Glassnode suggests that Bitcoin’s long-term conviction is not lost yet

Data from Glassnode suggests that long-term capitulation by Bitcoin holders has not yet reached a scale that would involve a widespread loss of conviction.

Access to long-term holders of bitcoin has decreased by 61.5k BTC since Nov 6.

According to the latest weekly report from Glassnode, BTC’s long-term holder supply has observed a significant decline recently.

The “long-term holders” (LTHs) constitute a cohort that includes all Bitcoin investors who have held their coins since at least 155 days ago.

Owners belonging to this group are statistically the least likely to sell at any point, so moves by them can have noticeable implications for the market.

The “long-term holder supply” is an indicator that measures the total number of coins currently stored in the wallets of these resolute investors.

Changes in the value of this metric can tell us if the LTHs are currently accumulating or selling.

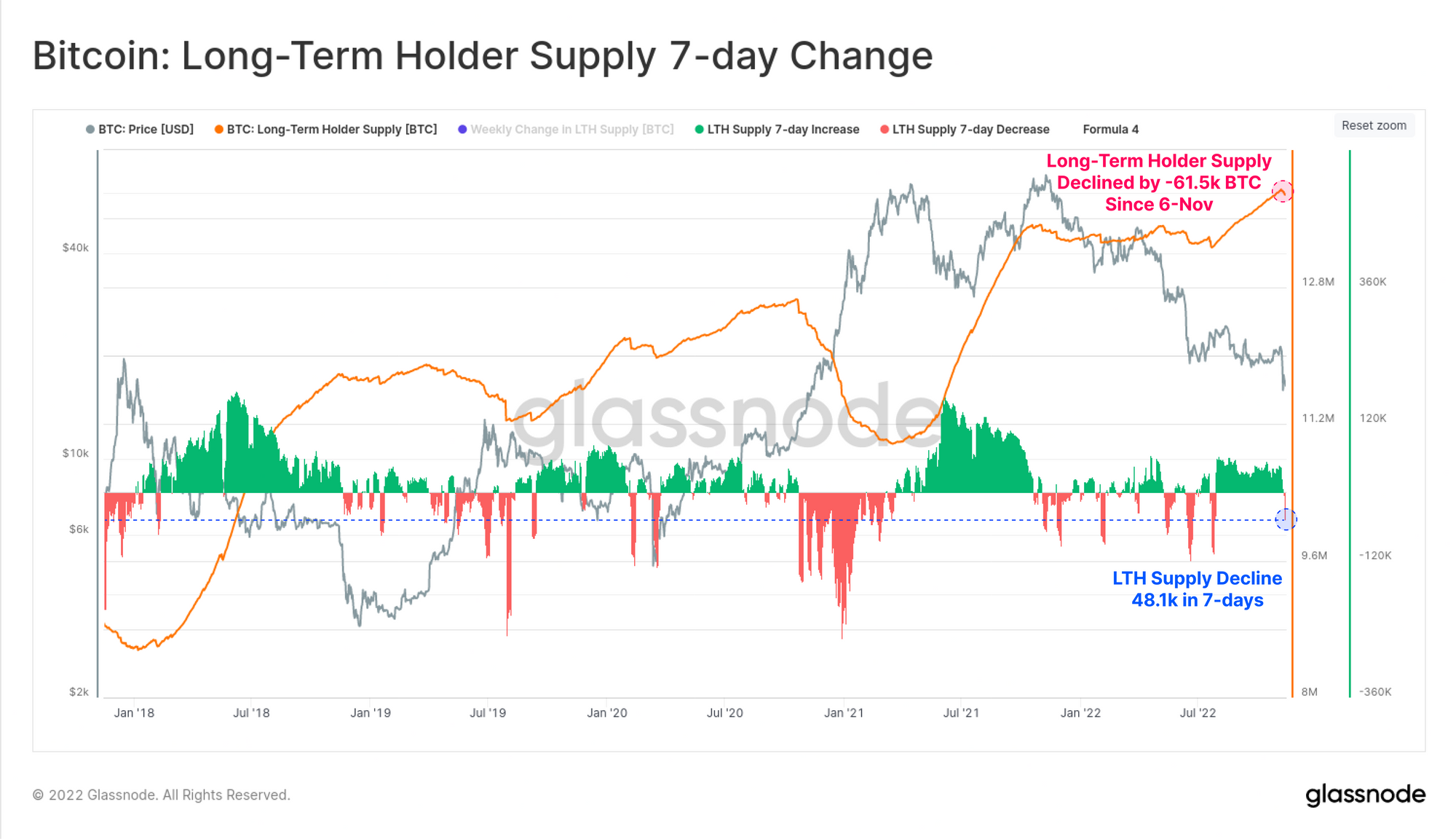

Now, here is a chart showing the trend of Bitcoin LTH supply over the last few years:

Looks like the value of the metric has decreased in the last few days | Source: Glassnode's The Week Onchain - Week 46, 2022

As you can see in the graph above, Bitcoin LTH supply had been riding a constant uptrend for many months prior to last week, setting new records.

This means that the market had continuously accumulated crypto as the bear market continued.

However, since November 6 (when the crash triggered by the FTX collapse began), the indicator has fallen sharply, suggesting that LTHs have engaged in some selling.

In total, the drop has accounted for around 61.5000 BTC leaving the wallets of the LTHs in this period so far.

The chart also includes data for the 7-day changes in this Bitcoin indicator, and it appears that the metric has a negative value of 48.1k right now.

This value is not insignificant, but as can be seen from the graph, this red spike is not on par with those observed during the previous sales.

The report notes that this may mean there hasn’t been a widespread loss of conviction among Bitcoin’s most resolute owners yet.

Nevertheless, it remains to be seen where the metric goes from here. “Should this develop into a sustained decline in the LTH supply, it may indicate something else,” warns Glassnode.

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.8k, down 15% in the last week. Over the past month, the crypto has lost 13% in value.

The value of the crypto seems to still be trading sideways | Source: BTCUSD on TradingView

Featured image from Daniel Dan on Unsplash.com, charts from TradingView.com, Glassnode.com