Further Bitcoin Volatility Ahead? Here’s what the options markets are saying about the BTC price outlook

Bitcoin looks set to end Wednesday’s session largely unchanged in the mid-$24,000s, giving market participants some much-needed time to catch their breath after a hectic seven days of price action. This time last week, Bitcoin had just fallen back below $22,000 for the first time in over three weeks, weighed along with the downside in US stocks on concerns about Fed tightening.

A series of high-profile US bank collapses (Silvergate, SVB and then Signature Bank) will trigger further risk flows, driving the BTC price as low as $19,500 by Friday, where Bitcoin tested its 200DMA and realized price for the first time in nearly two months.

A proactive response by the US government to freeze deposits and launch a new bank liquidity program (which helped the USDC, a key part of the crypto market’s plumbing, get back to the $1 peg) helped Bitcoin end last week on a strong footing.

Expectations that the risk of a banking crisis would deter the Fed from engaging in significant further rate hikes, as well as narratives that cryptocurrencies like Bitcoin are a safe haven against problems in the traditional financial system, then helped propel Bitcoin as high as the mid-$26,500s s by Tuesday.

It was Bitcoin’s highest level since June of last year, and at its peak this week, marked gains of over 35% compared to last week’s low of under $20,000. Bitcoin’s wild swing from two-month lows to nine-month highs during few days have traders betting that more volatility is likely to come now. At least that is according to the Bitcoin options markets. Let’s take a deeper look.

Traders increase their Bitcoin volatility bets

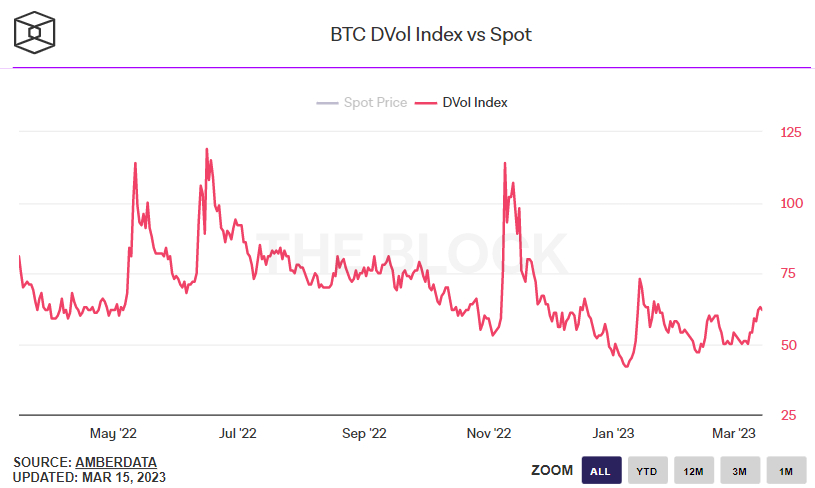

Over the past week, Deribit’s Bitcoin Volatility Index (DVOL) has jumped from around 50 (which is not far above historic lows) to nearly two-month highs of around 62. It remains below the highs hit here in January in the 73 range from when BTC burst back above $20,000. Deribit is the dominant crypto derivatives exchange.

And it’s still well below last year’s post-FTX collapse highs in the 114 area. But it still shows that investors are positioning themselves for chopper waters going forward. And that makes sense when you consider the key $25,200-400 resistance area that Bitcoin broke this week, which technicians believe opens the door to a potentially quick rally towards the next major resistance area around $28,000, and perhaps even above $30,000 .

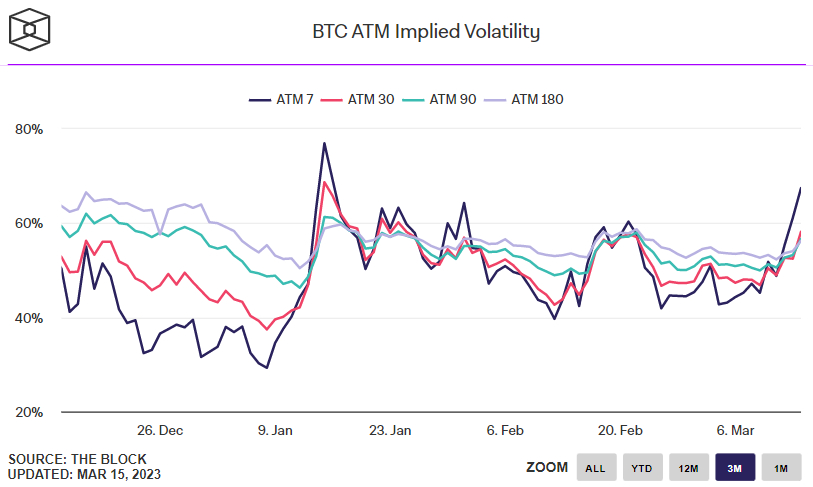

Meanwhile, implied volatility according to At-The-Money (ATM) Bitcoin option prices has also increased. ATM implied volatility for options expiring in 7 days hit its highest level since mid-January on Tuesday at 67.44%, up from previous monthly lows in the 42% range. ATM implied volatilities according to options expiring in 30, 90 and 180 days have all also risen to multi-week highs.

