Grayscale Bitcoin Trust (GBTC): ETF conversion may happen faster than many expected

Olemedia

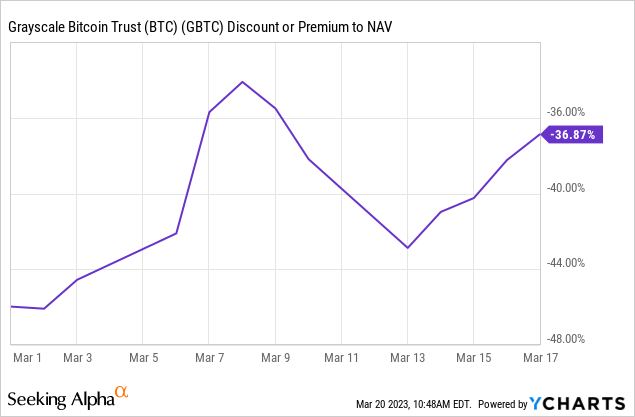

I have been in a measured Bitcoin (BTC-USD) accumulation mode since October 2022. I have been particularly interested in the Grayscale line of products such as Grayscale Bitcoin Trust (OTC:GBTC). I intend to keep this until Grayscale converts it to an ETF (thus closing the discount to NAV on this closed-end fund). GBTC is currently trading at a 36.87% discount. I think that is still a very wide discount (very few closed-end funds trade at such a discount) that is not justified to begin with, but especially not because Grayscale sued the SEC for not allowing it to convert GBTC to an ETF.

GBTC discount to NAV (Grayscale)

This lawsuit signals that the company wants to convert the closed-end fund into an ETF/ETN. There are also clear business incentives because converting GBTC to an open product will create the biggest such US-based product. The largest ETF/ETN in a category tends to attract quite a bit of the flows. It is also a much easier vehicle to hold or trade for many investors.

Unfortunately, the FTX blowup set the crypto world back a bit. It certainly doesn’t help Grayscale with its case against the SEC. A month ago I didn’t think there was any rush to get this, but thought it might look like a great buy in a few years.

Two important things have changed:

1) Grayscale’s oral arguments in the Grayscale vs SEC case went very well.

2) The tension around deposit security again casts Bitcoin in a favorable light.

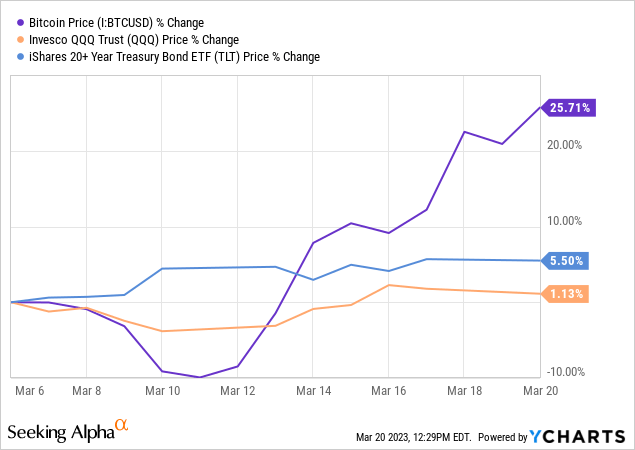

The recent banking turmoil with today’s acquisition of Credit Suisse ( CS ) by rival UBS ( UBS ) will not have escaped anyone’s attention. Bitcoin’s popularity was likely a product of the Great Financial Crisis and the widespread unhappiness surrounding banking. This sentiment is becoming more prominent as the banks burst again. I think this is reflected in the recent Bitcoin price action. It took off around March 10 when Silicon Valley Bank failed:

