Global Payments Q4 Earnings: An Underrated Fintech Play (NYSE:GPN)

AsiaVision

Investment thesis

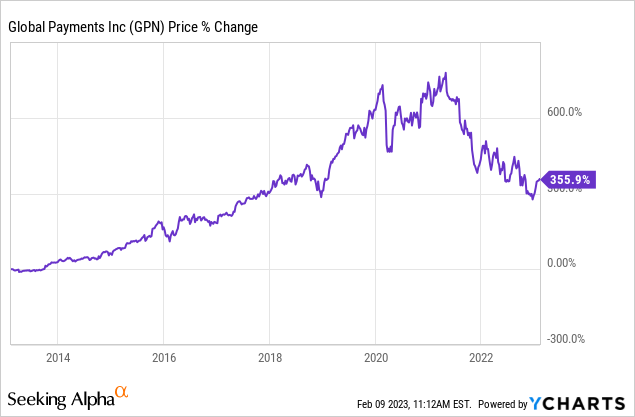

Global Payments Inc. (NYSE:GPN) may not be a household name, but it actually plays an important role in the fintech space. Thanks to the acceleration in digital transformation over the last decade, the company was up over 350% during the period, comfortably outperforming the broader indices.

However, performance has been weak over the past two years, and it is currently trading nearly 50% below all-time from 2021. I think this is a good bottom fishing opportunity for investors, as the company’s fundamentals remain strong. The market opportunity remains large, and secular tailwinds should continue to provide growth. The latest profit result was also very solid in terms of the macro environment. Following the share price decline, Global Payments Inc.’s current valuation is very attractive as multiples are well below peers and its own historical averages. I like the upside potential here, which is why I’m considering Global Payments Inc. as a purchase.

Why global payments?

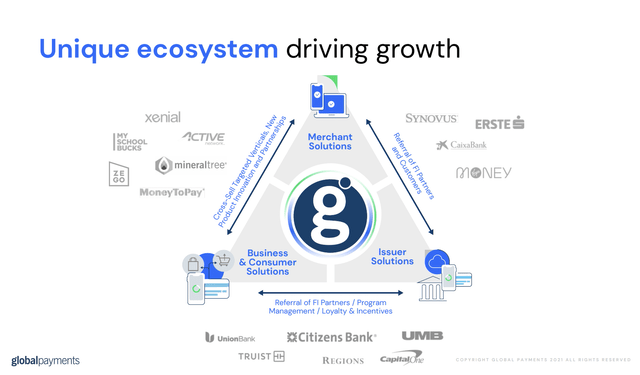

Global Payments Inc. is a leading payment technology company providing software and services to merchants and businesses. The main goal is to help customers accept and process payments. It is divided into three segments which include merchant solutions, issuer solutions and business and consumer solutions. Seller solutions offer products for POS (point of sale), e-commerce, mobile payments, loyalty program and more. Issuing solutions help customers issue credit, debit or prepaid cards together with payment partners such as Mastercard (MA) and Visa (V). While business and consumer solutions offer products such as accounts payable automation, virtual cards, analytics and more. The company’s existing customers include big names such as Starbucks (SBUX), Volkswagen (OTCPK:VWAGY), H&M (OTCPK:HNNMY), etc.

Global payments

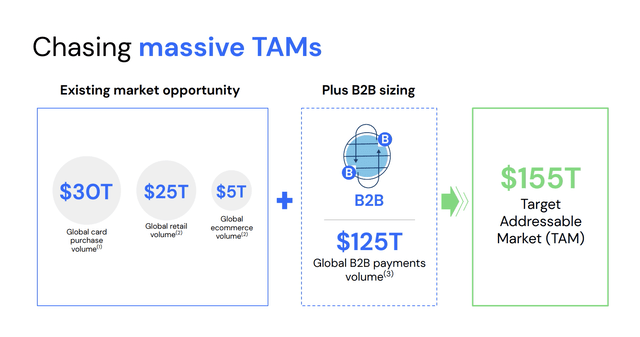

Global payments. has great market opportunities. According to Allied Market Research, the TAM (total addressable market) for fintech is projected to grow from $110.57 billion in 2020 to $698.48 billion in 2030, representing a CAGR (compound annual growth rate) of 20.3%. Fintech is one of the biggest trends in digital transformation. The adoption rate of digital payments has grown exponentially in recent years, and the pandemic further amplified it as everyone is forced to stay at home. The emergence of new industries such as e-commerce, ride-sharing, food delivery, etc. has also increased the use of digital payments. There are also plenty of alternative payment methods emerging, such as virtual cards and BNPL (Buy Now, Pay Later), increasing the overall transaction volume of the fintech space. I believe the fintech market will continue to grow rapidly, which should provide a tailwind for the company.

