GBTC: SEC strikes in shades of gray, Bitcoin – how the ‘arbitrary’ argument no longer matters

Chip Somodevilla / Getty Images News

On Wednesday, the SEC rejected the Grayscale Bitcoin Trusts (OTC: GBTC) proposed conversion to a spot Bitcoin (BTC-USD) ETF. The commission reproduced an earlier argument, saying that Grayscale and NYSE Arca had not shown sufficiently The fund is designed to prevent fraudulent and manipulative actions. Specifically, the SEC again focused on non-compliance with technical aspects of a general rule that an exchange-traded product has “a comprehensive monitoring sharing agreement with a regulated market of significant size related to the underlying or benchmark bitcoin assets.”

The grayscale rejection will have a significant, but difficult to quantify, negative effect on crypto adoption over time due to the type of access a US spot Bitcoin ETF would provide investors. Among traditional exchange-traded products, a spot-based fund like Grayscale’s has the preferred structure from a tougher asset and crypto ownership perspective. The value of the investment is on the chain. This is the key because the primary benefit of the Bitcoin blockchain is its decentralized ledger of value operating in an untrustworthy and unauthorized environment.

Instead of a spot-based product, the SEC has given investors off-chain, which means less transparent participation through the CME derivatives market. Furthermore, this Bitcoin futures market is distinctly licensed and trustworthy. Please note that Bitcoin futures trades are never on the chain, even at settlement, because they are only settled in cash without physical delivery.

Ironically, and despite the impending rejection of spot-based ETFs, ProShares Short Bitcoin Strategy ETF (BITI) began trading earlier in June, offering futures-based card exposure to retail investors without the rigor of having a margin, futures or options account. In relation to this, this article deals with the main dispute regarding the agreement on surveillance sharing and what has become known as the “arbitrary and whimsical” argument. Understanding and weighing this argument is necessary for those who are now considering holding their positions in the Grayscale Bitcoin Trust in the longer term. It is also assessed how the rejection affected the timeline for possible spot-based ETFs and takeaways for how one now views the Trust.

Litigation on “a regulated market of significant size related to the underlying”

Grayscale immediately applied for review of the rejection decision to the United States Court of Appeals for DC Circuit. The review was filed on behalf of Grayscale by former U.S. Attorney Donald Verrilli. Interestingly, Verrilli has argued for dozens of cases before the Supreme Court, including the Affordable Care Act, and is recognized for effectively making technical legal arguments.

Grayscale Tweet GBTC Litigation (Twitter)

In a letter to investors, Grayscale summarized the main content of their argument against the SEC decision.

The SEC fails to apply consistent treatment of Bitcoin investment vehicles, as evidenced by its rejection of GBTC’s application for conversion to a spot ETF, but approval of multiple Bitcoin futures ETFs. If regulators are comfortable with ETFs that have derivatives of a given asset, they should logically be comfortable with ETFs that have the same asset.

It is the SEC’s arbitrary and capricious actions and discriminatory treatment of issuers that make it necessary to take this matter to court in the interests of GBTCs and our investors.

In April, the SEC approved the listing of a futures-based ETF called the Teucrium Bitcoin Futures Fund (BCFU). In the approval, the SEC accepted Arca’s agreement on surveillance sharing with CME as a reliable way of meeting standards for detecting and deterring tampering. And the SEC said in the approval that the Teucrium futures product is adequately protected by the monitoring sharing agreement from manipulation attempts made “indirectly by trading outside the CME bitcoin futures market”, for example in the underlying spot markets.

In the final order of shades of gray, however, the SEC again argues for the following.

… as the commission also says in these orders, this rationale does not extend to detecting bitcoin ETPs. Spot bitcoin markets are currently not “regulated”. If an exchange that wishes to list a spot bitcoin ETP is dependent on CME as the regulated market with which it has a comprehensive monitoring sharing agreement, the assets owned by spot bitcoin ETP will not be traded on CME. Because of this significant difference, with respect to a spot bitcoin ETP, there will be reason to question whether a monitoring sharing agreement with CME will actually help detect and deter fraudulent and manipulative fraud affecting the price of spotbitcoin. held by this ETP.

Source: Order Not Approved – List and trade shares in Grayscale Bitcoin Trustsec.gov p. 67 (link above)

Note that the crypto industry had expected clarification, rather than a reformulation of this somewhat confusing logic in the Teucrium order. The SEC discussed a number of related issues at length. But there is still no complete explanation for one key point for investor protection. Why and how does a surveillance sharing agreement that adequately protects a futures-based product by detecting the effect of manipulation performed in the spot markets not protect a spot-based product?

Furthermore, in the application, Arca had claimed that “the CME futures market represents a large, monitored and regulated market”. Data was also presented that CME constitutes a market of significant size related to spot Bitcoin, not just Bitcoin futures. From November 1, 2019 to August 31, 2021, the CME futures trading volume was “approximately 50% of the trading volume of certain US dollar-denominated spotbitcoin platforms, including Binance, Coinbase Pro, Bitfinex, Kraken, Bitstamp, BitFlyer, Poloniex, Bittrex and itBit. ” This may be the idea Grayscale has in mind when writing to investors, “we are confident in our legal team, as well as our compelling, sound legal arguments.”

For the sake of completeness, the SEC responded to this line simply by questioning the relationship between the futures market, which trades derivatives based on the spot market, and the actual spot market:

Recitations of data reflecting the size of the CME bitcoin futures market and the size of the spot bitcoin market are not sufficient to establish a link between the CME bitcoin futures market and the proposed ETP.

