Tags in this story

bitcoin legal tender el salvador, CDSS, credit default swap spread, financial derivative, GDP, Ghana default, government bond yield, IMF, inflation rate, interest costs, government debt

all about cryptop referances

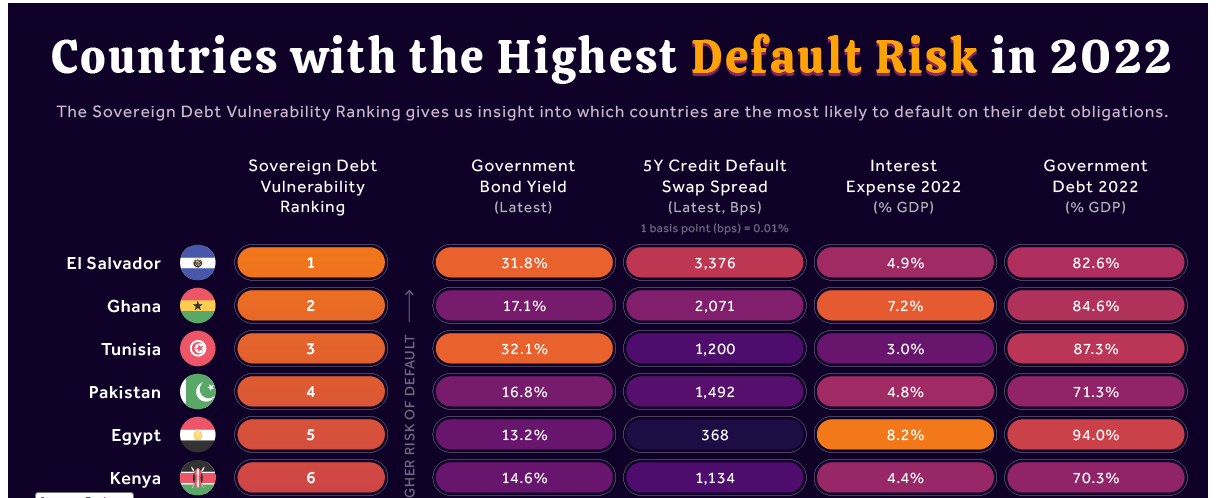

According to Visual Capitalist, Ghana is now placed second on the list of countries with the highest default risk in 2022. Only four countries, namely Ukraine 10,856 basis points (bps), Argentina (4,470), El Salvador (3,376) and Ethiopia (3,035) have a credit swap spread that is higher than Ghana’s at 2,071 bps.

After seeing inflation soar to over 29% in June, Ghana, West Africa’s second largest economy, is now ranked as one of the countries most likely to default this year, Visual Capitalist’s latest sovereign debt vulnerability rankings show. According to the data, Ghana is now placed second, just behind the Central American state and the first country to make bitcoin legal tender, El Salvador.

As shown by data from Visual Capitalist – an online publisher focusing on technology and global economics, among other things – Ghana’s five-year credit default swap (CDSS) spread of 2,071 basis points (bps) is one of the highest globally. Only four countries have a credit swap spread higher than Ghana: Ukraine (10,856 bps), Argentina (4,470 bps), El Salvador (3,376 bps) and Ethiopia (3,035 bps).

As explained by Investopedia, CDS “is a financial derivative that allows one investor to swap or offset credit risk with another investor.”

Another metric that points to Ghana’s likely default is the country’s interest expenditure as a percentage of gross domestic product (GDP). According to Visual Capitalist data, with a share of 7.2%, Ghana’s interest expense ratio is the second highest in the world, behind only Egypt (8.2%).

When these calculations are combined with the country’s debt as a percentage of GDP at 84.6%, and a government bond yield of 17.1%, Ghana, which eventually agreed to seek help from the International Monetary Fund (IMF), looks destined to follow. following in the footsteps of Sri Lanka, which defaulted on its obligations in May.

Meanwhile, according to the Visual Capitalist ranking, Tunisia is the African country with the second highest default risk in 2022 and is followed by Egypt. Globally, Tunisia is ranked third, while Egypt and Kenya are ranked fifth and sixth respectively. The top ten countries with the highest standards are Namibia.

Register your email here to get a weekly African news update delivered to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.