Here is but of FUD around Bitcoin mining

Bitcoin mining continues to show signs of volatility. With rising mining costs and unpredictable revenues, will interest in mining continue to grow, or will miners move on to greener pastures with proof of work?

Here is AMBCryptos Bitcoin price prediction [BTC] for 2022-2023

One of the reasons behind the growing FUD among Bitcoin miners is the fluctuations in the income generated by miners. In fact, the same has been consistently volatile for the past few months.

In parallel, Bitcoin’s hash rate has also continued to rise, with the same increase of 10% in the last 30 days, according to Messari.

A lot of uncertainty about the revenue generated, combined with an increasing hash rate, can increase the selling pressure on miners.

Source: Glassnode

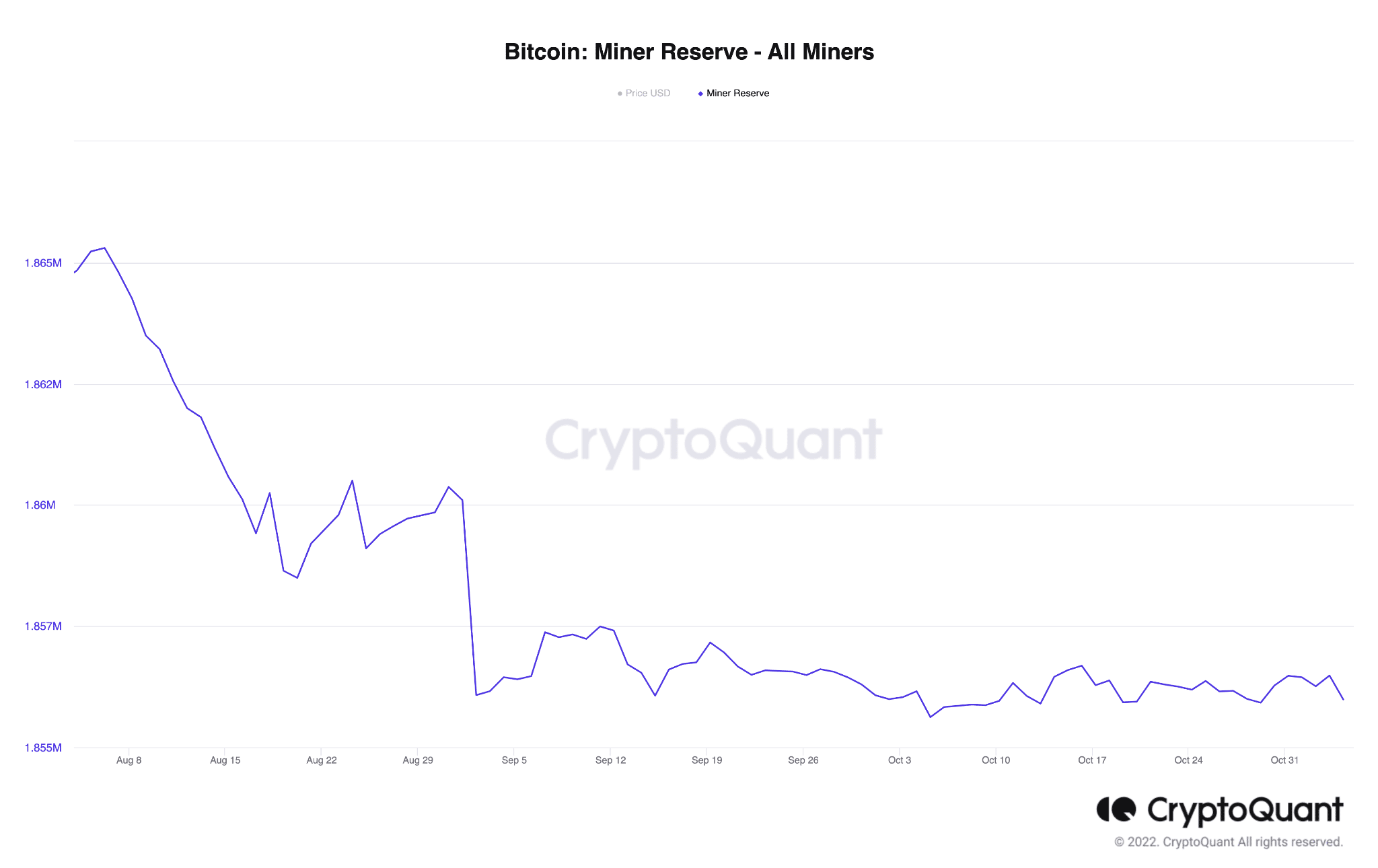

Another indicator of increasing selling pressure will be the decline in miners’ reserves. As can be seen from the chart, Miners’ Reserves for Bitcoin have dropped significantly in the last 3 months. This calculation highlights the reserves that Bitcoin miners have not yet sold. When miners start selling, it can cause prices to drop.

