Has US inflation peaked? Five things to know in Bitcoin this week

Bitcoin (BTC) enters another key US macro week with a welcome break to the upside.

Having avoided a now-familiar breakdown around the weekly close, BTC/USD is rising higher at the time of writing on August 8th to once again tackle resistance in place for two months.

Can the bulls win? Momentum appears to be strong across crypto, but a number of potential stumbling blocks lie in the way.

With fresh US inflation data, the macro picture could still disrupt the status quo, while sellers also show no sign of budging to allow recovery of levels above $25,000.

Amid continued claims that Bitcoin is enjoying nothing more than a “bear market rally”, Cointelegraph takes a look at the state of the market as the new week begins.

These five factors will be worth keeping in mind when considering where the Bitcoin price action may take place over the coming days.

BTC Seals 2nd Week Above Key Bear Market Support

Unlike in recent weeks, Bitcoin allowed traders to breathe a sigh of relief at the weekly close on August 7.

Instead of declining at or immediately after the candle closed, BTC/USD instead began to rise, these gains included an impressive hourly candle, which added almost $500.

The close itself was impressive, marking Bitcoin’s highest weekly candle close since June — a firm break from the previous weekly downtrend — data from Cointelegraph Markets Pro and TradingView show.

BTC/USD 1-week candlestick chart (bit stamp) with 200-week MA. Source: TradingView

Additionally, BTC’s price defended its key 200-week moving average (MA) two bars in a row, cementing the likelihood that the trendline is now forming support. This comes despite several tests during the week, with the 200-week MA at around $22,900.

Before the close, some were already predicting volatility.

For popular trading account TraderSZ on Twitter, this would take the form of a “big bullish move”, one that ended up being on the upside.

“I know it’s hard to convince you that $BTC has bottomed. But you can’t ignore it. Never Break This Line in History,” colleague Jibon added alongside a weekly chart with another MA trendline.

Looking at possible targets, anywhere between $25,000 and $28,000, commentators believe, with Cointelegraph already reporting one trader’s expectations of a $30,000 retest.

Analyzing separate data governing two exponential moving averages (EMA), trading resource Stockmoney Lizards agreed with Jibon that a macro bottom has already been completed for Bitcoin.

“Cycles repeat themselves. Shortly after the EMA bands are crossed, the cycle is low. From there, the uptrend is close,” it summarized on August 7:

Medium term target 38k – 40k which is in this descending resistance level area. After this we will see a breakout and another bull run.

$40,000, while high by today’s standards, is also not without supporters — even as part of an extended bear market rally.

US inflation picture complicated by falling commodities

The main macro event in what is otherwise a sleepy summer month will come in the coming days.

US inflation will remain at the top of the list of topics of discussion in crypto beyond August 10th when the Consumer Price Index (CPI) numbers for July hit the radar.

The schedule is already ingrained in the minds of risk-asset traders everywhere – while not indicative of a specific trend per se, CPI releases are reliably accompanied by market volatility before, during and after the fact.

The question on everyone’s lips this time, however, is whether inflation has peaked.

The issue is complex: Fuel prices began to fall in July, while CPI components such as rent prices, conversely, reached all-time highs.

The decline in commodities is a key reason for optimism for Tesla CEO Elon Musk, as Cointelegraph reported, who used the trend as a basis to suggest that inflation would decline from here.

“Obviously this could change, but the trend is down, which suggests we are past peak inflation,” he said during Tesla’s annual shareholder meeting last week.

However, after months of key rate hikes, the Federal Reserve will not make a decision on further monetary policy moves until September. More broadly, the central bank is in a bind, commentators argue, and is unable to raise interest rates much longer without unintended side effects.

Old hands keep at it

According to on-chain monitoring resources, hodlers are unfazed by the recent increases in BTC price action after months of decline.

While this is not unusual, it is still interesting to see how the will of long-term owners will be tested if further gains come in.

In automated updates this week, chain analytics firm Glassnode noted that the amount of BTC supply last active in the past 24 hours is declining on average, potentially reflecting a lack of knee-jerk reactions to price movements.

Likewise, the seven-day MA of median transaction volume on the chain hit its own one-month low on the day, breaking its previous lows from August 1.

