Global banks exposure to crypto is around 0.01%

The global banking regulatory standard Basel Committee’s latest report estimates global banking exposure to crypto at 0.01%, as the 19 largest financial institutions hold crypto assets of €9.4 billion, which equates to 0.14% exposure.

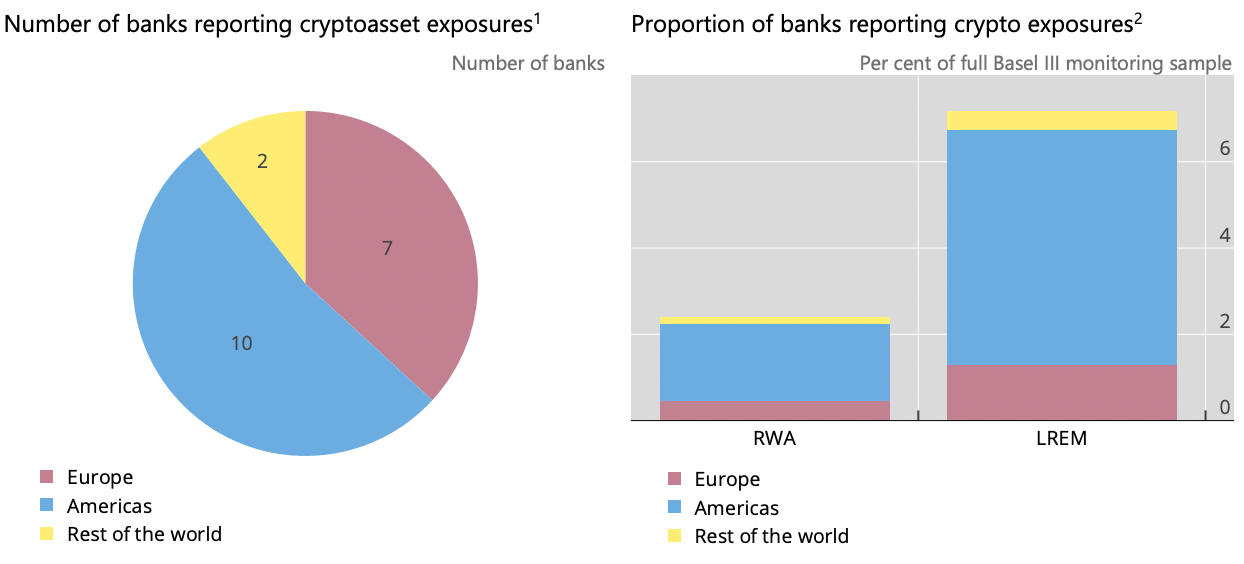

The report obtained crypto asset data from 16 Group 1 banks and three Group 2 banks. Ten of these banks were from America, seven were from Europe, and the remaining two were from the rest of the world.

Considering these financial institutions’ size and level of expansion, the report estimates that global crypto exposure will turn out to be around 0.01% after Group 3 banks are included.

That said, the report also acknowledges crypto’s exponential growth rate and reminds us that estimating the real rate of exposure is difficult. It says:

“As the market for cryptoassets is rapidly evolving, it is difficult to determine whether any banks have under- or overreported their exposures to cryptoassets, and to what extent they have consistently used the same approach to classify any exposures.”

Exposure distributions

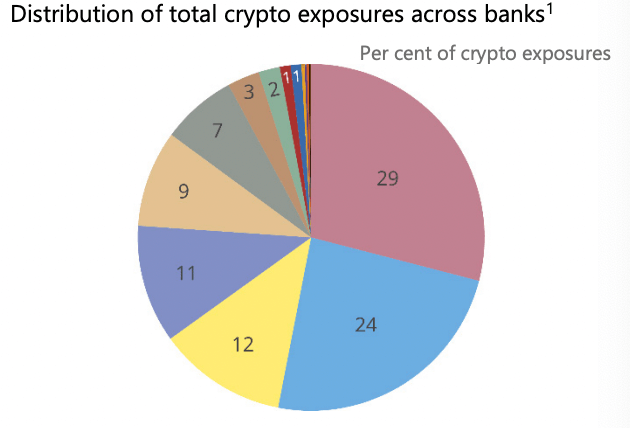

Crypto assets belonging to the ten US banks account for around a third of the total €9.4 billion. The distribution between these banks is not even.