However, despite the decline in revenue generated and high selling pressure, the mining input for Bitcoin miners remained stable and did not witness many fluctuations, according to CryptoQuant. This is a sign that the number of coins received as a reward for mining remained the same, despite volatility in other areas.

Source: CryptoQuant

Fear, uncertainty and impact

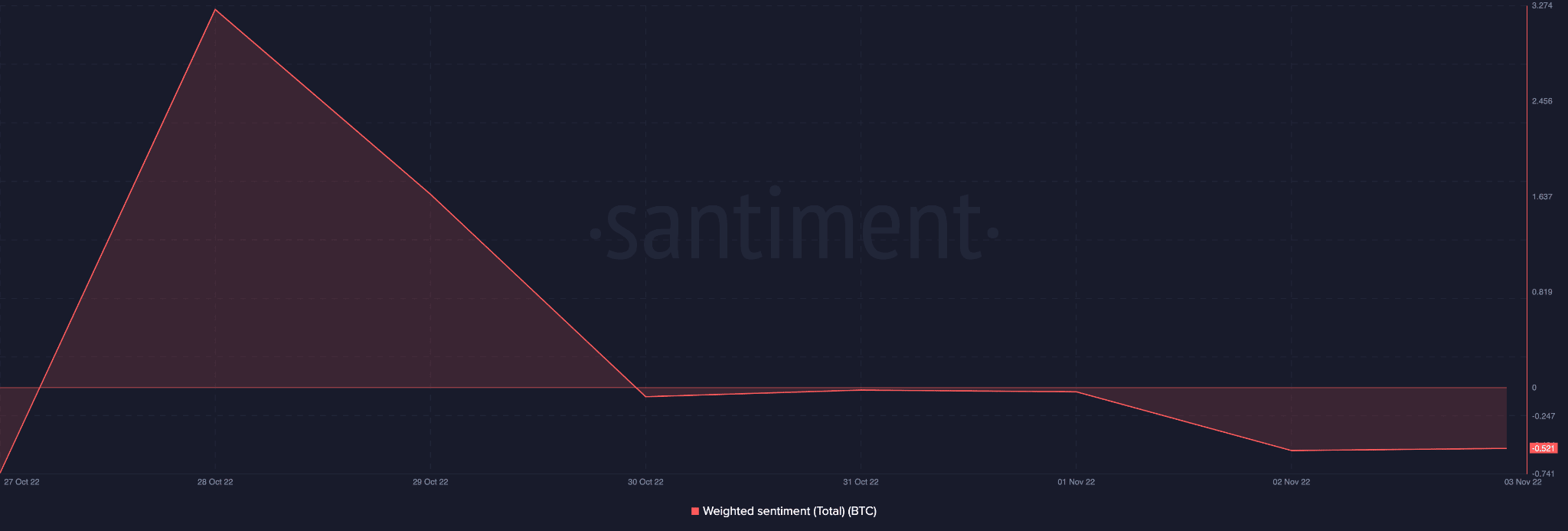

R&D around mining could have led to the drop in weighted sentiment for Bitcoin. As can be seen from the chart attached here, the weighted sentiment went south over the past week $BTC.

A drop in weighted sentiment suggests that the crypto community had more negative than positive things to say about Bitcoin, at the time of writing. Bitcoin was also observed to lose its footing on the social front.

In accordance LunarCrush, a social media analytics firm, over the past 3 months, Bitcoin’s social mentions and engagements have dropped. In fact, the number of social mentions for Bitcoin weakened by 19% and the number of engagements fell by 29% in the last 90 days.

Source: Sentiment

And yet, despite growing negative sentiment and declining engagement numbers, the number of new addresses on Bitcoin’s network has continued to grow.

In accordance glass node, The number of new addresses on Bitcoin reached a 10-month high and 17 thousand new addresses were registered. This influx of new addresses could be positive for $BTC’s prices.

The future of Bitcoin’s price and the fate of its miners will continue to be intertwined. It remains to be seen if miners are willing to weather this bearish storm or if they will soon jump ship.