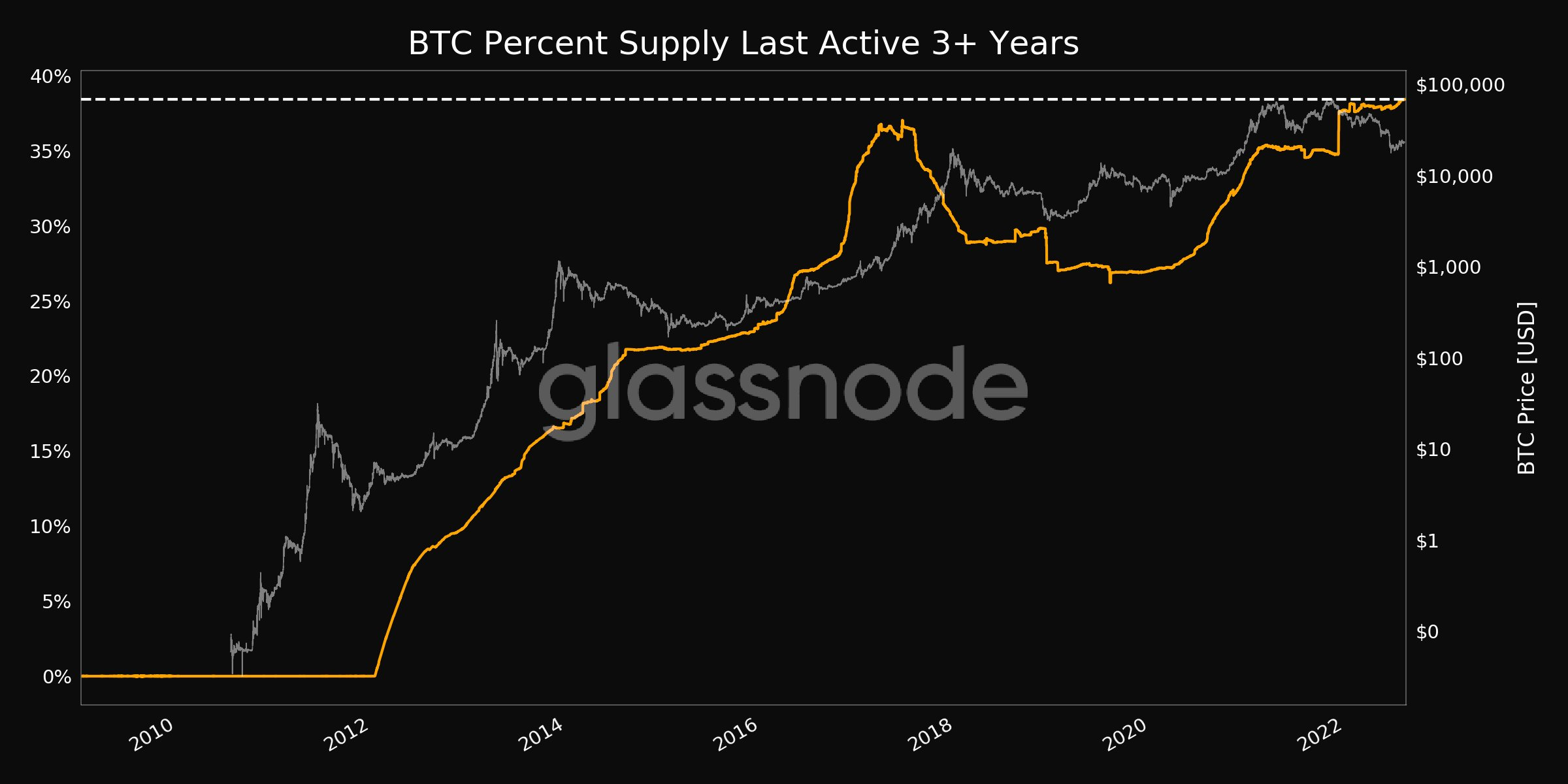

On higher timeframes, the trend is also visibly skewed towards pragmatism. The share of BTC supply that has been dormant in wallets for three years or more continues to rise, reaching new all-time highs of 38.426% on the day.

