Helium partners with T-Mobile for 5G and moves to Solana Blockchain

NicoElNino

Helium’s (HNT-USD) ambitious plans to expand its network offerings beyond its low-data, low-power Internet of Things (IoT) network, dubbed “The People’s Network,” are in full swing as it recently announced a partnership with T-Mobil for their 5G network, Helium Mobile. Will this be the next big shift in mobile technology since the iPhone? Let’s dive in.

Laying the groundwork: The many changes at Helium

Before we dive into the Helium/T-Mobile partnership, let’s discuss the many moving pieces at Nova Labs, the rebranded startup that powers all Helium networks with a goal of making it easier to build networks for connecting devices. The highest level change is that Nova Labs is restructuring to become a “network of networks”; Helium started as a standalone blockchain powering the IoT, their flagship product that has shown incredible growth despite being only powerful enough to serve devices like trackers and sensors, but not powerful enough to serve mobile devices. The blockchain established a “proof of coverage” consensus mechanism, currently running 3,500 validators and approaching 1,000,000 hotspots. This was a proof of concept that a decentralized connected device network, albeit a very simple version, could be applied to many border use cases such as 5G, WiFi, VPN, etc. To scale, they have therefore established a “network of networks”, powered by highest level of the Helium DAO network that will provide a high-level governance structure for each subDAO network.

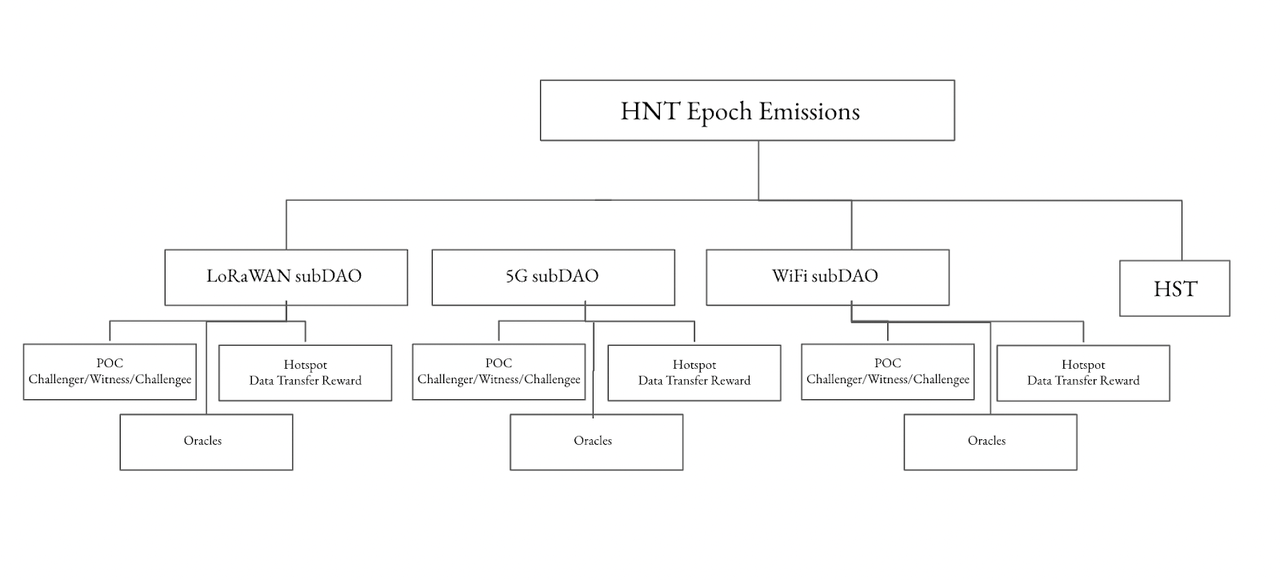

The other big change is that Nova Labs has decided to allocate tokens for each subDAO network. The flagship IoT network will use the IoT token, while the 5G network will use the mobile token. So what happens to the original HNT token? It will continue to exist as a reserve-style currency that powers the network and will be held in each subDAO’s treasury. IoT and mobile token holders will be able to redeem their tokens for HNT from these respective treasuries, but this is a one-way street (HNT cannot be redeemed for either IoT or mobile). There is currently no tradable market for IoT or Mobile tokens, which can only be earned by operating a hotspot on their respective networks. See the image below for further clarity on the new structure:

Helium’s new DAO/subDAO structure (Helium GitHub)

The third major change is the proposal to move the Helium networks from their standalone layer 1 blockchain to Solana (SOL-USD), which overwhelmingly passed on September 22nd. According to a Helium Foundation blog post, “Solana offers significant benefits to Helium that include, but are not limited to, scale, community, and composability. Proof-of-Coverage and data transfer accounting will be moved to Oracles”. This will scrap their new “proof-of-coverage” technology that secured the Helium blockchain network, leveraging data oracles instead.

