FRANKFURT, GERMANY, Aug. 20, 2022 (GLOBE NEWSWIRE) — Golddoge Sachs, the first leveraged index that allows users to invest in an exclusive selection of the best assets, diversified as mutual funds with the best return expectations, has been introduced to the crypto market using dollar cost averaging (DCA) to achieve the best possible return just by holding.

With technology reaching new heights every day, there is a financial product for everything. But despite all the progress, there is still a lot to be done in the crypto sector. Consider an investment banker trading stocks in a conventional market. For every financial need, there is a product or service available. He uses ETFs. But as a crypto enthusiast, he finds that he needs to do a significant amount of work there himself. Having to do things that he doesn’t do himself with his shares.

One such investment banker, who calls himself “Moby” in crypto space, came up with the idea of a crypto brokerage platform that would return 633% APY on a safe investment in crypto space, and called it Golddog Sachs.

Golddog Sachs principle and work

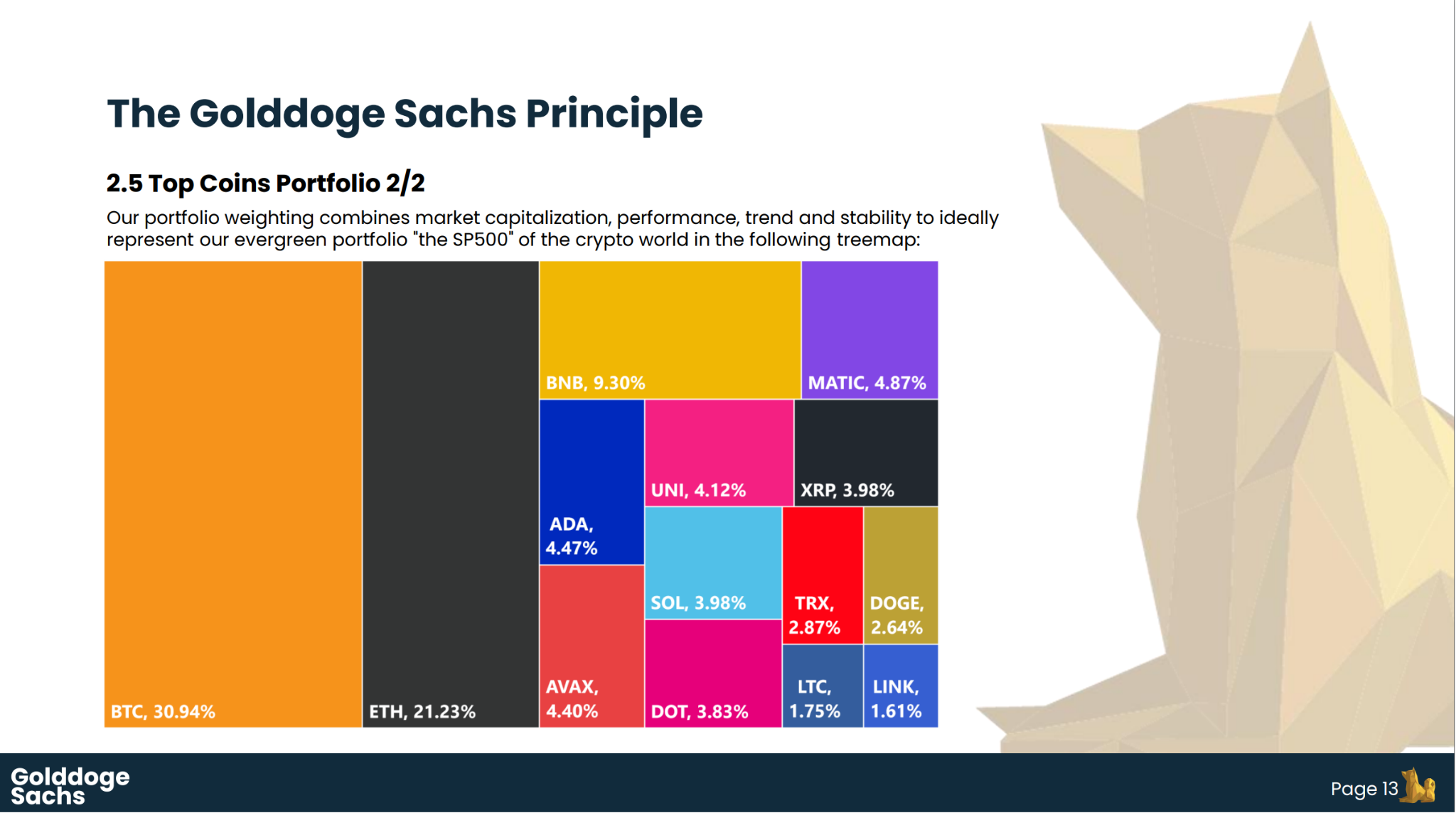

Users buy a single Golddoge Sachs ($GDS) token and eventually the purchases build up the investment pot which further buys in 14 cryptocurrency blue chips including the absolute big coins like Bitcoin, Ethereum, BNB, etc.

With the continuous trading volume, the investment pot continues to build. Over time, this investment pays dividends as the crypto market rises. This yield is periodically siphoned off and paid out to holders through buybacks in $GDS. Thus, the token replicates the dividend.

If the token grows because demand increases, this also increases the token value, creating a simple but effective leverage effect.

The token is launched with the blue chip ETF and is initially exclusively available on the Binance Smart Chain (BEP20). But Moby claims that more chains and more types of ETFs are planned, so there is something for everyone. Users simply need a wallet, similar to the stock market, and no accounts are required.

