GBTC: Million Dollar Bitcoin Bet

alexsl

It’s been about eight months since I last covered Grayscale Bitcoin Trust (GBTC) and I have a bit of a love-hate relationship with this ticker. I first wrote about GBTC for Seeking Alpha in December 2019. My thinking at the time, the premium made GBTC much less interesting than holding BTC directly:

The question an investor should ask is “if the trust lags the asset, charges a premium to buy and falls 2% annually, why buy the trust above the asset?”

This logic still applies if we only compare GBTC to self-custodial Bitcoin (BTC-USD), but it is not necessarily applicable if we compare GBTC to other Bitcoin proxy stakes in a traditional investment account. GBTC has the advantage of providing tax-advantaged exposure to BTC if the investor is okay with not actually holding the keys to the coins. Last July, I quit my last GBTC article with this:

After the liquidation of a top shareholder, I think GBTC shares at a 30% discount are a solid way to long Bitcoin for a potential rally in the spot price.

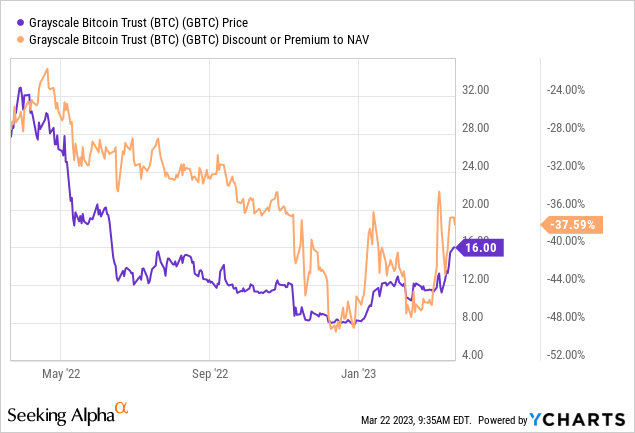

Eight months later, GBTC is roughly where it was at the time of my article publication in July 2022, but the discount to NAV is actually greater by just under 38%:

Since that article, concerns about Grayscale’s parent company and general market panic actually pushed the GBTC NAV discount down to 49% as recently as December. Despite the lousy market sentiment around Grayscale, Digital Currency Group and the underlying asset, I think GBTC is long at this point and I suspect the worst has already been priced in through the NAV discount.

SEC Litigation

Earlier this month, Grayscale’s case against the SEC went before District of Columbia Circuit Court of Appeals judges. Perhaps the most interesting thing from that hearing was not how Grayscale’s argument was received by judges, but rather how the SEC’s argument was received. From CoinDesk’s write-up at the time:

The judges questioned the SEC’s logic in distinguishing between Bitcoin spot market prices and futures market prices. Grayscale’s argument is that the SEC acted arbitrarily by rejecting the ETF application and previously approving Bitcoin futures ETFs.

The lawyer for the SEC was hit with a barrage of difficult questions from the judges, and the market saw this very positively for Grayscale. Assuming Grayscale wins this lawsuit, it stands to reason that the SEC will take one of two approaches following the decision:

- The agency will approve Grayscale’s next conversion application

- The agency will go the other way and reject the BTC futures ETFs

I personally think option 1 is more likely. As a redeemable ETF, GBTC’s NAV discount should close considerably. If the SEC does not allow US-based investors a “safe, regulated” way to gain Bitcoin exposure through an ETF, it could, in my opinion, risk significantly damaging the agency’s integrity.

After all, it shouldn’t be lost on investors that Gary Gensler’s SEC has allowed ETFs that track the conversations of a cable TV personality, but not a spot Bitcoin ETF. Taking the position that a Bitcoin spot ETF cannot exist due to theoretical manipulation risk while allowing two ETFs that one man can push around with a TV show seems counterintuitive; and it is I who choose to be generous.

The Balaji venture

Balaji Srinivasan is a venture capitalist and entrepreneur. He was previously CTO at Coinbase (COIN) and can certainly be seen as a pro-crypto advocate. He has made headlines in recent days due to a bet he posted on Twitter that calls for a Bitcoin price of $1 million within 90 days. His argument for this call stems from the proliferation of bank failures and what he calls a “stealth financial crisis” leading to hyperinflation in the US dollar.

Although some of the most bullish Bitcoin advocates see this $1 million BTC bet more as a publicity stunt than an honest effort, Srinivasan himself insinuated on a recent podcast appearance that the bet is more about the banks than Bitcoin:

I hope I don’t win. Right. Because this is a way to call attention to this creeping financial crisis.

