Good Faith Doctrine and NFTs – How a Boring Monkey NFT Dilemma Can Present Unique Copyright and Contract Issues

“NFT buyers have been enticed by the idea of marrying the digital image with derivative rights. This practice should not be rejected solely because of the risk, but buyers should exercise caution when acquiring these assets.”

Source: Wikipedia (fair use)

Could something called a “Bored Monkey” be embedded in a non-fungible token (NFT) and associated with smart contracts? How can this present unique and challenging questions regarding copyright law? Over the past two months, the public has tracked down what started as a phishing scam involving actor Seth Green’s NFT from the Board Ape Yacht Club. It then developed into a public quest to regain NFT and the rights to develop a broadcast program based on the character depicted in the digital image. The trials and tribulations associated with Seth Green’s efforts to finally regain its “lost” NFT, yielded interesting media clicks. It also raised awareness of copyright issues that have not yet been fully resolved. Seth Green may be reassured to know that he is once again the rightful owner of his Bored Ape NFT, but the legal community should not be as quick to move on.

Boring monkeys

Bored Ape Yacht Club is not unique to Seth Green. According to their website, the Board Ape Yacht Club is a collection of 10,000 unique NFTs made by four friends who “set out to make some dopaper, test [their] skills, and try to build something (ridiculous). ” Numerous celebrities have been associated with the purchase of individual Bored Ape NFTs, which has allowed the collection to be valued at over $ 1 billion. The popularity and alleged appreciation of the Bored Ape Yacht Club collection is both interesting and confusing, and often elicits an involuntary head-shaking response. But celebrity status “must have” is not what makes this special set of NFTs that contribute to a good copyright discussion. Rather, and more importantly, when the original authors created the Bored Ape Yacht Club collection, they also made it clear that each holder of an individual NFT would have full commercialization rights to his individual monkey depicted in the NFT. According to Fast companyhis review of the Bored Ape Yacht Club, “whoever owns a Bored Ape can spin it into whatever movie, music, TV, book or media project they want.” It was the commercialization rights and not the digital image that were the primary concern for Seth Green, and they present us with a major legal issue for discussion.

The saga of the stolen monkey

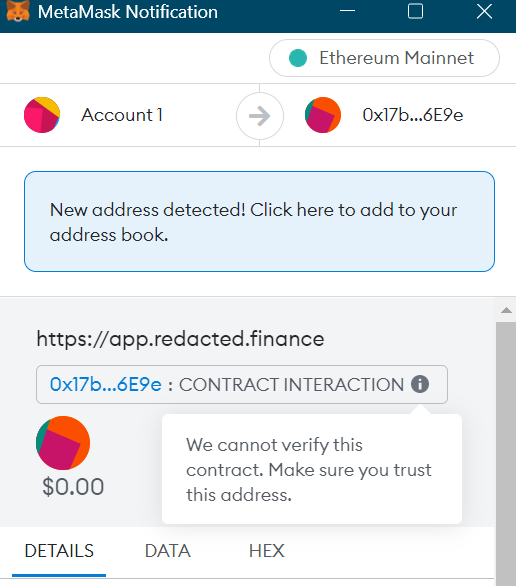

Seth Green claimed he was the victim of a phishing scam in which a criminal was able to access the Ethereum Blockchain software’s wallet application. Access to Green’s wallet application for Blockchain software again gave access to his NFTs, which included an individual Bored Ape NFT from the Bored Ape Yacht Club collection. The stolen NFT included not only the digital image of Bored Ape, but also the entire set of rights under the Copyright Act for the commercialization of Bored Ape. These rights were most likely enshrined as a smart contract stored on the Ethereum Blockchain. According to Green, an alleged good faith buyer bought the stolen NFT from the perpetrator, which was all documented in the transaction register stored on Blockchain. Green later discovered the unauthorized transfer and publicly stated that he was facing the potential of not only losing ownership of the specific digital image embedded in the NFT, but also losing the rights to the commercialization effort that was allegedly underway. After some public complaints to Twitter and paid $ 260,000 to the buyer in good faith to acquire the stolen NFT, the Seth Green saga ended, but not before they created a question that did not necessarily have a clear answer.

Good Faith buyers and NFTs

Since the problem with Seth Green appears to have been resolved, it is unlikely that we will know the details of the theft of the NFT and the subsequent, alleged purchase in good faith of the stolen NFT.

Nevertheless, the general facts of the Bored Ape NFT saga raise the question: Should the doctrine of good faith buying apply to NFTs? If so, do the unique aspects of NFTs and the information contained in NFTs create unique problems under the Contract or Copyright Act?

The common law doctrine of buyers in good faith, which was developed to protect consumers, is rooted in commercial transactions of physical objects. The doctrine extends the debatable historical legal preference to favor economic concerns over individual rights. The doctrine of buyers in good faith has been incorporated into the Copyright Act, first and foremost as regards the distribution right to a work. However, the application of the doctrine in copyright law results in a situation where a buyer in good faith of an object that is subject to copyright protection, can not know whether the seller legally owns the copyrights it claims to sell in connection with the object. In this connection, copyright law restricts the application of the doctrine of a buyer in good faith in such a way that a buyer cannot take pure property (regardless of knowledge) if the seller’s expression was an act of infringement.

In the unique context of NFTs, an initial question may be whether an unauthorized transfer of control / ownership of the NFT data embedded in Blockchain may ever be subject to the doctrine of good faith buyers.

As used on NFTs, proving a good faith buyer may be inherently handicapped by the unchanging transaction history of Blockchain that forms NFT. Unlike the purchase of many physically stolen items, the acquisition and control of NFT leaves little room for ignorance about the transaction history of NFT. For example, in the Seth Green Bored Ape NFT case, it would have been impossible for the person who purchased the NFT from the offender to claim that they were not aware of Seth Green’s previous ownership rights. By applying the doctrine of buyer in good faith as applied to personal property, the ownership history enshrined in the transaction history of NFT may not protect the original owner. However, if it is framed as a copyright issue in the digital work, the narrower application of the doctrine of good faith buyer under the Copyright Act may be sufficient to replace and undermine a claim of good faith buyer.

The unique thing about the Bored Ape Yacht Club collection is that it includes full commercialization rights in NFT, for example via a smart contract. This raises another question: Does the doctrine of a buyer in good faith apply to the protection of copyrights beyond the distribution rights that are most traditionally associated with the doctrine? Given that context, the doctrine of buying in good faith for NFTs – or a repetition of it – may depend on the specific facts of each scenario. However, there are other important factors to consider. Was the buyer in good faith aware of the derived rights that were part of the purchase? Does the smart contract represent a valid form of transfer of the full commercialization rights? Would equity principles support the acquisition of rights that extend beyond the transaction of the digital image embodied in NFT?

Gray space

These questions are unresolved, and there is very little precedent. This area of investigation is currently in the gray space of speculation. Rarely have intellectual property rights been proactive in solving new problems.

Considerations of real estate and contract principles are very relevant for this study and should be balanced against principles of equity. NFT buyers have been lured by the idea of marrying the digital image with derivative rights. This practice should not be rejected solely because of the risk, but buyers should exercise caution when acquiring these assets. The spotlight is beginning to shine on market priorities and insurance of client funds in the digital age. Much consideration should be given to the role of smart contracts in intellectual property rights and the place NFTs can increasingly have in the acquisition and transfer of these rights. Only time will tell.