Global Payments: Undervalued With Fintech Industry Tailwinds (NYSE:GPN)

metamother works

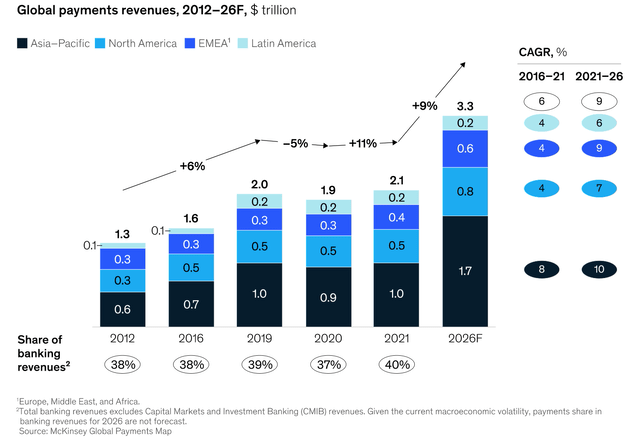

Global Payments (NYSE:GPN) is a leading fintech company specializing in payment solutions. The company has an elite list of clients that includes Burger King, Starbucks, Gucci, Virgin Atlantic and Tacobell. In addition to large financial institutions such as HSBC. According to a study by McKinsey, revenues from “global payments” are projected to grow at a 9% compound annual growth rate and reach a staggering $3.3 trillion by 2026. Global Payments (the company) is predicted to benefit from this growth trend as its strategy focuses on strengthening its product position as “software and payments converge”. The ideal payment system is smart, flexible and secure, with seamless API integration, which is exactly what Global Payments offers. A good example of this is Uber (UBER), which takes a payment automatically after the trip. Payments are evolving into this frictionless, unified experience, combining both the offline and online worlds. In this post I will break down Global Payments business model, financials and valuation, let’s dive in.

Global Payments (McKinsey)

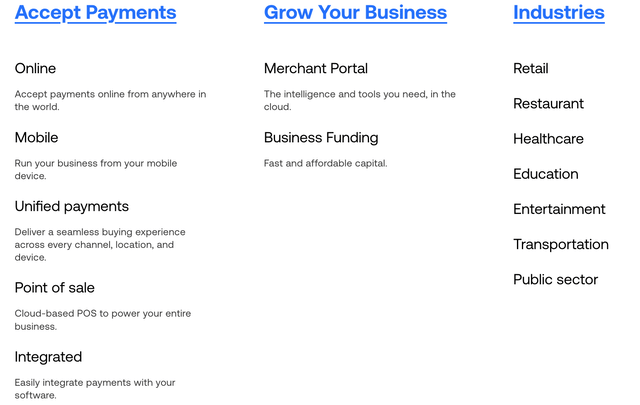

Fintech business model

Global Payments is a financial technology that specializes in payments, across online, mobile and point of sale [PoS]. E-commerce websites have increased in popularity since the late 90s, and Global Payments offers solutions for them. For example, the company offers a “turnkey” payment page for a business customer’s website or app, which is PCI compliant out of the box. Global Payments also offers the popular “PayLink” solution which enables business customers to send a unique payment link via SMS, WhatsApp or email to receive an instant payment. This is a great solution and useful for those in the “gig economy” or those who accept one-time payment solutions. Unified Payments is also a rapidly growing industry, as brick-and-mortar retailers continue to strengthen their online presence and aim to merge offline and online. An example would be let’s say you search online for a particular pair of sneakers and it automatically tells you that they are in stock at a nearby store. This improves the customer experience, as it reduces mail time. In addition, the company can save on logistics costs by utilizing the stores as return hubs. Companies such as Virgin Atlantic and Brewdog are also leveraging Global Payments for their services, so it’s clear that the industry opportunities are diverse.

Global Payments (Official Site)

Global Payment also offers Point of Sale [PoS] hardware for brick-and-mortar merchants, powered by cloud-based software. The software acts as a game-changer, as it enables the management of inventory expenses, prices and discounts, and even employee tracking. The idea is that you can track customer payment trends to optimize inventory and staffing over the period. For example, Mercedes-Benz Stadium in Atlanta, Georgia uses Global Payments PoS for its entire payment system. This includes advanced features such as a “Digital Menu”, a self-kiosk ordering system and fan loyalty campaigns. This system is a real game changer for stadiums as it improves the customer experience as there is no need to wait in long queues. In addition, the stadiums can capture more customer data and profile the most valuable customers, ultimately generating greater revenue. Global Payments’ PoS solutions compete with trendy companies like Block (SQ), formerly Square, and So-Fi, which also target stadiums.