The Helium/T-Mobile partnership

Nova Labs understood early on that scaling a 5G network and competing directly against the likes of AT&T, Verizon and T-Mobile would be difficult, to say the least. In contrast to the very low-cost hardware required to run the low-data IoT network, a 5G network will require a significant investment from individual hotspot operators; current 5G hardware rigs sell between $2,600 and $5,700. Instead, Nova Labs will utilize the T-Mobile network for all voice calls initially, while data transfers will utilize the Helium 5G network where available and the T-Mobile network where coverage is lacking. Over time, the hope is that Helium 5G coverage will replace T-Mobile coverage and be able to handle a significant portion of voice calls and data. According to the Helium 5G website, plans for the lowest 1GB/month data plan will cost users $5/month, but beyond that the price is still TBD.

Currently, Helium’s 5G network has approximately 5,000+ node operators, a growth of over 60% in the last 30 days, all operating in the US. You can view their IoT network and 5G network on their well-designed block explorer page.

Tokenomics and investment perspective

The changes happening at Nova Labs and the Helium ecosystem are necessary to scale properly. Helium is looking to create a diverse network that can connect many types of devices, which means they need to have the ability to scale to an enormous level. Recognizing that their own monolithic blockchain would not be able to scale properly is a strength for Nova Labs management team to be able to recognize flaws in their current approach and make the necessary changes.

Their financing is also a significant positive from an investment perspective. Their latest funding round, Series D, provided $200 million in additional funding at a $1.2 billion valuation. Their current market cap is roughly half of that valuation of around $593 million. Crypto VCs that have backed the project over multiple seed rounds include: Google Ventures, Andreessen Horowitz, Tiger Global, Khosla Ventures, Multicoin Capital and Union Square Ventures.

Helium has also been able to demonstrate real network growth with their flagship IoT network as they near one million hotspots, and hopes to do the same with their 5G network as they already have over 5,000 5G radios in the US

However, the main question is where does the value arise after all these changes? Does the value accrue at the HNT token level, or will the value accrue with each sub-DAO’s token (ie mobile or IoT)? Do tokens work synergistically, and this is one rising tide that raises all boats scenario, or do tokens dilute or cannibalize each other’s value? This is still to be determined.

With the transition to Solana, we know that Helium validators are no longer needed, and thus the 6.85% HNT emission to validators will now be moved to the reward pool, making it more lucrative to run a subDAO hotspot. The announcement of a Solana-enabled mobile phone actually makes practical sense now, leveraging the Solana blockchain and potentially leveraging Helium Mobile for their coverage, while the Solana mobile phone itself could become a hotspot for a given Helium network, could provide the first real shakeup in the mobile phone world since the invention of the iPhone.