Bitcoin % offer last active 3+ years ago chart. Source: Glassnode/Twitter

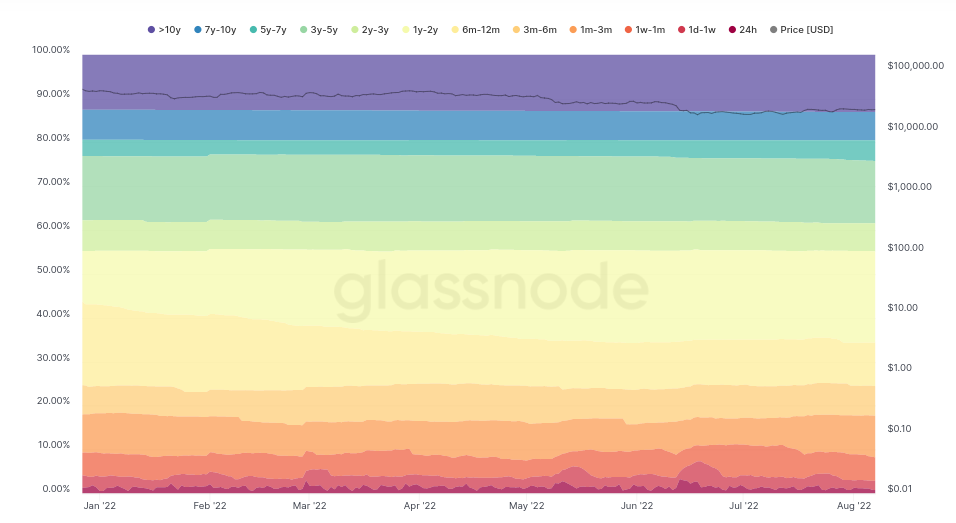

The changes are easier to see on the HODL Waves metric, which provides an overview of what proportion of the BTC supply has been dormant for certain periods of time.

2022, it shows, has seen a marked increase in stationary coins for between one and two years.

Bitcoin HODL Waves Chart (Screenshot). Source: Unchained Capital

Coinbase order book is ‘dead’

In terms of hoarding, current conditions appear to be severely lacking for exchanges due to little genuine interest in buying crypto assets.

While the world’s largest asset manager, BlackRock, announced a partnership with US exchange Coinbase last week, the order book remains “dead”, says one commentator, with interest from retail this summer.

The Byzantine general further noted a “crazy imbalance” between bids and asks, indicating that the majority of exchange users are waiting for BTC/USD to match the June low of $17,600.

Data from the Binance order book provided by chain monitoring resource Material Indicators also highlights gaps in activity well above $24,000.

However, this can change quickly as the spot price moves up and down the trading range.

BTC/USD Buy and Sell Levels (Binance) as of August 7. Source: Material Indicators/Twitter