Financial statements for the third quarter

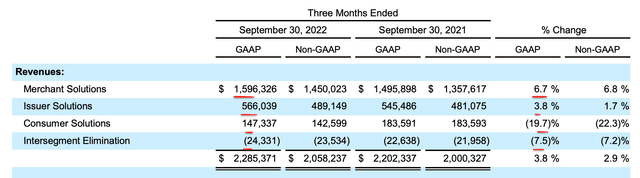

Global Payments reported solid financials for the third quarter of 2022. Revenue was $2.06 billion, which was up 3.7% year-over-year and beat analyst estimates of $22.98 million. This growth rate was lower than in previous quarters with 6.7% reported in Q2.22 and 8.35% in Q1.22. However, let’s “pop the hood” and look at possible reasons for this slowing growth rate at the macro level. First, third-quarter earnings were slightly impacted by currency headwinds, driven by a strong dollar impacting earnings. Therefore, on a constant currency basis, revenue was actually up 6% year-over-year, which is slightly better.

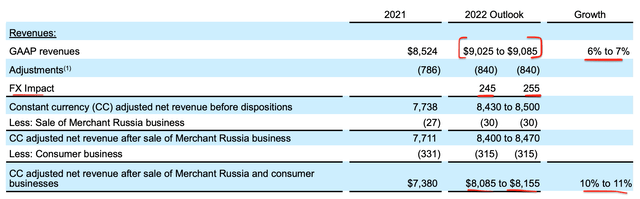

Adjusted income (Q3.22 report)

Forward management forecasts, between $245 and $255 million in Fx headwinds for the full year 2022. Exchange rates are a macroeconomic issue for almost all companies. A positive is that currency can be kept in the local denomination and reinvested locally to avoid exchange rates. Although the management did not allude to whether this was part of the strategy. Global Payments reported “faster growth” in regions such as Central Europe and Southeast Asia, which is positive for overall market share growth. A McKinsey report indicates that the Asia-Pacific region accounts for over half of global payment revenues and is thus a huge market.

Apart from the headwinds in the foreign currency, I think further international expansion is a solid strategy. Management alluded to rapid adoption of its “differentiated solution”. I think this is because many smaller niche countries in Europe have less competition than the US. For example, US-based Block is also aggressively expanding internationally and reporting solid results.

Global Payments also exited Russia in 2022, through the sale of its Russian trading operations. Adjusted third-quarter revenue including sales revenue was $1.93 billion, up 9% year-over-year. Therefore, with these factors included, the overall growth rate has improved.

Global Payments’ largest segment “Merchant Solutions” contributed 69.8% of the total turnover. This segment reported $1.596 billion which increased 6.7% year over year or 10% on a currency neutral basis. The company reported strong growth in its point of sale [PoS] software solutions which increased by nearly 30% in the quarter which is unprecedented. This growth was driven by the solid value proposition previously discussed in the “Business Model” segment. The PoS software basically enables the tracking and optimization of inventory, cash flow, offers and promotions. This means it can actually drive real revenue growth for business customers, as opposed to just being a commodity solution like many pure hardware PoS systems, without what I like to call the “intelligent backend”.

Revenue by segment (Q3.22 report)

Global Payments reported solid revenue growth in the “teens” for its “Omni channel” solutions. This was mainly driven by strength in the education vertical, via the School Solutions business. Global Payments has created a niche for itself and delivered the payment solution for large universities such as Oxford University. The company also reported growth in Real Estate SaaS platform Zego, which was acquired in 2021. This platform enables property managers to set up leasing, recurring payments, utility management and much more. The solution is immensely popular with over 7,000 registered property managers representing over 11 million housing units in the US. I think this business segment is solid given that real estate is still a fairly old-fashioned industry, which is primed for complete digitization.

The company’s Issuer Solutions segment reported $566 million in revenue, which increased 3.8% year over year. This was driven by strong growth in commercial card transactions of 25% year-on-year. This segment also expanded its partner strategy by signing two new partners.

The Global Payments, Consumer Solutions business reported $147 million in revenue, which was down an eye-popping 19.7% year-over-year. In the third quarter, earnings calls did not refer to the exact reasons for this, which was disappointing. Although the company has been approved for its sale of NetSpend’s consumer business, which is possibly related. In addition, the company has received “clearance” for the acquisition of EVO Payments for 2.5 billion dollars, which is expected to strengthen the B2B part of the payment business.

Margins and cash flow

Global Payments reported an adjusted operating margin of 45.2%, up 240 basis points year over year, which was solid. This was driven by a 310 basis point improvement in the issuer segment’s adjusted operating margin, which rose to 46.4%. This was a result of business-scale efficiencies and software improvements.

Total adjusted earnings were $2.48, which increased 18% year over year on a constant currency basis. This was in line with analysts’ expectations.

