Global fintech finance poised for reset in 2023: report

A widespread downturn in the technology sector saw fintech funding fall by a third globally to $63 billion in 2022, according to S&P Global Market Intelligence’s Global Fintech Funding Trends report. Fintech funding saw a massive slowdown in the last quarter of 2022, registering just 599 rounds worth $8 billion, compared to nearly 1,000 rounds worth $26 billion in the year-ago period. The current uncertainty, compounded by the collapse of Silicon Valley Bank in mid-March, is likely to lower the amount of capital raised by fintechs this year to where it was in 2020 when COVID-19 brought much of the world to a standstill.

The Take

A challenging macro environment is likely to prompt venture capitalists (VCs) and startups to go back to the drawing board to reassess their risk tolerance and market opportunities. Across financial verticals, we expect investor rotation into B2B and out of B2C to accelerate in 2023. A geographic rotation may also be on the cards, with VCs scouting less crowded parts of the world where traditional finance is still largely non-existent . Payment organization, cross-border payments, swipe networks that provide access to a range of banking relationships and income financing can be among attractive fintech models. Intermediaries that reside in the embedded finance space appear to be safe bets as well.

Leading markets

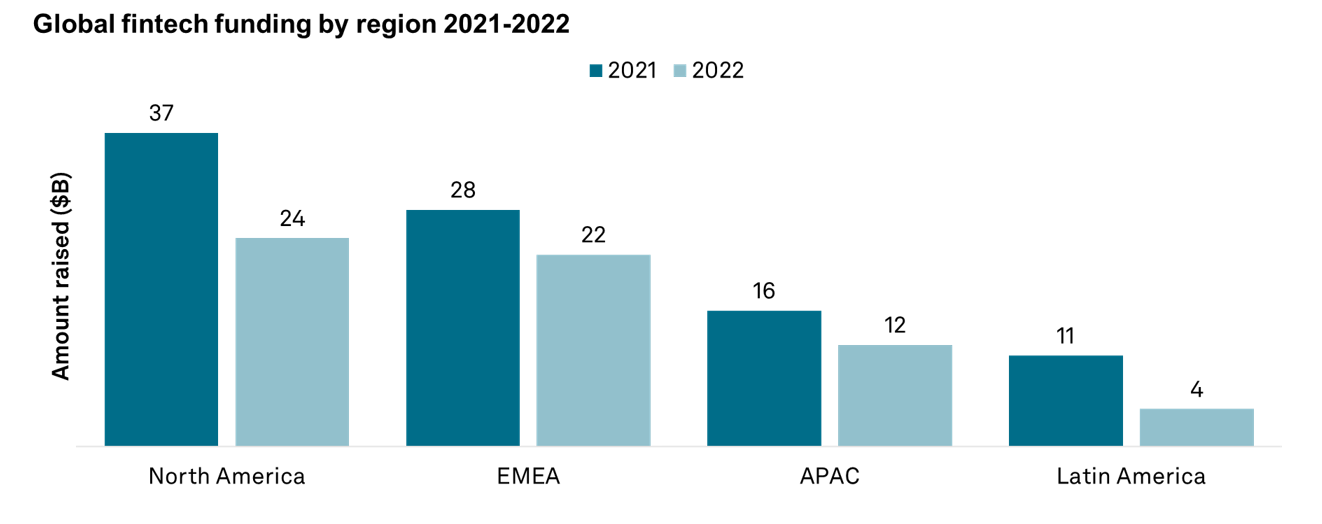

As fintech-focused venture capitalists turned off stocks in 2022, Latin America saw the sharpest drop in funding at 59%, followed by North America at 34%. The EMEA and APAC regions declined by 19% and 25% respectively.

Fintech funding value declined across regions in 2022

Source: S&P Global Market Intelligence, 2023.

The share of global venture capital attracted by individual countries correlated somewhat with their share of global GDP. However, it is heavily skewed in favor of the US, UK and India. The three markets attracted more than half of fintech funding from 2021 to 2022, while representing only a third of global GDP.

The US saw fintechs raise $23.59 billion in 2022, down 31% from $34.31 billion in 2021. UK fintech funding came in at $10.19 billion in 2022, down from $12.4 billion in 2021, while Indian fintechs collectively raised $3.52.6 billion, down from $3.52.6 billion. billions.

The Southeast Asian region, which includes Singapore, Indonesia, Malaysia, Thailand, the Philippines and Vietnam, has emerged as the fourth most crucial hub for fintech-focused venture capitalists, pulling in $5.4 billion, almost flat compared to 2021.

Africa was among the few markets to buck the downturn, registering a slight increase in fintech investment, albeit on a low base. African fintechs raised $1.26 billion in 2022, up from $1.11 billion in 2021. The Middle East, another growing fintech hub globally, witnessed a slight decline in fintech funding to $1.47 billion in 2022 from 1 .59 billion dollars in 2021.

Fintech verticals

Among fintech verticals, payments saw the brunt of the decline, with total funding value falling to $19 billion from $30 billion in 2021. Robust digital payments trends may encourage VCs to continue backing category leaders, but capital will likely come with strings attached.

Funding for digital lenders fell by about a fifth to $11 billion in 2022. In developed economies, the inherent advantages of buy now, pay later compared to other consumer finance options are likely to diminish in the short term amid rising interest rates and high inflation. However, in developing countries, where traditional credit is limited, digital lenders that acquire high-quality borrowers and maintain low arrears are set to grow.

The banking technology vertical, which includes licensed digital banks and fintechs without banking charters (neobanks), saw the largest percentage decrease in funding (42%), falling to $10 billion. However, following the collapse of Silicon Valley Bank, fintechs may gain new customers due to a greater propensity among businesses to work with platforms that suggest quick account opening, payroll integration and instant access to funds. An industry-wide shift toward optimizing costs and growth could also lead to a more favorable outlook for fintech-as-a-service providers, a segment interchangeably referred to as embedded finance.

In particular, the seed rounds got hotter in 2022, a trend that could continue this year. The round size in the seed space grew by 40% on average as VCs kept the faucet open for companies at the earliest stage of entrepreneurship.

Methodology

S&P Global Market Intelligence’s Global Fintech Funding Trends report details venture capital activity in 2021 and 2022 and highlights leaders in various fintech verticals and geographies. Our analysis leverages S&P Global Market Intelligence’s private placement transaction data for privately held fintechs. It covers all equity-focused venture rounds and excludes transactions categorized as debt. The transaction dates reflect the estimated end date of the offer at the time the data was compiled, but some rounds may be extended later. We use a best-effort approach to identify and validate fintech funding rounds and to determine appropriate fintech verticals by reviewing company websites, press releases, filings and media reports.