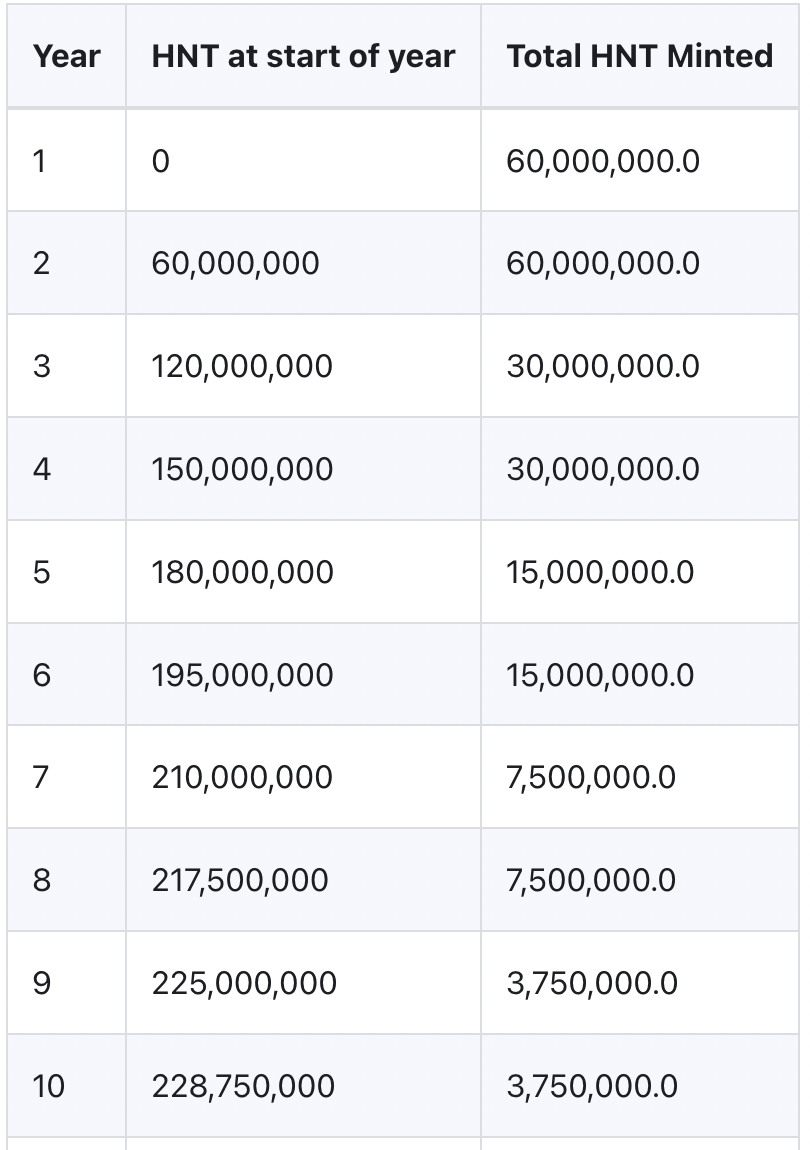

HNT’s current inflation rate is approx. 20%, with a halving of the distribution rate every two years. See the image below for the token distribution schedule, the current circulating supply is just over 125 million tokens, which puts HNT between year 3 and year 4:

HNT Deployment Plan (Helium GitHub)

To reduce the impact of inflation, HNT holders must either operate a hotspot and/or stake their HNT to generate a partially offsetting return. However, from a fundamental level, it is almost impossible at this point to derive any kind of intrinsic value to HNT, mobile or IoT given all the significant changes and the potential for further changes down the road. It is best to keep it simple when formulating an investment thesis for HNT:

The positive ones

HNT is down over 90% from its all-time highs, which makes for a tempting entry point. Helium has a proven track record through the continued growth of their IoT network. The Helium Mobile 5G network has already established a remarkable foundation for 5G Radio hotspots given the capital requirements to operate. Finally, Helium’s ability to scale forward given the new DAO/subDAO structure and the transition to Solana creates the ingredients for something potentially massive here.

There will now be at least two new tokens in the Helium ecosystem in IoT and Mobile, and likely more to come as more networks launch as subDAOs and operate with their own tokens. The SubDAOs keep a supply of HNT in the treasury so that the token holders can redeem their tokens for HNT if they wish. Each subDAO’s treasury receives HNT tokens based on their DAO Utility Score detailed on Helium’s GitHub page. The Treasury reserve naturally creates buying pressure for HNT.

Ethos is important. The many promises of blockchain technology are that individuals can finally have digital ownership of their data and individuals can be the beneficiaries of our own data rather than the current structure where our internet activity and habits are the product of the likes of Google ( GOOGL ) , Facebook (META), etc. Part of the way Helium structured the 5G network is that users can CHOOSE to contribute network activity data for compensation. This should not be overlooked from an investment perspective, as this puts the power back in the hands of the individual and provides a potential dividend to users of the network, which can be used as an onboarding tool.

Unknown and negative

Although the investment potential is huge, it is very difficult to determine where the value will arise. Will value accrue on the subDAO tokens (ie IoT and Mobile), on the DAO token level with HNT, both or neither? Further clarity is needed here.

The move to Solana is a massive shift to the existing Helium structure. The dismantling of Helium’s original blockchain to move to Solana, and therefore scrapping proof-of-coverage and using oracles instead, creates an entirely new mechanism for servicing the various Helium networks. There may be significant hiccups in the transition process. Additionally, it should be noted that Solana is not without its own problems with decentralization and network disruption.

Crypto regulation should be on the minds of all crypto investors. A major concern for Helium is that the only US exchange HNT is listed on is BinanceUS. This could be a foreshadowing of Helium being called a security by the SEC in the future.

The bottom line

The potential for decentralized connected device networks is massive, and Helium is a well-funded project with various networks under development and has the potential to scale and integrate additional device connectivity networks. Helium is well positioned to be the first to market on this concept on a large scale. However, the move to Solana will be a massive undertaking and creates too many unknowns in the short term. In addition, the question behind which token in the Helium ecosystem will actually accumulate is still unknown. A small, speculative allocation to HNT is guaranteed to gain exposure to the massive upside of Helium if they succeed in scaling their 5G network, but we recommend a HOLD until the Solana transition is complete and there is greater clarity around token value vesting .

Side note: this is potentially a massive win for Solana and could be the next big blockchain use case beyond decentralized finance (DeFi) and NFTs. If Helium gets real traction with their 5G network, and the Solana blockchain proves they can handle network demand, this would be very bullish for Solana.