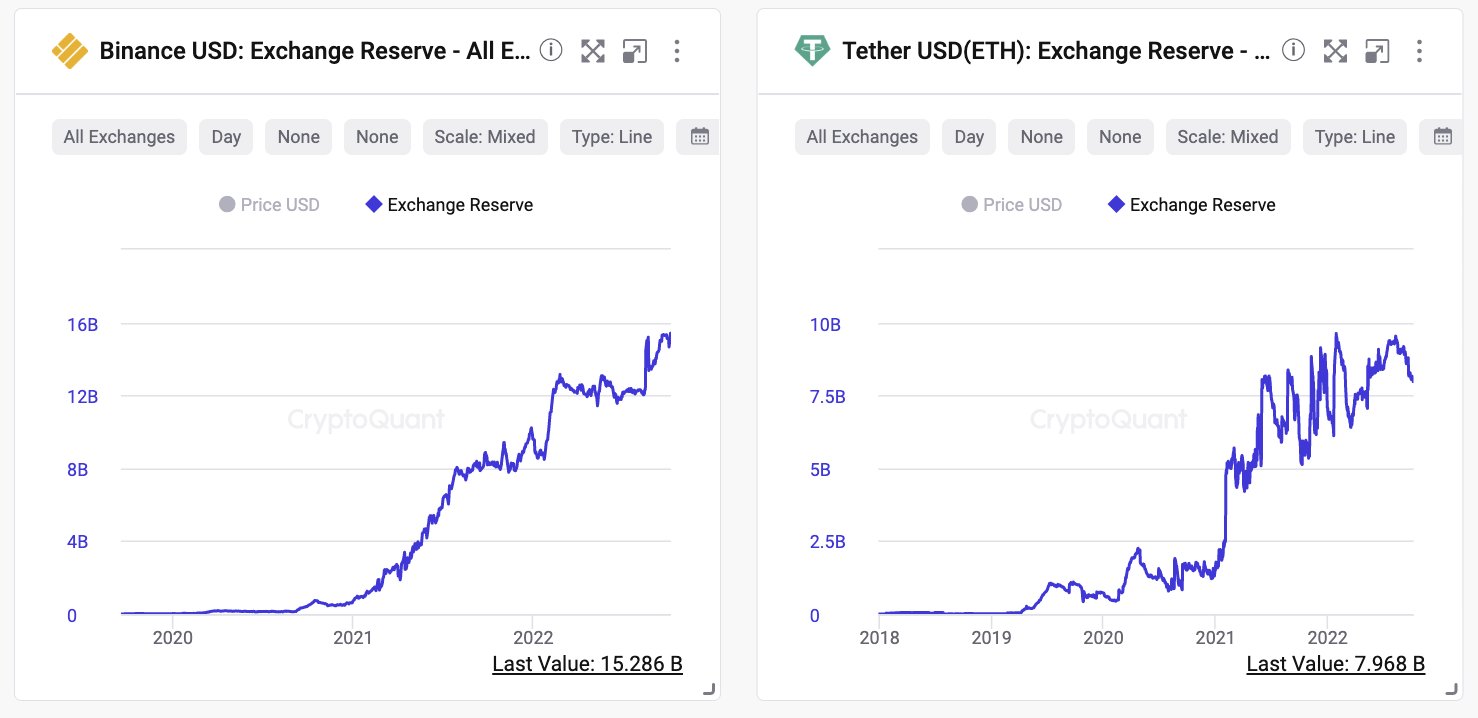

For now, the head of the research firm says that crypto-native stablecoins such as Tether (USDT) and Binance USD (BUSD) are moving back to digital asset exchanges.

“For BUSD, 70% of the offer is in exchange. USDT is 25%.

The BUSD exchange reserve is growing despite bear markets, which may indicate that crypto-natives are accumulating some coins.”