Sentiment “unironic” marks the price bottom

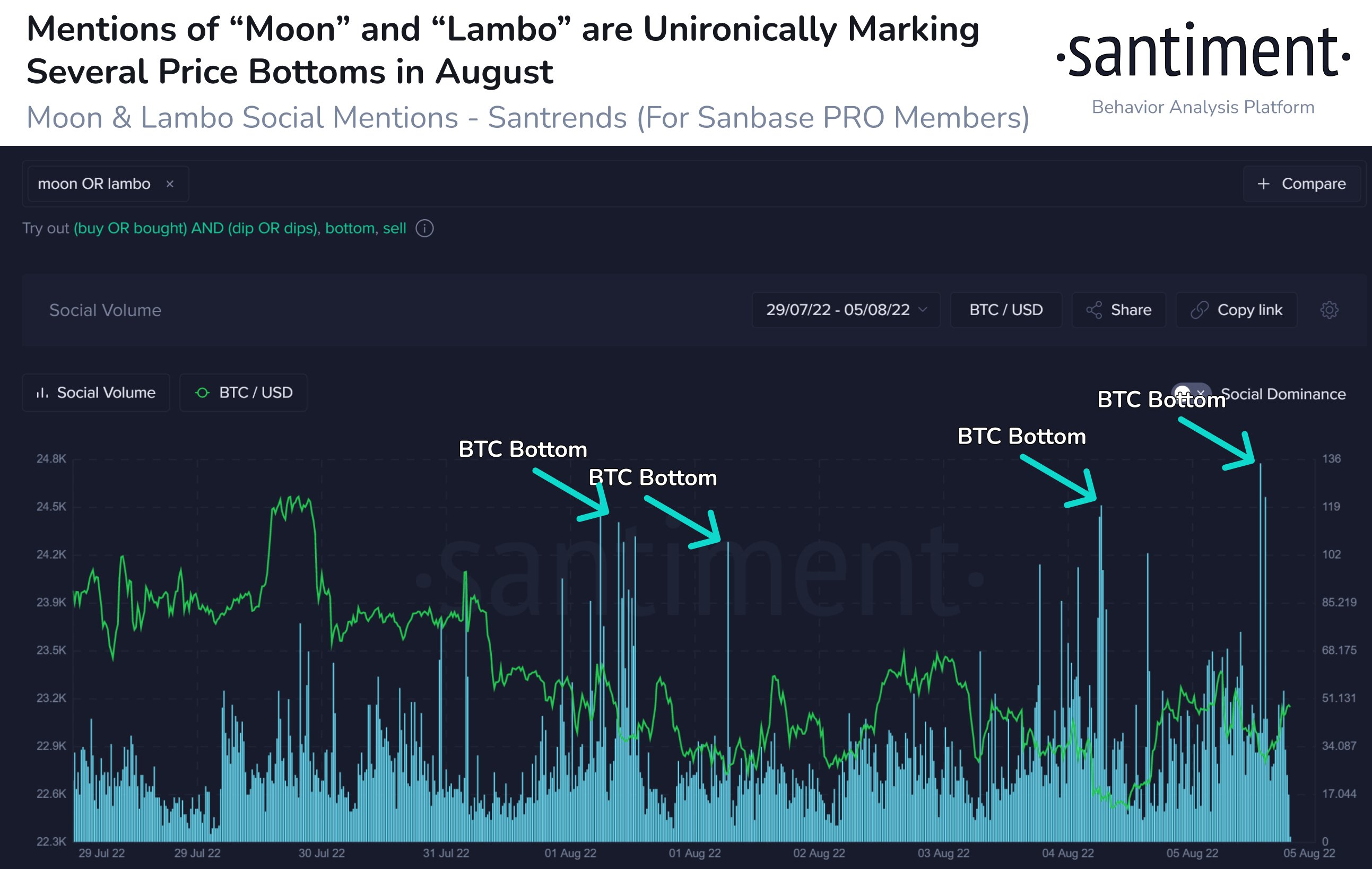

When it comes to the bear market rally, sentiment data can provide an unlikely clue as to whether the true bottom is indeed in.

As noted by research firm Santiment and macro analyst Alex Krueger, mainstream interest in Bitcoin bear markets actually tends to peak soon after, not before, macro asset price bottoms.

While Kruger contrasted the events of March 2020 with 2009 in the S&P 500, Santiment pointed to Bitcoin-related social media content around the BTC price floors.

Even mentions of classic crypto audience terms like “moon” and “Lambo” peak when the worst of the price decline is done, it concluded in findings published last week.

“During the 2022 crypto crash, the public has sarcastically called for moon and lambo as prices fall again,” researchers explained on Twitter:

The true irony, however, is that the spikes in these words actually often mark moments when $BTC is about to rise.

Bitcoin social media engagement chart. Source: Sentiment/Twitter

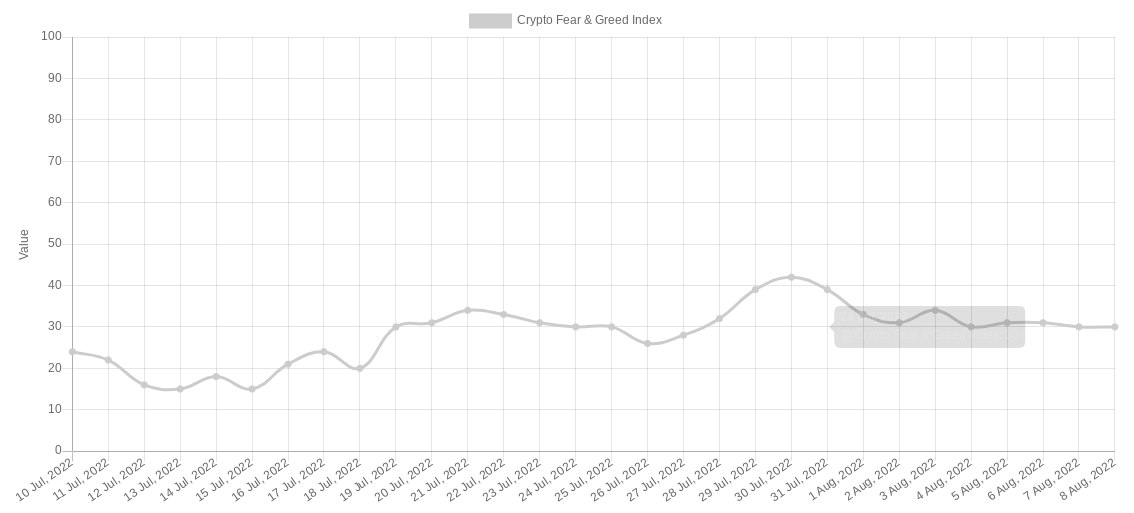

Meanwhile, according to the sentiment gauge, the Crypto Fear & Greed Index is building support above the market’s “extreme fear” zone, which has been absent since mid-July.

The index measures 30/100 on August 8, unchanged from the previous day and representative of “fear” as the general market sentiment. “Extreme fear” corresponds to a score of less than 25.

Crypto Fear & Greed Index (screenshot). Source: Alternative.me