FTX killed crypto, long live Bitcoin

The FTX collapse has revived the narrative that “Bitcoin maximalists were right all along.”

Given the size of the troubled exchange and the number of devices captured online, the FTX scandal has dominated headlines of late.

Worse, each passing day seemingly brings additional twists that point to serious failings within the company and among the regulatory bodies that were supposed to prevent such scandals from happening in the first place.

In particular, questions linger about Sam Bankman-Fried’s (SBF) political influence and connections, as well as FTX’s apparent “passport” with the Securities and Exchange Commission (SEC).

Behind the veil of high-profile sports and celebrity endorsements, FTX managed to build a reliable reputation in its relatively short three and a half year existence. Although skeptics said the red flags were always there, there is no consolation for those who bet on FTX and lost big.

At the heart of the scandal is FTX’s original FTT token and the way it was managed. During a liquidity stress test, it failed to justify its high market value of $3.4 billion before the collapse.

The net result of the scandal is the loss of billions and an industry struggling to preserve what little reputation and credibility remains.

Undoubtedly, the bankruptcy has given birth to a new wave of Bitcoin maximalism, and as some might say, their vitriol against sh*tcoins has proven to be on track time and time again.

Self-storage Bitcoin as the answer

The leading cryptocurrency is simple in design and by all accounts a dinosaur in terms of technology. However, Maxis points out that these same “flaws” are what make Bitcoin the only digital asset to hold.

On the basis that Bitcoin has no regulatory basis, perverse incentives or groups with special rights, maxis claims that the principles of decentralization, transparency and immutability only apply to BTC.

In passionate defense of this view, the Bitcoin-only crowd has been labeled toxic and narrow-minded in the past. Still, the events of the past week demonstrate some degree of truth, at least from the perspective of anti-Ponzinomics used to exchange tokens.

With hit after hit from Celsius, BlockFi, Voyager, Terra Luna and more, the penny is starting to drop. Trust, simplicity and honesty trump returns and short-term gain.

As the industry emerges from the FTX black swan, the BTC maxi move will only grow stronger.

Altcoins are “evil”

On-chain analyst Jimmy Song wrote a long piece about the “moral case against altcoins.” He covered a number of points against altcoins, including the false run on the legitimacy of BTC and the impact of short-term incentives from VCs.

He claimed that “altcoins are evil” and simply mirror the fiat system, but in a new package. With that, their proliferation will not lead to financial freedom, which is often the goal of many entering the crypto space. Rather, the existence of altcoins only confuses cryptocurrency from the perspective of getting the real thing, i.e. Bitcoin.

In addition, Song argued that the altcoin space is hindering Bitcoin adoption, thus preventing those who need it most from acquiring it due to the attention of newer, shinier projects.

“Altcoins are a cesspool of theft, cronyism and rent-seeking. Altcoins build on the reputation that Bitcoin has worked hard to achieve. They enrich the VCs and altcoin pumpers at the expense of the poor and vulnerable.”

Most people would have labeled such views as extreme in the past, or perhaps too black and white. However, the incessant CeFi scandals this year have pushed more people to accept these points.

Data on the chain shows that the krone has fallen

Despite selling pressure affecting the Bitcoin price in the immediate term, long-term HODLers continue to believe.