Two institutions account for more than half of the total crypto exposure, while four account for around 40%. The remaining 10% is shared between 13 banks.

Token distribution

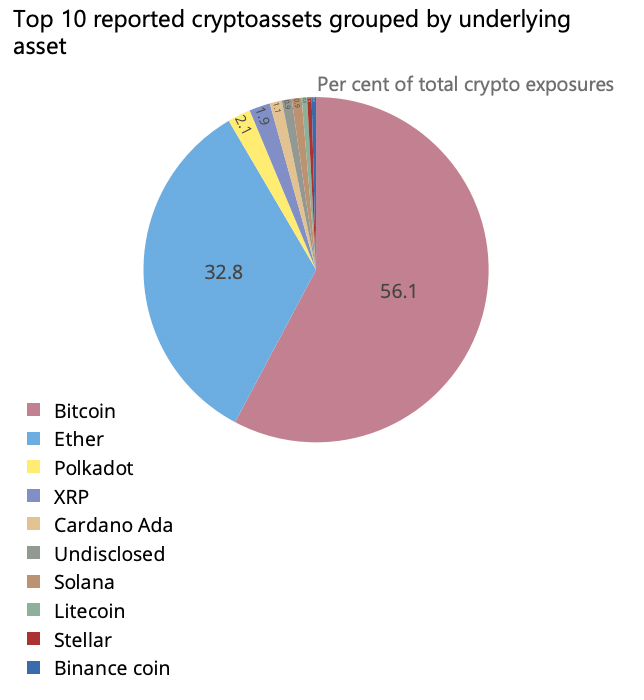

According to the data, Bitcoin (BTC) and Ethereum (ETH) are the most held assets. Among all 19 institutions, Bitcoin exposure is at 31%, while Ethereum’s is at 22%. Tokens that have Bitcoin or Ethereum as underlying assets follow as the third and fourth most held assets. Bitcoin-based tokens account for 25%, while Ethereum-based tokens account for 10%.

When the amount of Bitcoin and Bitcoin-based tokens are calculated together, exposure to Bitcoin was 56.1%, while Ethereum’s was 32.8%.

The remaining 10% is shared between other coins. Ripple (XRP) follows as the third most exposed coin with 2%, while Cardano (ADA) and Solana (SOL) come in fourth and fifth with 1% each. Litecoin (LTC) and Stellar (XLM) rank sixth and seventh with 0.4% each.

Banks have also reported holding USD Coin (USDC) in smaller amounts, which are not included in the charts above.

Activity distribution

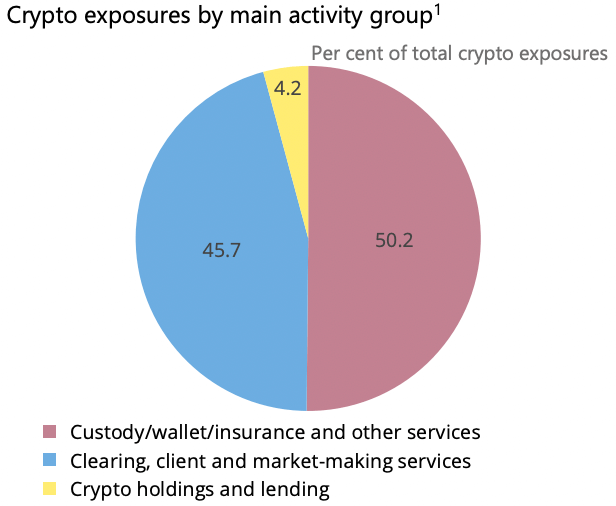

In terms of crypto-related functions offered by participating banks, holdings and lending, market-making, and custody/wallet/insurance services came in as the top three functions.

Among the three, custody/wallet/insurance and similar services proved to be the most dominant with 50.2%. This category includes all custody, wallet and insurance services for crypto-assets and the facilitation of client activity such as self-directed or manager-directed trading.

Clearing, client and market-making services came second in line with 45.7%. All trading activities on customer accounts, clearing of crypto derivatives and futures, ICOs and issuance of securities with underlying crypto assets fall under this category.

Finally, holding and investing in cryptoassets, lending to entities and issuing cryptoassets backed by assets on the bank’s balance sheet are grouped under the cryptoholding and lending category, which came out as the least preferred activity at 4.2%.