Global payments

Q4 Earnings

Global Payments just reported earnings for the fourth quarter, and the results are solid considering the macro headwinds. Revenue growth was soft, but the bottom line was very impressive. The company reported revenue of $2.25 billion, up 2.7% year over year from $2.19 billion. On a constant currency basis, revenues increased by 4%. Growth was primarily driven by merchant solutions, which saw revenue increase 5.3% on the year from $1.48 billion to $1.55 billion, which now accounts for 68.9% of total revenue. Within the segment, e-commerce and omnichannel commerce were the highlights, with growth in the mid-teens. Issuer Solutions revenue increased 2.3% from $569.6 million to $582.6 million, while Consumer Solutions revenue decreased 18.6% from $175 million to $142.4 million, as SMBs (small and medium-sized enterprises) were greatly affected by the slowing economy.

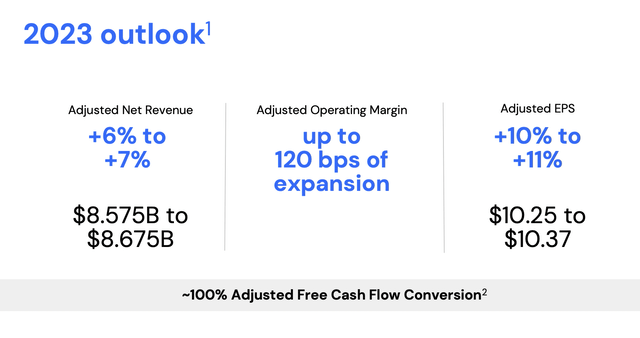

The company did an excellent job of cost and expense control for this quarter. Cost of service decreased 4.1% year over year from $968 million to $927.9 million. This led to gross profit increasing by over 8% year-on-year from $1.23 billion to $1.33 billion. Gross profit margin was 58.8% compared to 56.2%, up 260 basis points. SG&A (selling, general and administrative) expenses also increased only 1.6% year over year from $905 million to $919.5 million. This resulted in operating income increasing a whopping 27% from $321 million to $407.6 million. Operating margins increased significantly from 14.6% to 18.1%. EPS was $0.93 compared to $0.72, up 29.2% YoY. The company also initiated FY23 guidance that represents revenue growth of roughly 6%-7%, while EPS growth should be 10% to 11%. This is very optimistic as it suggests a re-acceleration in top line growth.

This quarter showed the importance of good management. Despite weak revenue growth due to lower expenses, Global Payments Inc. still managed to achieve strong bottom-line growth thanks to timely cost-cutting initiatives.

Global payments

Investor Takeaway

I think Global Payments Inc. is a solid value play. Digital transformation will only continue to accelerate and fintech will continue to be a big part of it. The market opportunity is huge, and the company should take advantage of the ongoing tailwind. After the huge decline in the share price, the company’s valuation looks really attractive. It currently trades at a fwd EV/EBITDA ratio of 10.22x which is very cheap (I use the EV/EBITDA ratio as it can take into account the company’s heavy debt load).

This is significantly lower than other fintech companies such as Fiserv ( FISV ), Visa and Mastercard, which have an average EV/EBITDA of 19.16x. This represents a significant premium of 87.4%. On a historical basis, it also trades at a 38.9% discount compared to the 5-year average EV/EBITDA of 16.73x. The company’s latest financial results are solid. Income growth is soft, but according to guidance, this will normalize in the coming year. Bottom line growth continues to be strong despite headwinds, and a long-term EPS CAGR of 10%+ is definitely achievable.

I believe that a lot of negativity is already reflected in the current valuation of Global Payments Inc., but the upside potential is still being overlooked. This gives a good ratio between risk and reward. Therefore, I rate Global Payments Inc. as a buy.