Fuelart’s Art+Tech & NFT Startups Report H1 2022 is about to be released

ART+TECH & NFT STARTUPS REPORT H1 2022 by FUELARTS

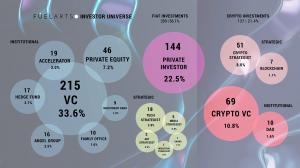

ART+TECH & NFT STARTUPS REPORT 2022 _ Investor Universe

ART+TECH & NFT STARTUPS REPORT 2022 _ Geographical spread

FUELARTS releases its second report, dedicated to H1 2022 and the investments that Art Tech and NFT startups have received during this period.

— Denis Belkevich, General Partner, FUELARTS

NEW YORK, NEW YORK, USA, September 12, 2022 /EINPresswire.com/ — This report focuses on Art+Tech & NFT ecosystems, portraits of investors and analysis of specialized funds ready to invest in this sector.

Together with the analyses, we present interviews with key stakeholders in the industry. In this section, we’ve included interviews with Head of Pace Verso Ariel Hudes, NFT collector and venture capitalist Ryan Zurrer, co-founder of Artfacts and Limna Marek Claassen, Head of Finance and Operations at Galaxy Labs Mohnish Mehta, and Art Blocks’ COO Hugh Heslep.

In March, Fuelarts released its first report, which gained a lot of credibility from Art+Tech & NFT representatives. In just half a year, this report has reached 10,000 downloads, taking its rightful place among other reports in this industry.

Key facts from a new Fuelarts report:

– In H1 2022, 123 Art+Tech startups received $2.600 billion in total funding, representing 237% of investments for the full year 2021 ($1.098 billion). Out of a total of 801 startups – 15.2% have received funding during the first 6 months of 2022.

– 12 startups from the “physical” art market received only $99.2 million (3.8% of total funding), while 111 startups from the Digital Art Market and the NFT sector – $2.501 billion (96.2%).

– Within the first 6 months of 2022, there were 640 investors who participated in 766 rounds. 13.4% of them have made more than one investment in various Art+Tech & NFT startups in H1 2022. Only 4.1% of investors made three or more investments in this sector.

– Traditional (non-crypto) VC investors and private individuals (both fiat and crypto) were the most active in funding Art+Tech & NFT startups – with 33.6% and 22.5% of investments made respectively.

– From June 2021 to August 2022, 33 specialized investment funds have announced to raise funds for distribution in Web3 startups (including Art+Tech & NFT). The total amount of announced assets is $23.72 billion, with only $1.5 billion (6.3%) already invested.

– 83% of art market strategists, who participated in the report’s survey, consider it inevitable that the market will turn towards physical art, which behaves more predictably as a resource in times of economic crisis. In particular, this could lead to an increase in the role of shared ownership and traditional art investment instruments proposed by Art+Tech startups.

Press kit with all additional information.

* FUELARTS is an investment company specializing in the Art+Tech industry. Our mission is to support the development of the emerging Web3 ecosystem, supporting bold entrepreneurs as they build a more efficient, transparent and accessible art market.

In 2019, FUELARTS was founded by serial entrepreneur Denis Belkevich and former COO of Christie’s Americas, former senior VP of Artnet Roxanna Zarnegar.

Our vision for FUELARTS is to become not only an investment vehicle, but a platform that merges art and capital. FUELARTS includes 3 main structures:

● Fuelarts Accelerator provides tools to support founders of Art+Tech startups.

● Fuelarts Insights shares content and analysis to engage and grow the Art+Tech community.

● Fuelarts Capital is a venture arm that invests in graduates of accelerator and infrastructure managers.

Scaling the business and expanding its reach, FUELARTS today has a diverse international team of art market, PR, venture capital and Blockchain & NFT professionals. The team includes experts from the United States, China, France, Switzerland, Ukraine and Ecuador.

From 2023, the goal of FUELARTS is to become a VC company builder, helping startups in the NFT and blockchain space to build a business model that can shift focus as market demands change.

Anna Shvets

Tatchers’ Art Management

managing [email protected]

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

![]()