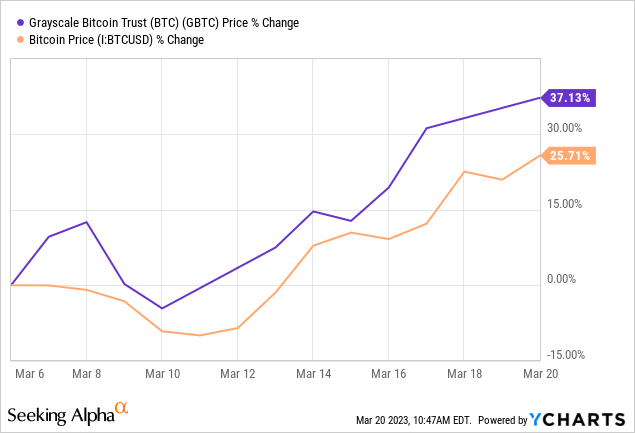

GBTC price (YCharts)

In part, it is also a duration trade. Bitcoin also seems somewhat correlated with the 30-year Treasury and the Nasdaq.

With interest rates falling hard through the banking crisis, this is also a tailwind. But in my opinion, that only explains part of the oversized feature.

Bitcoin price (YCharts)

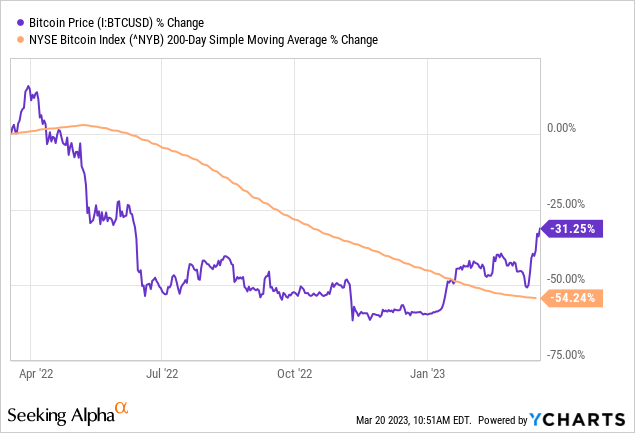

Bitcoin is rising above its 200-day moving average, and the longer it is ahead, the more and more quantitative traders (momentum/trend followers) start buying into that trade.

The movement in the GBTC has been even more pronounced, and it is because of the March 7th oral argument hearing that went very favorably for the GBTC. GBTC also broke through the 200-day moving average and is likely to be picked up by quantitative strategies (these were previously likely to be short).

The way I understand the Greyscale vs SEC lawsuit is like this: Grayscale claims it’s not true if the SEC 1) allows a Bitcoin futures ETF but not a 2) Bitcoin spot ETF.

I understand Grayscale’s argument as follows (remember, I’m not a lawyer, you can read the unofficial transcript here):

- Futures derive their prices from the spot and are approved by the SEC

- Because SEC has accepted the situation of futures ETF where; futures and off-exchange manipulation will be detected by the CME (Futures exchange) a Bitcoin spot ETF (while fraud monitoring futures) should also be allowed

The SEC’s position is contradictory when it argues that the manipulation of the over-the-counter Bitcoin spot will be detected in Futures because the price action will also show up there.

The SEC also argues that the manipulation of Bitcoin spot off-exchange to defraud investors in a potential spot ETF will not necessarily show up in futures and may not necessarily be detected.

Greyscale then argues that the spot ETF can rely on the same fraud monitoring system that the futures ETF uses.

The SEC’s defense against this appears to be that Grayscale must first determine whether futures or spot Bitcoin can be considered to lead the other.

This again seems to be a peculiar argument because 1) the futures market did not exist before they were allowed to trade. 2) I would argue that this is not how liquid markets work. Futures and spot markets are much more likely to be part of a price dialogue. A dialogue held in check by moderators (ie arbitrators). Sometimes one will lead, and other times another market will lead. It cannot be true that one market leads consistently, otherwise arbs will start showing other markets before the lead disappeared.

It looks very much to me like the SEC is citing dubious reasons to stop the creation of a spot ETF. Another sign that the case may be quite weak was the attempt to invoke the Chevron doctrine. The doctrine makes it more difficult to guess the agency:

The scope of the Chevron deference doctrine is that when a legislative delegation to an administrative agency on a particular question or issues is not explicit, but rather implicit, a court may not substitute its own interpretation of the statute for a reasonable interpretation made by the executive agency. . Rather, as Justice Stevens wrote in Chevron, when the statute is silent or ambiguous with respect to the specific question, the question before the court is whether the agency’s action was based on a permissible construction of the statute.

