Global X FinTech ETF: Too risky; Stay Away (Technical Analysis) (NASDAQ:FINX)

B4LLS

Introduction

Federal Reserve Chairman Jerome Powell has indicated that the US central bank plans to continue raising interest rates to bring inflation back to normal. This approach creates headwinds for the overall stock market and makes it particularly difficult for growth stocks, which are more vulnerable to changes in interest rates. This article looks at the outlook for a sub-segment of emerging growth stocks; fintech.

FINX Fintech Proxy continues to slide down

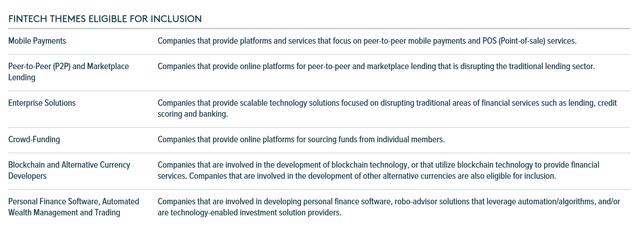

Global X FinTech Thematic ETF (NASDAQ:FINX) gives investors exposure to the growth potential of the fintech industry. The main topics covered in the ETF are as follows:

FINX Fintech Themes (Global X Fintech Thematic Fact Sheet)

FINX ETF Composition

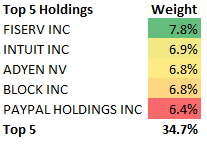

The FINX ETF is a diversified index in which no single share accounts for more than 10% of the total exposure. The top 5 holdings make up 34.7% of the overall index. Fiserv ( FISV ), Intuit Inc ( INTU ), Adyen NV ( OTCPK:ADYEY ), Block Inc ( SQ ), and PayPal Holdings Inc ( PYPL ) make up the top 5 holdings. The top 5 holdings are roughly equally distributed. It is a moderately diversified index.

FINX ETF Top 5 Holdings (FINX ETF website, author’s analysis)

Key fundamental drivers of the FINX ETF

High interest rates

As the Federal Reserve raises interest rates to fight inflation, the cost of waiting to receive profits from investments increases. This can be particularly problematic for growth stocks, which may not make a profit for several years. In the case of fintech, there is the added complexity of credit risk, which makes fintech growth stocks much more susceptible to sharp, adverse changes in rates. The evidence proves this:

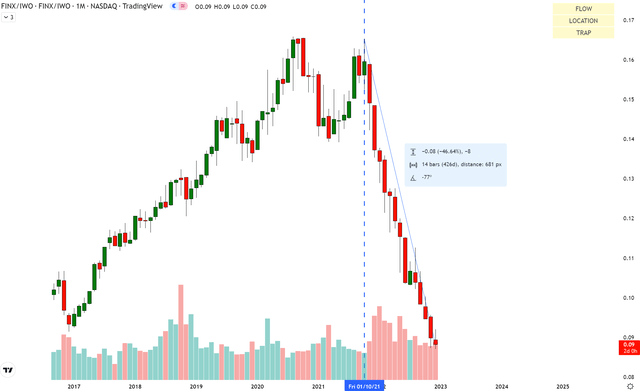

Fintech growth is worse than smallcap growth (TradingView, Author’s Analysis)

As can be seen from the decline in the relative chart above, fintech growth stocks have underperformed even the more volatile small-cap growth stocks.

Another important reason for this underperformance could be:

Fintech models with high risk

Some new-age fintech models such as “Buy Now, Pay Later” (BNPL) are likely to suffer from unsustainable credit growth, leading to high default rates and a breakdown of the core business model. Indeed, some Harvard experts have warned of the dangers of further consumer debt:

When people start buying household goods on credit, it signals a problem.

– Marshall Lux; Harvard Kennedy School Fellow

More recently, the Consumer Financial Protection Bureau (CFPB) has launched an investigation into popular BNPL programs. The outcome of such research is a key thing to monitor that will affect the performance of the FINX ETF.

Given the basic background, here’s how I read the technicals on FINX:

If this is your first time reading a Hunting Alpha article using technical analysis, you may want to read this post, which explains how and why I read the charts the way I do, using the principles of flow, placement and trap.

