Global efforts to fight cryptocrime

The Internal Revenue Service (IRS) will send cyber agents to Australia, Colombia, Singapore and Germany to investigate the use of crypto in tax crimes.

The IRS will help international law enforcement investigate tax and financial crimes using cryptoassets, decentralized finance and mixers.

Cyber agents vital to international investigations

According to an IRS spokeswoman Carissa Cutrell, the agents will participate in a 120-day pilot from June to September.

If successful, the agents will remain in their respective countries to act as proxy for a case agent in ongoing investigations. They will advise US case agents on the possibility of obtaining certain evidence and assist with cultural and legal considerations.

Currently, the IRS has one online specialist stationed in The Hague in the Netherlands. The agent works with Europol.

Jared Koopman, director of Cyber and Forensic Services at the IRS, told CNBC that funds seized from criminal activity are sent to hardware wallets set up by the agents responsible for enforcement. The US Marshals Service and the US General Services Administration then liquidate the assets.

The new cohort will join eleven agents stationed in Mexico, Canada, Colombia, Panama, Barbados, China, Germany, the Netherlands, the United Kingdom, Australia and the United Arab Emirates.

IRS focuses on tax evasion in 2023

The IRS uses technology developed by blockchain security firm AnChain.ai to scrutinize crypto tax disclosures and investigate white-collar crime. It is set to receive an $80 billion federal injection for enforcement actions, including crypto tax evasion.

Last September, the IRS issued a John Doe summons to MY Safra Bank, requesting transaction information for one of its crypto clients, SFOX. It sought to compare SFOX’s client information and other records to determine whether the brokerage’s clients complied with disclosure rules.

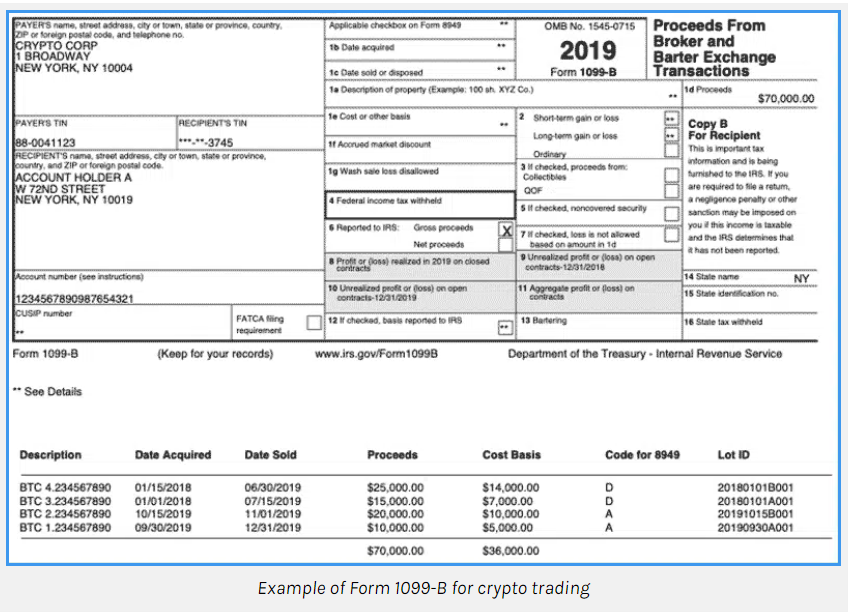

The new infrastructure bill will force crypto brokers to disclose clients’ identities and transaction activity starting in 2024. Brokers must issue Form 1099-B to clients starting in 2024. This form will track crypto transactions starting January 1.

Last month, the tax authorities opened for comment new guidance on the taxation of non-fungible tokens (NFTs).

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.