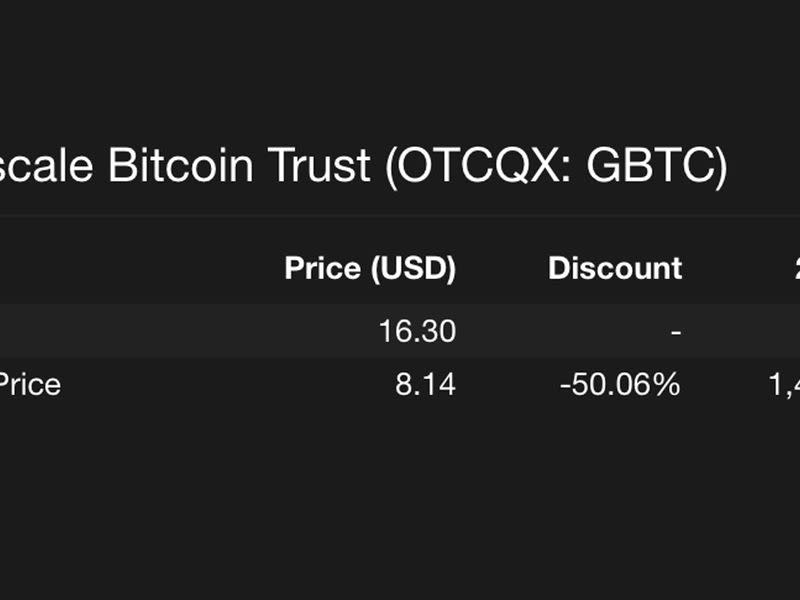

Grayscale Bitcoin Trust Discount Hits Record 50%

Grayscale Bitcoin Trust (GBTC) shares hit a record discount rate to the price of bitcoin (BTC), pushing past 50% for the first time after the US Securities and Exchange Commission reiterated its reasons for rejecting an application to convert the world’s largest bitcoin fund of an exchange-traded fund.

Crypto analysts have said the discount would likely close if the conversion went through, as the redemption process available to ETF market makers would likely see the shares traded back against the price of the underlying bitcoin.

Over the past couple of hours, the discount has since pulled back a bit to around 48.66%.

Managed by Grayscale Investments, GBTC was designed as a way to allow investors in traditional markets to gain exposure to bitcoin, the largest cryptocurrency. The fund currently has around $10.7 billion in assets under management, a figure that is down 65% over the past 12 months, largely thanks to this year’s sharp decline in crypto prices.

The fund trades at a discount in part because investors, while free to sell GBTC shares in the market, have no option to redeem their holdings in exchange for bitcoin in the trust. And in the meantime, they are charged a 2% fee.

Negative sentiment surrounding the trust has swelled in recent weeks as fears emerged that crypto trading firm Genesis Global Trading, owned by Grayscale’s parent company Digital Currency Group (DCG), may file for bankruptcy.

Grayscale says it’s business as usual, but analysts and Twitter posters have suggested that any financial fallout for DCG could at some point affect GBTC. (CoinDesk is an independent subsidiary of DCG.)

Pablo Jodar, a cryptoanalyst at GenTwo, a financial services provider, said some “investors do not trust the information that Grayscale discloses about the amount of bitcoin they hold, which contributes to selling pressure.”

He also said that a recent wave of withdrawals from major crypto exchange Binance may have dampened market sentiment. “The market doesn’t trust middlemen anymore, which is why you see investors moving money out of exchanges and financial instruments like GBTC,” he added.

Grayscale is currently being sued by hedge fund Fir Tree to obtain details of GBTC to investigate potential mismanagement and conflicts of interest. The firm said it wants Grayscale to resume redemptions and cut its 2% fees for the trust.