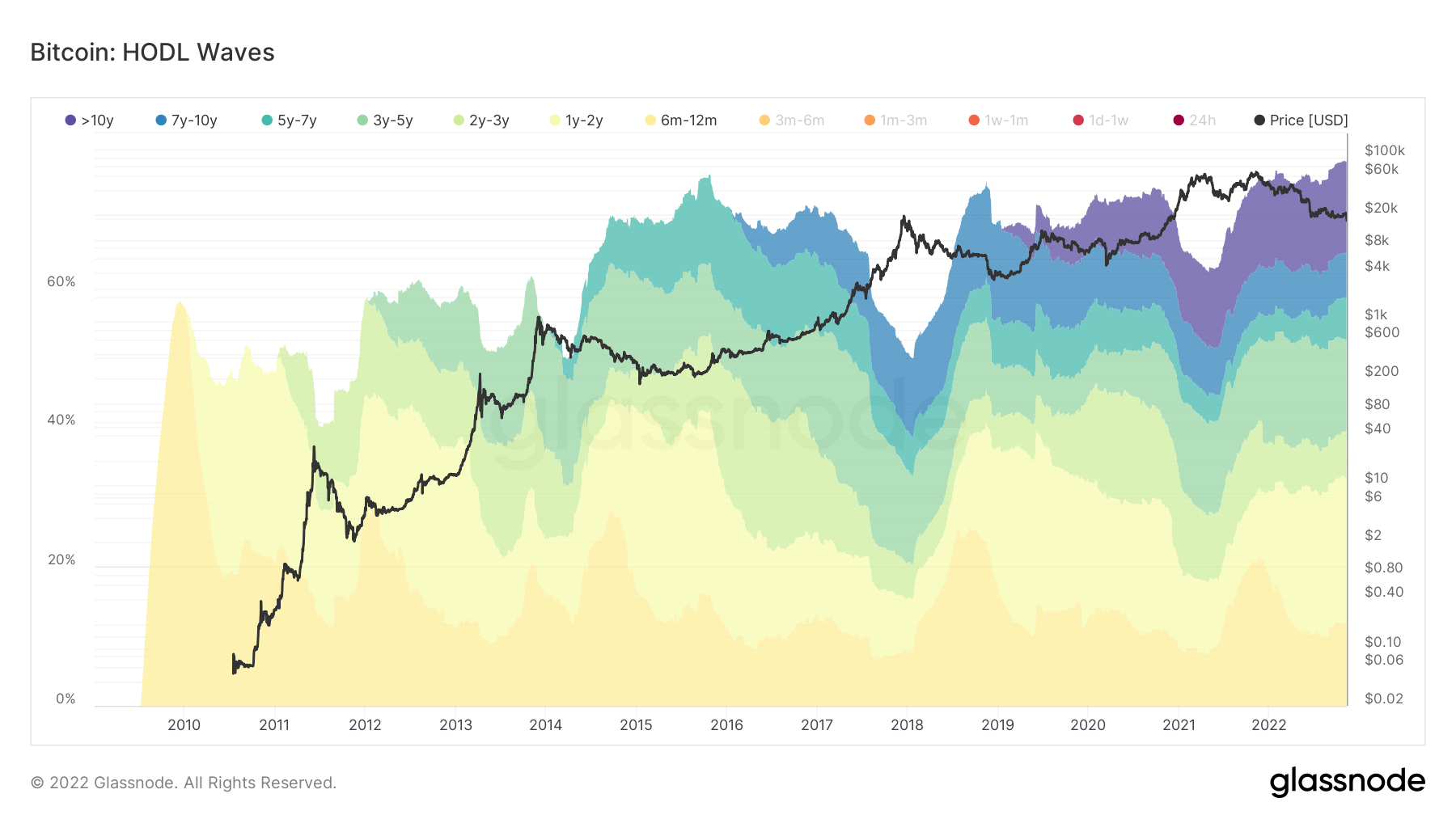

The HODL Waves chart shows the amount of BTC in circulation divided by age ranges that represent the last time the supply was moved.

The diagram below shows a strong rise in the age group over 10 years. This has been a noticeable pattern since around 2020. However, the >10y wave continues to widen as the BTC price falls.

In addition, the total age groups add up to 76% – a new all-time high.

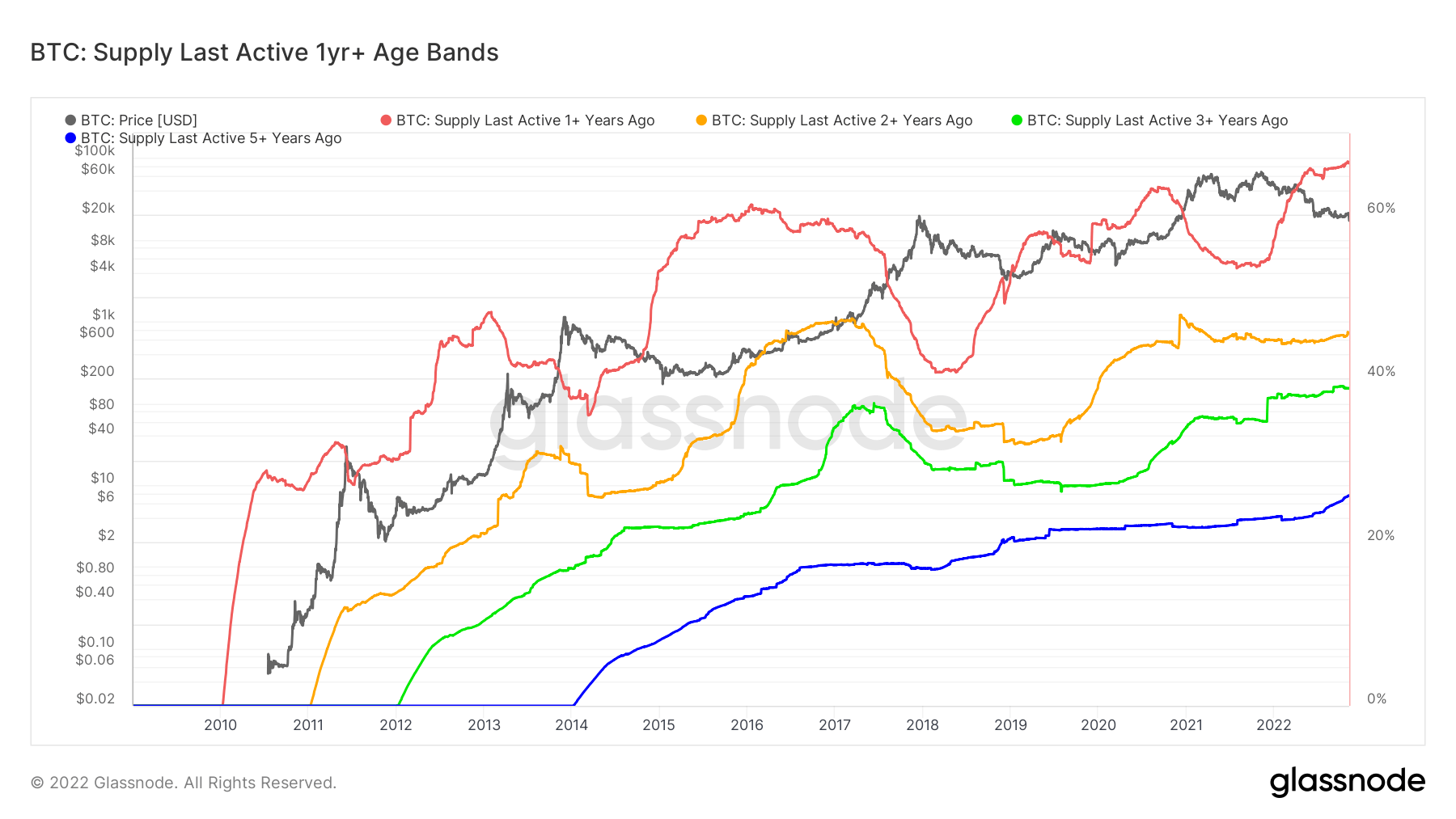

Analyzing active offer over a wider period of time shows a general increase in all categories over one year. The most active since 2022 is the 1+ year ago red group, suggesting that relatively recent participants are maxing out.