Traders once again neutral on BTC Price Outlook

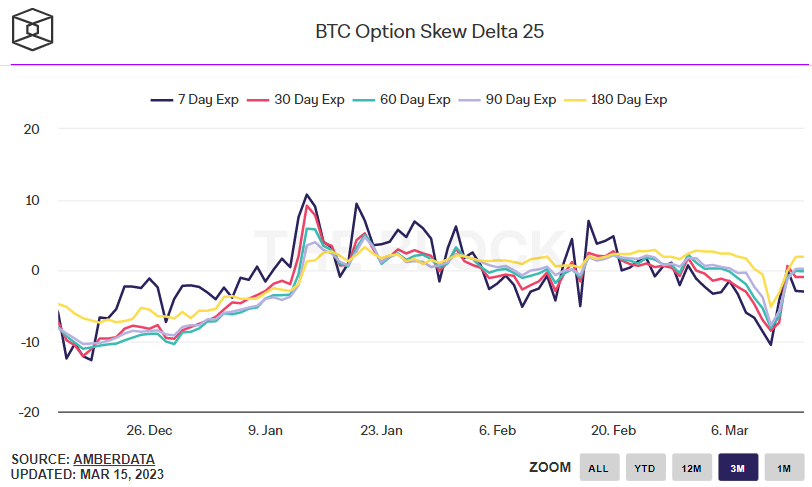

As Bitcoin fell below $20,000 for the first time in two months last week, the BTC price outlook according to the 25% delta bias of Bitcoin options expiring in 7, 30, 60, 90 and 180 days fell to the lows of years of between -5 to -10.

The 25% delta option bias is a popularly watched proxy for the extent to which trading desks are over or underpricing for upside or downside protection via the put and call options they sell to investors. Put options give an investor the right, but not the obligation, to sell an asset at a predetermined price, while a call option gives an investor the right, but not the obligation, to buy an asset at a predetermined price.

A bias of 25% delta options above 0 suggests that desks charge more for equivalent call options versus puts. This implies that there is stronger demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

However, in the wake of the BTC price rally to nine-month highs, options markets have reverted to a largely neutral view of the market. The 25% delta bias of Bitcoin options expiring in 7, 30, 60, 90 and 180 days are all back to close to 0.

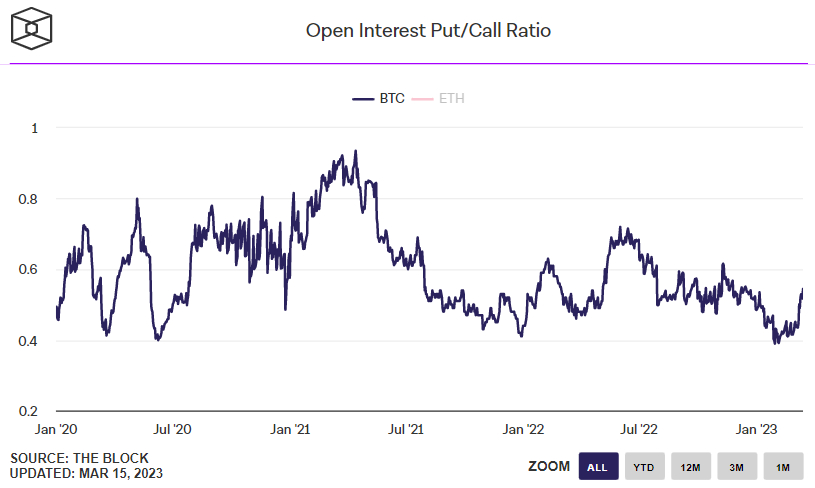

However, sending a more bearish signal is the ratio of put and call options on Deribit. The ratio of open interest to Bitcoin puts and calls was 0.54 on Wednesday, the highest level of the year and up from recent record lows below 0.40. A ratio below 1 means that investors prefer to own call options (bet that the price will rise) rather than put options (bet that the price will fall).