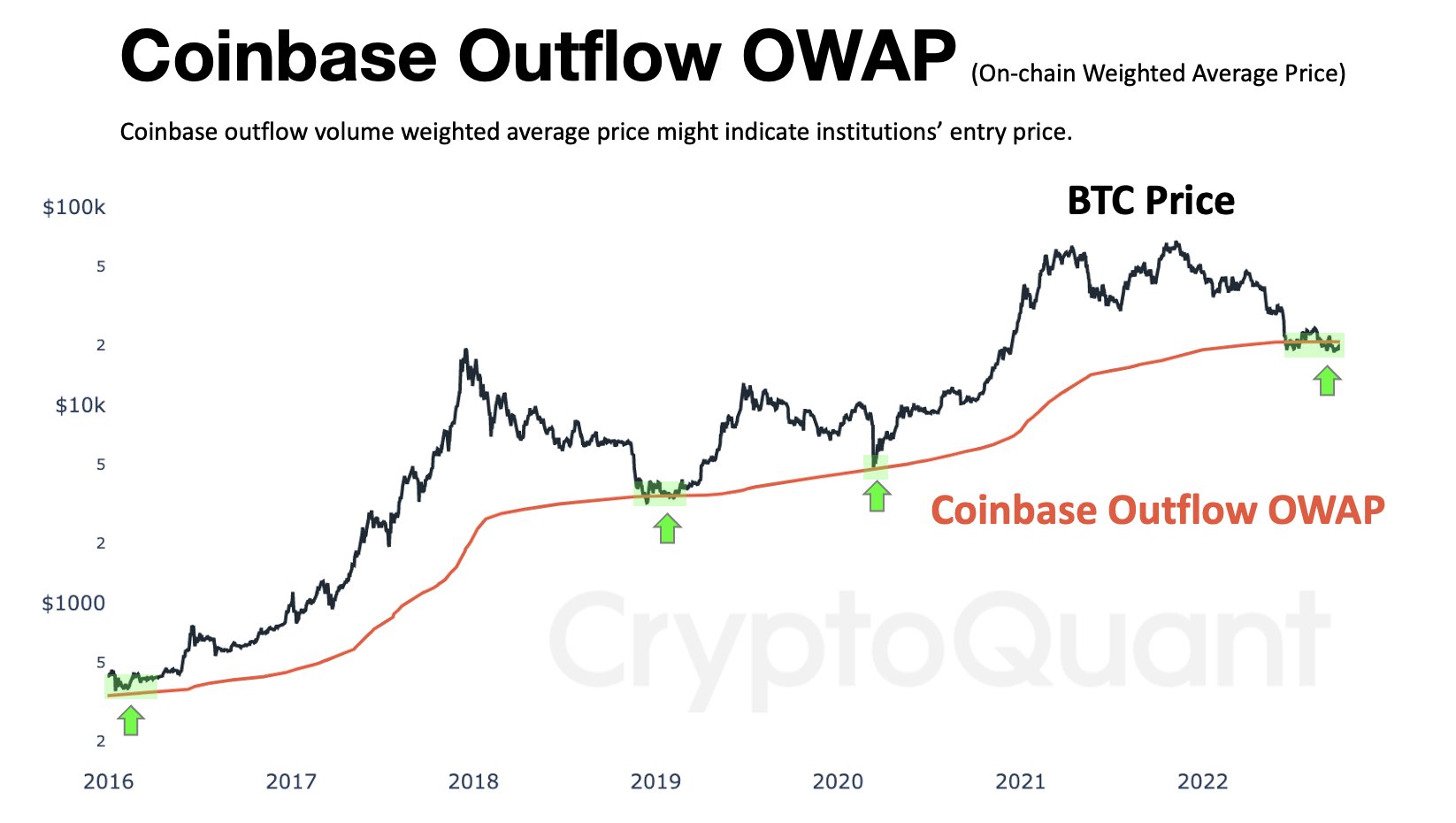

Looking at Bitcoin, Ki Young Ju says he is keeping a close eye on a chain value that could signal that BTC is about to bottom.

“BTC price now is close to the estimated entry price for institutional investors who have used Coinbase services such as prime brokerage, custody, etc. If you still believe institutions drive this market, this bull hopium may work for you.”

According to the chart shared by the analyst, the Coinbase outflow on the chain weighted average price may indicate the entry price of institutional investors. With the calculation approaching BTC’s recent price action, it could indicate that institutions and deep-pocketed investors are defending their Bitcoin positions.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Art Furnace