Source: Order Not Approved – List and trade shares in Grayscale Bitcoin Trustsec.gov p. 50 (link above)

And in particular, the SEC explains how the monitoring sharing agreement with CME can be trusted by a point-based ETP.

However, if an exchange that proposes to list and trade a spot bitcoin ETP identifies CME as the regulated market with which it has a comprehensive monitoring sharing agreement, the exchange may overcome the Commission’s concern by showing that there is a reasonable probability that a person attempting to manipulate spot bitcoin ETP must trade on CME to manipulate ETP …

Source: Order Not Approved – List and trade shares in Grayscale Bitcoin Trustsec.gov pp. 67-68 (link above)

So here lies the “arbitrary and whimsical” point. The SEC puts a higher bar when it comes to asking spot-based ETPs to be able to show that a potential manipulator is likely to trade on CME. And more importantly, the SEC specifically does not require this from the futures-backed products.

Consequently, in the Teucrium Order and the Valkyrie XBTO Order, the Commission explains that it is unnecessary for a listing exchange to establish a reasonable probability that a potential manipulator will have to trade on CME itself to manipulate a proposed ETP whose only non-cash holding will be CME bitcoin. futures contracts.

Source: Order Not Approved – List and trade shares in Grayscale Bitcoin Trustsec.gov p. 67 (link above)

I believe that the approval of futures-supported products such as Teucrium’s, while rejecting those supported by bitcoins such as the Grayscale Bitcoin Trust, is likely to create an injustice between issuers that are not permitted by the Exchange Act. Grayscale will dispute this apparent inequality through the recently filed lawsuit.

Long, hard battle ahead

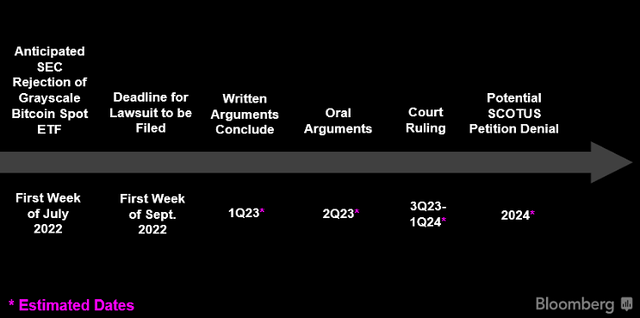

James Seyffart of Bloomberg Intelligence twitret an estimated timeline for the resolution of the grayscale lawsuit and the proposed court decision would not come until the end of 2023 or the beginning of 2024. Let us set aside the possibility of an earlier settlement or that the case will go quickly. Both the reset in the timeline and the SEC’s unchanged position change the present value and expected value thinking regarding the trust.

GBTC Litigation Timeline (@JSeyff on Twitter)

Note that on 28 June, Trust traded with a 29% discount on NAV. Since a conversion to the ETF would remove the rebate, in the months before the rejection it was a meaningful incentive to hold GBTC due to the relatively higher expected value. This position was particularly relevant as Grayscale’s lawyers and the general public had provided significant arguments to the SEC in support of the ETF listing, including highlighting the “arbitrary and capricious” point.

However, due to the significant postponement of the dissolution timeline and the rejection by the SEC of the argument for differential treatment, the Grayscale Bitcoin Trust is no longer a preferred method of gaining exposure to Bitcoin. This is despite the advantage it still has in terms of the simplicity and strength the custody schemes provide investors. Over the past year and a half, it appears that the SEC has developed an increasingly active and antagonistic position towards the crypto space. And it is a political reality that the SEC management, and the management’s position on securities in the crypto sector that fall under their jurisdiction, will not change for many years.

And it’s not just the uncompromising position in the recent decision on shades of gray. As another example, the SEC has also gone to great lengths to maintain a hardline position in the lawsuit against Ripple (XRP-USD). Although it’s obviously from a biased perspective, it’s a fact – filled and interesting read in Fortune last month by Ripple’s Advocate General in which he argues, “we must finally clean up this regulatory sludge.”

In another similar move, in December last year, SEC leader Gensler hired critic Corey Frayer to advise on policy-making and inter-agency work with oversight of cryptocurrencies. In the years before he moved to the SEC, Frayer Senator Sherrod Brown and Representative Maxine Waters served as a senior professional in the areas of banking and financial services. This is remarkable as Sherrod Brown and Maxine Waters have been outspoken against cryptocurrencies in their roles as chairmen of the two most influential money and banking committees in the US Congress.

Summary

The SEC has rejected Grayscale Bitcoin Trusts’ application to convert to a physically supported Bitcoin ETF. From looking at the SEC’s past actions, a quick or easy solution to the recently filed lawsuit seems distant. At the end of last year, the trust was a preferred means of gaining exposure to Bitcoin as it invests directly in the chain, provides quality deposits and trades at a large discount in relation to the value of its assets. Because this rebate would disappear immediately upon conversion to an ETF, Trust’s expected value in the short term was higher than similar products in the months leading up to the SEC decision. However, the SEC’s decision, which maintained its previous interpretation of what constitutes a “regulated market of significant size related to the underlying”, changes this value calculation dramatically. Although I am very constructive on Bitcoin in the region of 20,000 USD, I change my rating on Trust from buy to hold.