Fried circles at the bitcoin miners

Rapidly rising electricity prices should be bad news for cryptocurrency miners, right? The boutique investment house Kuros Associates believes so, after shorting US-listed Microstrategy and Riot Blockchain despite being a short-term bitcoin bull.

Miners “have a big problem [with] the rising energy costs, and it does not disappear immediately, says Tancredi Cordero, CEO of London-based Kuros. “The smart trade will be a put trade that expires in Q3. [Electricity] prices will skyrocket in the summer, and this will lead to lower growth margins for these companies. “

What sounds like a logical trade, however, may turn out to be a gamble, because when it comes to crypto production costs, there is a lot we do not know.

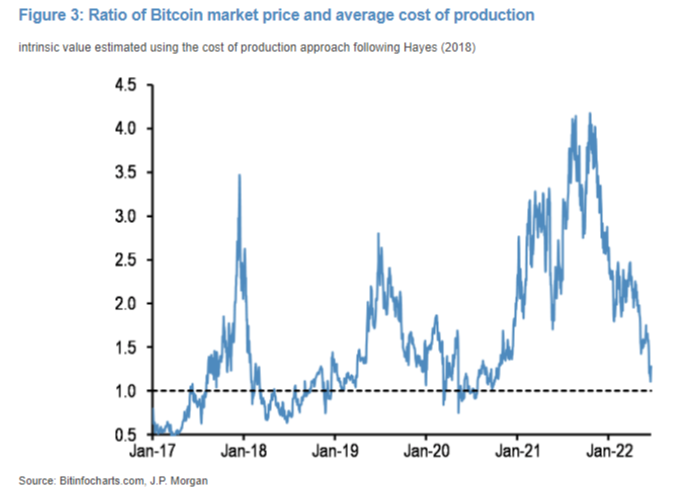

The average production cost of Bitcoin miners globally has fallen by almost a fifth in the last fourteen days, JPMorgan estimates. After hovering between $ 18,000 and $ 20,000 for most of 2022, the total cost of minting a coin has dropped to around $ 15,000. And since the beginning of the year, it seems that the least efficient miners have dropped out of the game.

JPMorgan’s approach is to treat bitcoin as a commodity and use a marginal cost of mining. The formula used is taken from an article from 2018 written by Adam Hayes from Hebraw University of Jerusalem, whose cost assumptions once gave a very approximate lower limit for the market price:

© Adam Hayes

To arrive at an overall figure, JPMorgan takes the current market price, hash rate and degree of difficulty and then runs them through the Hayes method – although the broker admits that its key input, an electricity cost of $ 0.05 per kWh, can only be a guess. Its benchmark index, the Digiconomist Bitcoin Electricity Consumption Index, stopped including a hardware efficiency estimate by mid-2020.

Relying on an assumption for one of the most important inputs to mining costs is clearly not ideal. However, since it is such an important variable, and the electricity costs of individual miners are often based on bilateral agreements with electricity producers, there is often little incentive for privately owned miners to disclose these costs. Arcane Research has estimated that North American listed miners such as Core Scientific, Marathon, Riot, Hut 8 and Bitfarms face electricity costs of between $ 24 and $ 40 per MWh, or $ 0.024 and $ 0.04 per kWh, based on the latest public revelations. Although this suggests that our assumption of electricity costs of $ 0.05 per kWh may be modest on the upside for previous years, but there can clearly be considerable variation.

The baselast index indicates that grid consumption falls on an annual basis from 120TWh at the beginning of June to around 93TWh. Meanwhile, bitcoin’s hash rate has hardly changed. This suggests either that miners are retiring their least efficient rigs, or that low-cost operators have increased capacity, JPM concludes:

This bears some echo from the first half of 2018 when the decline in bitcoin prices to or even modestly below our estimate of production costs was associated with an increase in average efficiency of mining hardware rather than a fall in hash rates, until the hash rates of finally fell at the end of 2018. When the halving of bitcoin block rewards in May 2020 effectively doubled production costs, miners responded relatively quickly through a combination of an increase in the efficiency of mining hardware and a reduction in hash rates, effectively indicating that less efficient rigs were taken off-line on time. The next halving event is likely to take place in May 2024, and may see similar dynamics.

It is also worth emphasizing that although mining cost estimates may form the lower limit for bitcoin, it is the sentiment that really matters:

Listed mining companies account for around 20 percent of all mining operations, according to JPMorgan. These companies should have purchasing power, better access to finance and more refined survival instincts and than rivals with craft mining fleets – but the market has not shown much confidence in their ability to move down the cost curve and ride out the crypto winter.

Nasdaq-listed Core Scientific, Marathon and Riot have all fallen nearly 80 percent so far this year, and many operators have sold their reserves, either to finance operating costs or to meet debt agreements.

Kuros Associates has reduced its efforts against US bitcoin miners in response to last week’s cryptocurrency market upswing, along with recent bouts of increased volatility across digital assets. Bitcoin can still double during the summer before falling to $ 1,000 by the end of the year, says Cordero, as institutional investors and hedge funds with a mandate for crypto only move out of symbols with smaller values and into the bigger names. “But when implied and realized volume goes down on options in this area, we will probably reopen trading.”