Growing demand for real-time fund transfers strengthens growth

Global blockchain in the banking and financial market

Dublin, Jan. 11, 2023 (GLOBE NEWSWIRE) — The “Blockchain In Banking And Financial Services Global Market Opportunities And Strategies To 2031” report has been added ResearchAndMarkets.com’s Offering.

This report describes and explains blockchain in the banking and finance market and covers 2016-2021, called the historical period, and 2021-2026, called the forecast period, along with additional forecasts for the period 2026-2031. The report evaluates the market across each region and for the major economies in each region.

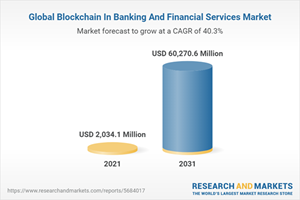

The global blockchain in banking and finance market reached a value of nearly $2,034.1 million in 2021, having increased at a compound annual growth rate (CAGR) of 62.7% since 2016. The market is expected to grow from 2,034, $1 million in 2021 to $17,583.4. million in 2026 with a rate of 53.9%. The market is then expected to grow at a CAGR of 27.9% from 2026 and reach $60,270.6 million in 2031.

The growth in the historical period was a result of the increasing demand for fast and real-time transfers of funds, the increasing use of digital banking services, strong economic growth in emerging markets and increased government initiatives. Factors that affected growth negatively in the historical period were the increasing risk of cybercrime and a lack of skills.

Going forward, the increase in the use of blockchain technology in the banking sector, growing use of cryptocurrency, and the increased use of blockchain to reduce fraudulent transactions will drive the market growth. Factors that may hinder the growth of blockchain in the banking and finance market in the future include scalability of blockchains and data localization.

Blockchain in the banking and finance market is segmented by type into public blockchain, private blockchain and others. The public blockchain market was the largest segment of the blockchain in banking and finance market by type, accounting for 62.0% of the total market in 2021. The public blockchain market is expected to be the fastest growing segment of blockchain in the banking sector. and financial services market type, going forward with a CAGR of 55.6% in the period 2021-2026.

Blockchain in the banking and finance market is segmented by application into fund transaction management, real-time loan financing, liquidity management and others. The fund transaction management market was the largest segment of the on-demand blockchain in banking and finance market accounting for 53.5% of the total market in 2021. The fund transaction management market is expected to be the fastest growing segment of the on-demand blockchain in banking and finance market, going forward with a CAGR of 58.1% in the period 2021-2026.

North America was the largest region in the blockchain in banking and finance market, accounting for 37.5% of the global market in 2021. It was followed by Western Europe, Asia Pacific, and the other regions. Going forward, the fastest growing regions in the blockchain in banking and finance market will be South America and the Middle East, where growth will be at CAGRs of 71.5% and 67.1%, respectively, from 2021-2026.

The global blockchain banking and finance market is moderately fragmented, with a large number of regional players operating in the market. The top ten competitors in the market accounted for 53.35% of the total market in 2021. Major players in the market include SAP SE, Amazon Web Services, IBM, Accenture plc, Oracle Corporation, ConsenSys, Hewlett Packard Enterprise, Bitfury Group Limited, Infosys and Auxesis Services & Technologies (P) Ltd.

The largest opportunities in the blockchain in the banking and financial services market segmented by type will arise in the public blockchain market, which will achieve $10,245.8 million in global annual sales by 2026. The largest opportunities in the blockchain in the banking and financial services market segmented by application will arise in the fund transaction management market, which will achieve $9,678.1 million of global annual revenue by 2026. The blockchain in banking and finance market will gain the most in the United States with $6,209.2 million.

Market trend-based strategies for blockchain in the banking and finance market include a focus on blockchain technology for insurance, a focus on blockchain integration in asset servicing, a focus on strategic mergers and acquisitions, and a focus on digital currencies.

Strategies adopted by players in the blockchain in the banking and financial market include expanding the product portfolio with new and advanced technology at new product launches, focusing on driving a new wave of digital transformation through financing projects and focusing on expanding the business’ presence through strategic collaboration.

|

Report attribute |

Details |

|

Number of pages |

254 |

|

Forecast period |

2021–2031 |

|

Estimated market value (USD) in 2021 |

2034.1 million dollars |

|

Projected market value (USD) by 2031 |

60270.6 million dollars |

|

Compound annual growth rate |

40.3% |

|

Regions covered |

Global |

scope

Markets covered:

-

1) By Type: Public Blockchain; Private Blockchain; Second

-

2) Upon application: Fund transaction management; Real-time loan financing; Liquidity management; Second

Key topics covered:

1. Summary

2. Table of Contents

3. List of figures

4. List of tables

5. Report structure

6. Introduction and market characteristics

7. Major market trends

7.1. Blockchain technology in the insurance industry

7.2. Blockchain Integration In Asset Servicing

7.3. Strategic mergers and acquisitions

7.4. Issuance of central bank digital currencies (CBDCS)

8. Global Market Size and Growth

9. Global blockchain in banking and financial market segmentation

10. Blockchain in banking and financial market, regional and country analysis

11. Asia-Pacific market

12. The Western European market

13. Eastern European market

14. North America market

15. South America market

16. The Middle East market

17. Africa market

18. Competitive landscape and company profiles

19. Important mergers and acquisitions

20. Blockchain in banking and financial market opportunities and strategies

21. Blockchain in the banking and financial market, conclusions and recommendations

22. Appendix

23. Copyright and disclaimer

Cabout companies mentioned

-

SAP SE

-

Amazon Web Services

-

IBM

-

Accenture plc

-

Oracle Corporation

For more information on this report, visit https://www.researchandmarkets.com/r/8igqg2

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We bring you the latest data on international and regional markets, key industries, top companies, new products and the latest trends.

Attachments

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900