The judges also seemed interested in the $4 billion in value that would be unlocked if GBTC were allowed to be converted into an ETF (due to the vanishing discount). A practical effect that would be of great benefit to investors.

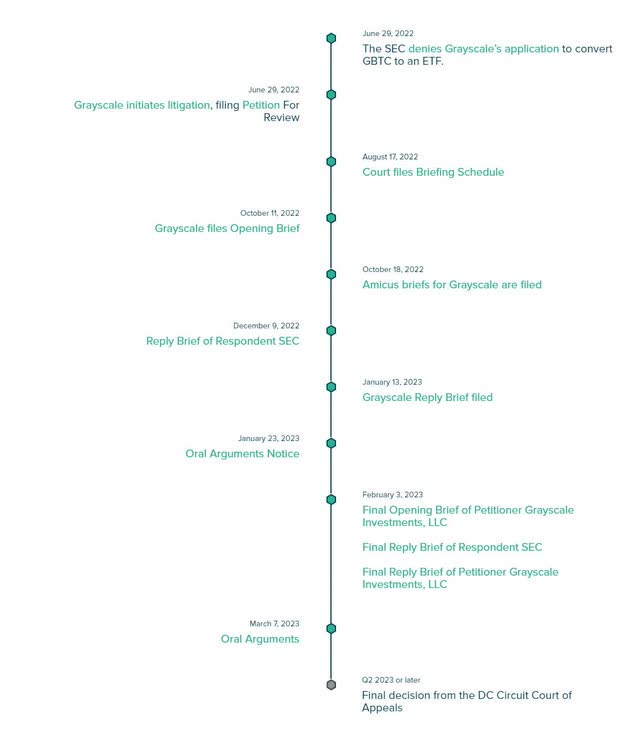

The timeline for the case looks like this:

Grayscale vs SEC Timeline (Grayscale)

A decision could follow as soon as Q2 of 2023. That doesn’t necessarily mean the discount will close. It will likely limit given the recent response. However, the SEC does not have to approve the conversion. If the SEC is found to be wrong here, it could choose to get rid of futures ETFs to equalize the treatment of the two classes. It seems like an unlikely answer, but it is theoretically possible.

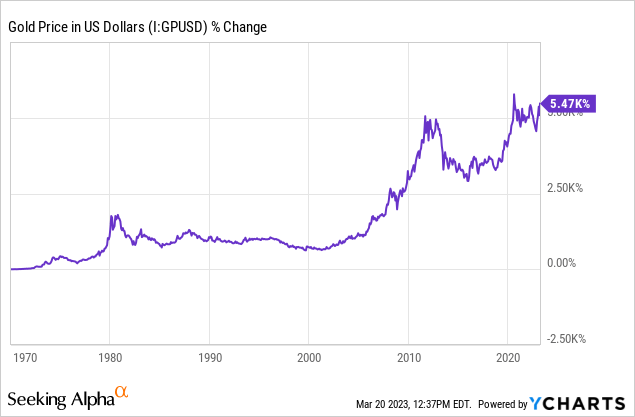

Finally, one last thing I think is important to understand is that a real US Bitcoin ETF will likely have an impact on Bitcoin itself. It makes the asset even more accessible and integrates it into the existing investment universe. When a gold ETF was launched it seems to have permanently affected the valuation of the metal.

On November 18, 2004, State Street launched the SPDR Gold Shares ETF (GLD), it exceeded $1 billion in assets in its first three days of trading. My impression has always been that it had a marked impact on the price of gold because it became much easier to include as part of an asset allocation plan:

I’m not sure if the recent bank panic-induced Bitcoin spike has legs, but several other potentially more lasting tailwinds could begin to drive Bitcoin back toward previous highs. I still think it’s quite likely that Grayscale Bitcoin Trust (OTC:GBTC) will look like a solid buy a few years from now.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.