All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, do your own research before making any kind of investment.

all about cryptop referances

Blur has a stranglehold on the NFT lending industry. Since the controversial NFT exchange started offering lending services to NFT collectors last month, it has managed to control 82% of the lending volume. What’s happening with Blur’s NFT lending program?

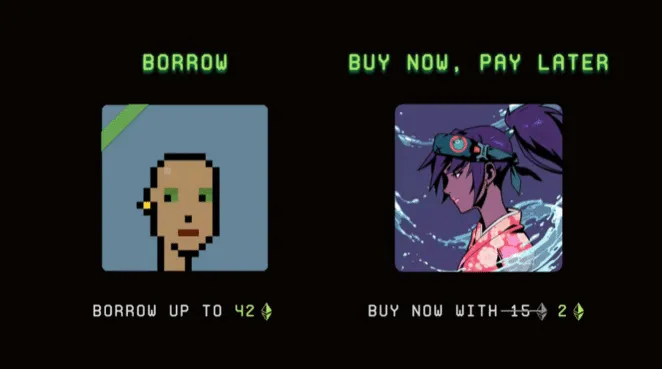

Blur made a big announcement last month. It will be about offering loans with security for blue-chip NFT holders. In addition, buyers can also purchase NFTs by making an upfront payment and financing the rest of the purchase. This program is called Blend, and since its launch has proved exceptionally popular.

Over the past 22 days, Blur has managed $308 million in loan volume. This figure represents a share of 82% of the total lending volume of $375 million in May. In fact, Blend has become so successful that this volume currently represents 46.2% of the exchange’s operations.

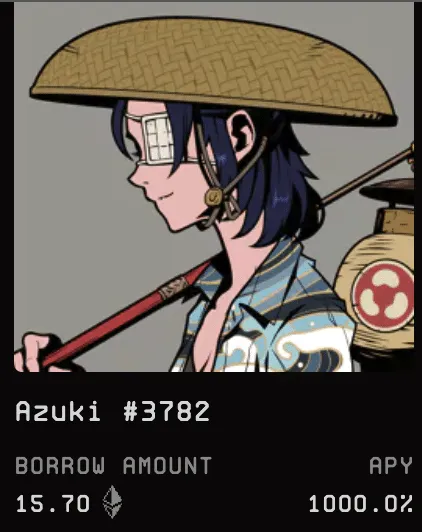

Blend users primarily target the Azuki collection. Known for its excellent art and rich collectors, Azuki provides a relatively stable floor for loan operators to work with. To date, Azuki has seen $127 million in loan volume. The platform also supports lending to other top NFT collections including CryptoPunks, Milady Makers, DeGods, Bored Ape Yacht Club and Mutant Ape Yacht Club.

So far, collectors with high net worth have dominated lending volumes. This is not surprising given that Blur is rewarding Blend users with their latest airdrop. As a result, whales are farming this airdrop by pouring money into the Blend platform. The more loans they offer and take up, the more lending points they get, and the bigger the airdrop these people will eventually receive.

Like Blur’s previous airdrop campaigns, Blend has had a ripple effect on the rest of the NFT market. Initially, prices moved higher as Blend unlocked liquidity previously locked in NFTs. Some holders posted their expensive goods as collateral to buy other NFTs, hoping that they would be able to execute profitable trades before having to pay sometimes exorbitant borrowing costs. Furthermore, some buyers took advantage of Blend’s low cash financing options to purchase NFTs for a fraction of the cost.

Despite its success, some members of the NFT community have been critical of Blend. Jonathan Gabler, the co-founder of alternative NFT lending protocol NFTFi, stated that “Unchanged, the current incentive design is likely to lead to bad outcomes for borrowers such as mass defaults or liquidation of high-risk loans, wash NFTs into point farmers, and as a consequence, could lead to much higher market volatility. Existing peer-to-peer protocols tend to be more borrower-friendly and lead to healthier loan markets.”

Regardless of any controversies, Blur has continued to assert itself as a disruptive player in the NFT market. Børsen’s Blend program is another example of its willingness to innovate to meet customer demands. Moreover, it also shows Blur’s understanding of its customer base – give NFT buyers a means to buy more NFTs and they will jump at the opportunity.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, do your own research before making any kind of investment.