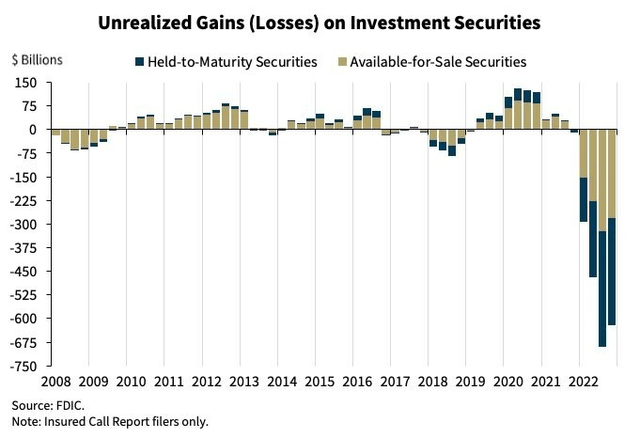

Srinivasan’s thesis for hyperinflation is that the banks are under water on collateral and cannot cover withdrawals if enough people want their deposits back. There is certainly some truth to these fears, as the unrealized losses on investment securities last year were nothing short of catastrophic:

Unrealized losses (FDIC)

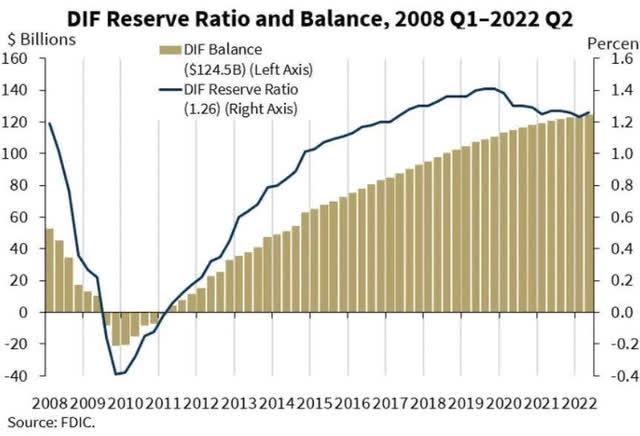

The reality is that information moves much faster in 2023 than it did during the last financial crisis, and the “bank race” no longer requires a physical bank branch. In Srinivasan’s view, the only option the central bank and the federal government will have is to stop all deposits through monetary debt. The FDIC simply does not have the reserves necessary to pay out all depositors in the event of a major systemic financial collapse:

FDIC

This is probably why the FDIC, the US Treasury and the Federal Reserve just announced the Bank Term Funding Program:

The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), which offers loans of up to one year to banks, savings associations, credit unions and other qualified depository institutions that pledge US Treasury bonds, agency debt and mortgage-backed securities and other qualifying assets as security. These assets will be valued at par. BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell these securities in times of stress.

Fat my weight. This program is staggering because it allows banks to borrow against government bonds at par, even if the positions are underwater. This is a roundabout way of turning the liquidity hose back on. As I see it, it makes more sense to borrow against underwater security if the parties involved have an understanding that the underwater security will not be underwater for long. Bitcoin was literally made for this moment.

Summary

In my view, there is now too much at stake for the SEC to not allow a spot Bitcoin ETF. If it doesn’t, the risk shifts to keeping BTC proxy capital with the established institutions. We are already living in what is likely to be another financial crisis, judging by the bank closures and bailouts we have witnessed in recent weeks. I find it very hard to believe that there aren’t other banks suffering from the same loan/loan duration problem that took out SVB a couple of weeks ago, and we can already see a sly admission of that through the Bank Term Funding Program.

Bitcoin has begun to account for a money printer that has only recently been turned back on. Even if the SEC loses the Grayscale lawsuit and ultimately decides not to approve the ProShares Bitcoin Strategy ETF (BITO) and other Bitcoin futures ETFs in an effort to keep BTC out of the legacy financial system, it can only squeeze in $930 million. AUM from these funds to GBTC anyway. Which is another possible catalyst that could result in the narrowing of the GBTC NAV gap. If that were to happen, even if Bitcoin’s performance is flat, GBTC will outperform. To be clear, I think BTC is best kept in self-custody, off exchanges. But for dollars stuck in TradFi retirement accounts, GBTC isn’t a bad idea given the setup.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.