In the third quarter of 2022, Global Payments reported $640 million in adjusted free cash flow, after $139 million in capital expenditures. The company also bought back 6.9 million shares, which was equivalent to $890 million.

The balance sheet is robust with ~$3.5 billion in liquidity and leverage of 3.1x on a net debt basis. The company took on $2.5 billion in additional debt through a senior unsecured note offering. This is not a good sign given the rising interest rate environment, but management claimed they had achieved a “below market rate” with a blended yield of 5.5% and maturity of 14.5 years. One positive is that the company has opened a new $5.75 billion revolving credit facility to provide additional financial flexibility and enable the company to make any opportunistic acquisitions.

Advanced valuation

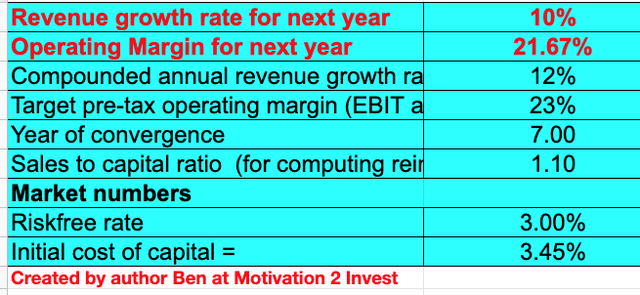

To value global payments, I have linked its financial data to my discounted cash flow model. I have forecast 10% earnings growth for “next year” which includes Q4.22 in my model and is in line with management’s estimates on a constant currency basis. In addition, I have predicted that revenue growth will accelerate in years 2 to 5, to 12% per year as I estimate that economic conditions will improve and payment volumes will increase.

Global Payments Stock Rating 1 (created by author Ben at Motivation 2 Invest)

I have forecast a pre-tax operating margin of 23% in FY7, which is a slight increase from the reported 21.67%. I estimate that this increase will be driven by economies of scale.

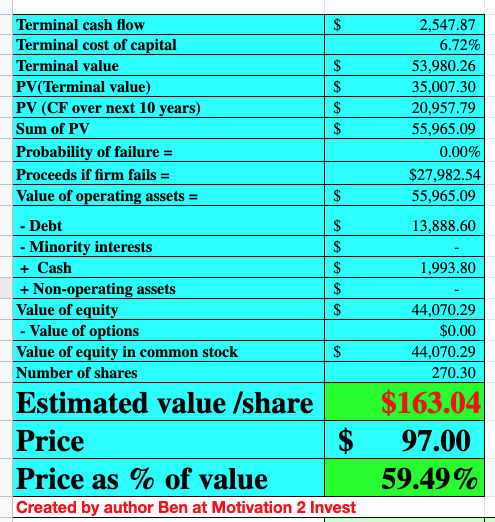

Global Payments stock review 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $163 per share, the stock currently trades at $97 per share and is thus ~41% undervalued.

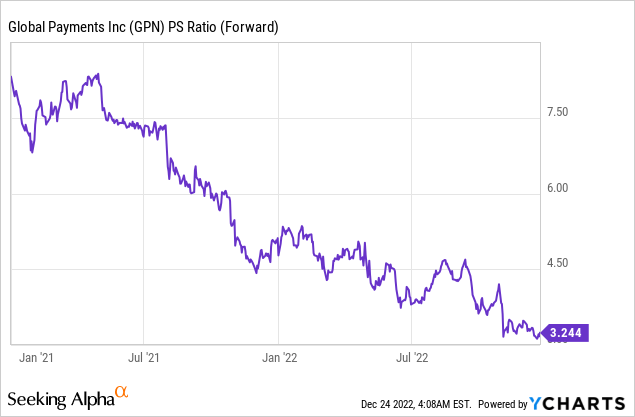

As an additional data point, Global Payments trades at a non-GAAP price/earnings ratio = 10, which is ~57% cheaper than its 5-year average. Price to sales ratio = 3.04, which is 48% cheaper than average.

Risks

Recession/lower payment volume

The environment of high inflation and rising interest rates has been a catalyst for many analysts to predict a recession. Even if a recession does not occur, I believe that the psychological fear surrounding a possible recession could cause consumers to reduce spending and thus the volume of payments would likely fall. Business customers are also likely to stick with whatever payment technology they use for longer periods of time, which can result in longer sales cycles. Global Payments also faces competition on many fronts from Block and Adyen (OTCPK:ADYEY) for their PoS solutions. In addition to PayPal (PYPL), FIS (FIS) and Stripe for their integrated payment solutions.

Final thoughts

Global Payments is a massively diversified company across its industry verticals and internationally. The company is poised to take advantage of industry growth trends such as frictionless payments and software-assisted payment analytics. The share itself is undervalued at the time of writing and in relation to historical multiples. Therefore, the company can be a great long-term investment.