Golddog ecosystem and tokenomics

Golddoge Sachs takes the path to secure success based on broad diversification, knowledge and DCA.

Golddoge Sachs protects users’ investments in the following ways:

- The investment pool acts as a safeguard against financial losses.

- Anti-swing trading token design

- Anti-fine taxation

- Launch ratio against snipers

- Fine protection in society

- Maximum transaction anti-dumping rules

- Max wallet anti-whale rules

Tokenomics

Golddoge Sachs ($GDS) has a tax of 15% on purchase and sale transactions which is distributed as follows:

- 2% goes to the development

- 3% goes to marketing

- 10% goes to the investment pool

The investment pool makes investments in the 14 best performing cryptocurrencies, and users receive returns on gains at the end of the month. But since the investment uses a leverage effect, users can expect to receive 3 times more than if they invested alone.

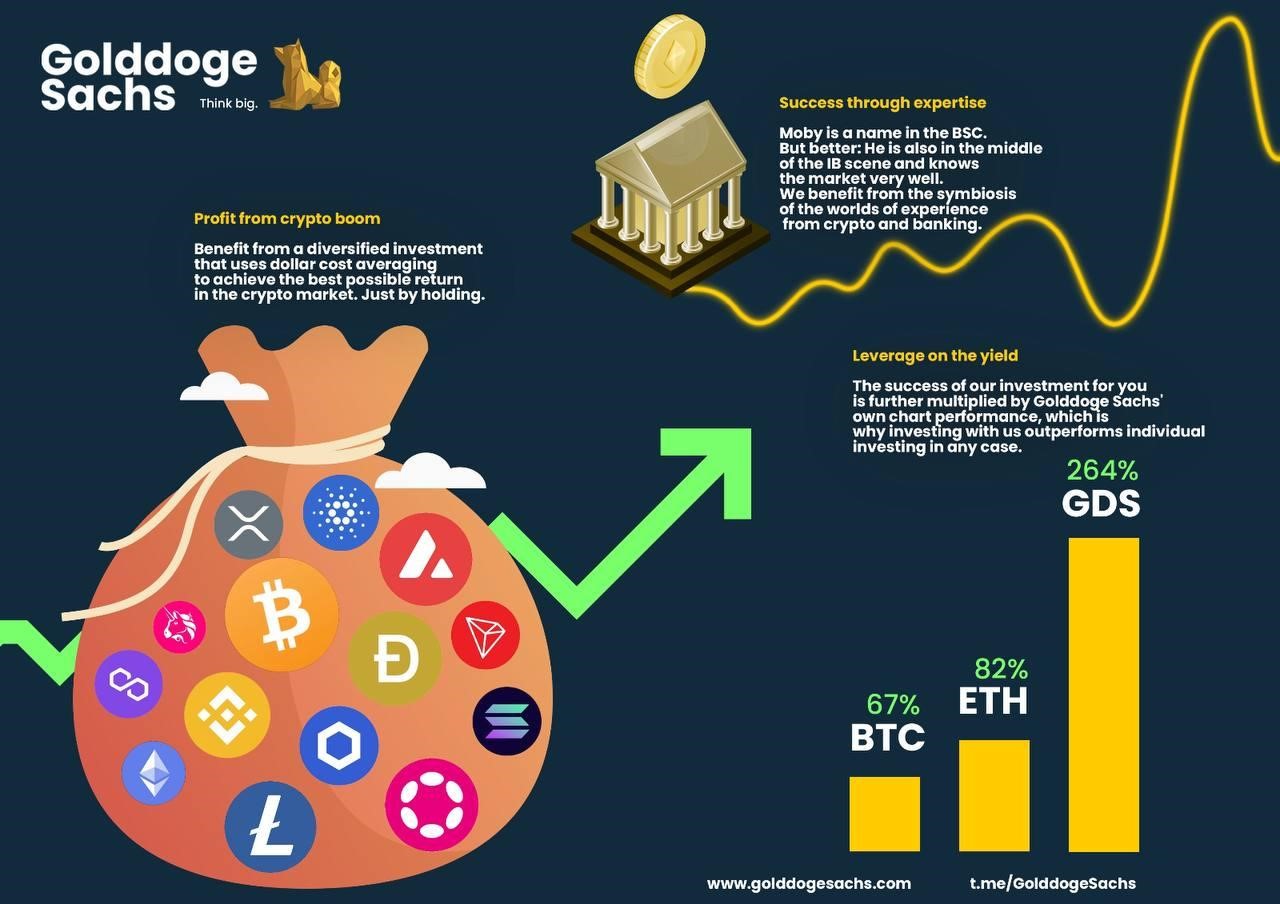

Investing with Golddoge Sachs outperforms individual investing in any circumstance since the success of their investments for clients is further multiplied by the success of their own chart performance.

To get more information about Golddoge Sachs, visit the project’s official website or read the official white paper.

About Golddog Sachs

Golddoge Sachs is a crypto ETF that allows users to invest in the top 14 cryptocurrencies using the $GDS token. With the Golddoge Sachs Token, users receive shares in a regularly generated return based on a premium portfolio built on the best crypto assets.

Based only on the performance of the cryptocurrency market and Golddoge Sachs’ integrated leverage, the conservative estimate of the annual return is 600% APY.

Website | Telegram | Twitter | Instagram | Facebook

References:

White paper:

Small paper:

One pager:

PCS:

BSC Explorer:

BSC contract address: 0x301c565E1114452eb8237f8ba837E2c846393fA1

Moby Dick

Golddog Sachs

Disclaimer:

The information in this publication is not investment advice, financial advice or trading advice. It is recommended that you practice due diligence (including consultation with a professional financial advisor) before investing or trading in securities and cryptocurrency.