Read about relative cash flow

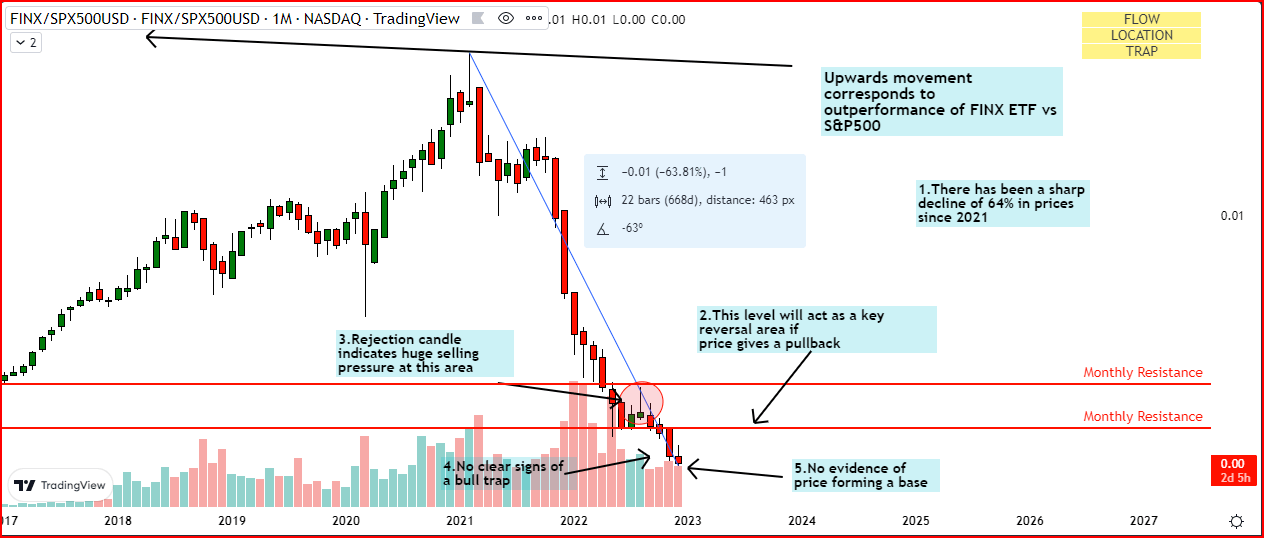

FINX vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

The FINX/SPX500 pair is in a continuous downward movement since the last two years. I see no clear signs of support. There have been no signs of a pullback apart from a small consolidation observed in July 2022. For now, there is no clear indication that the price is forming a base, which is a must if it is to show any real signs of reversal. There is also a lack of bull traps, which removes any reason to sell. Thus, I have a “hold” position on FINX/S&P500.

Read about Absolute Money Flow

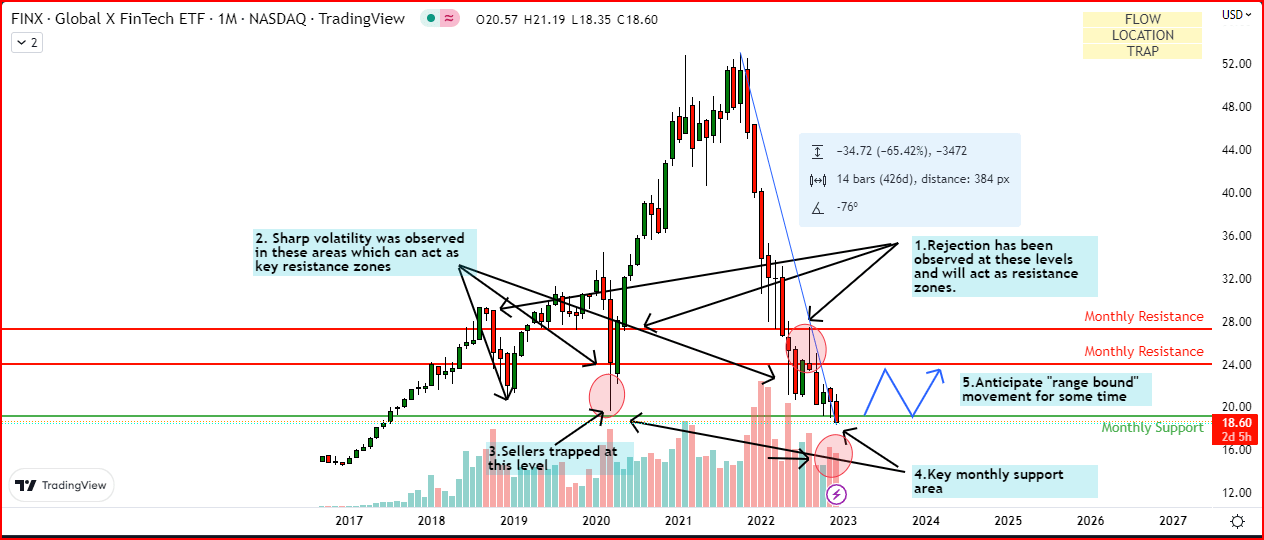

FINX ETF Technical Analysis (TradingView, Author’s Analysis)

For the standalone FINX ETF, a clear bearish setup can be seen if price pulls back towards $24. There has been sharp volatility in key resistance areas at $24 and $28. There are chances of a pullback at the current $18.60 levels as history suggests that bulls have found this area attractive, showing support in this area. I think there will be some area bound activity as shown in the chart. Therefore, this also means that I have a “hold” attitude towards FINX.

Summary

Overall, I think there are no signs of a bottom yet for FINX. The sellers’ rally down may be extended, but it would be a better reward:risk gamble to join the sellers at the culmination of a bull trap. On the fundamental side of things, I’m keeping a close eye on interest rates and also the events that will unfold from the CFPB’s inquiries into BNPL models. This is likely to be a key catalyst to create big moves on FINX on both sides. Overall, I think the FINX ETF is a “hold.”

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.