Former Morgan Stanley executive says crypto will change the financial system – the future of money?

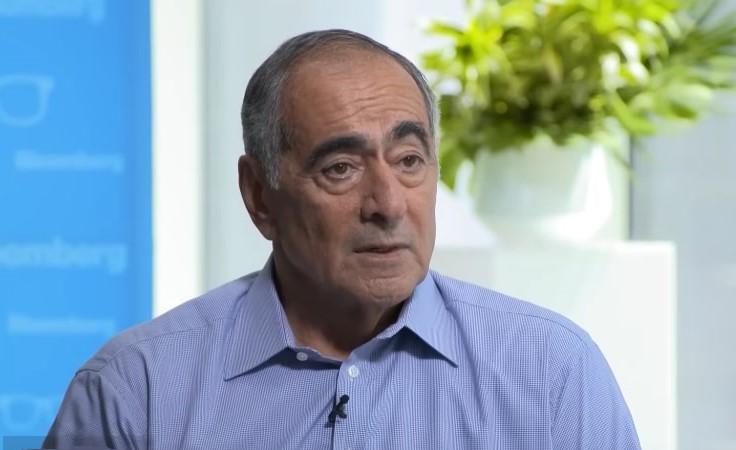

John Mack, former CEO of the major US-headquartered investment bank Morgan Stanleysuggests that bitcoin (BTC) and crypto may become part of the increasingly digitized world of commerce – and many of us may live to see it.

Speaking to CNBC about whether Wall Street would be digitized in the future, Mack said he doesn’t think “it’s going away,” but that it will change “dramatically.”

“Take crypto. It’s hard for me to understand why it has value,” he said, adding:

“So 50 years from now, maybe there will be a huge way money transactions take place.”

Crypto is easy to connect, Mack claimed. Since everything is online, people don’t have to worry about putting their money in banks, but “you have to make sure it’s isolated, protected and nobody can break into it,” he said.

That said, he went on to suggest that in the not-so-distant future, crypto and digitization in the world of commerce may be the norm.

“Fifty years from now, I think things will be even more electronic and driven more and more by input from people in the computers about how to trade, how to take risks and to make sure they don’t overstep their bounds.”

Mack has been a crypto investor for a while now. Asked if he still owns any bitcoin, he replied: “I do.”

Among his investments, he shared that through his family office, “we have some direct positions in crypto.”

Mack is a senior advisor for the securities firm Kohlberg Kravis Roberts and former CEO and Chairman of Morgan Stanley. He had been CEO of the bank from 2005 to 2010, and chairman from 2005 to 2012. Between 2001 and 2004, he served as CEO of the global investment bank Credit Suisse.

You can watch the interview here:

Meanwhile, Morgan Stanley itself entered the crypto game a while back. For example, in March 2021, it announced its plans to offer three bitcoin funds to its wealthy clients.

More recently, as reported in October, Morgan Stanley CEO James Gorman was less critical of crypto than some of his fellow investment bankers. “I don’t think crypto is a fad. I don’t think it’s going to go away,” Gorman said during an earnings call. “I don’t know what the value of bitcoin should or shouldn’t be. But these things do not disappear, said the CEO.

Furthermore, twelve institutional funds managed by Morgan Stanley may have had exposure to bitcoin indirectly through cash-settled futures or through investments in Grayscale Bitcoin Trustthe bank said in a March 31 filing.

____

Learn more:

– Morgan Stanley Exec Says Bitcoin Will Come for US Dollars

– “Time to Get Educated”: Morgan Stanley Brings BTC Funds to Rich Clients

– Cardano CEO Hoskinson argues VC money will flood ecosystem by 2024

– Crypto thrives through offshore corporate structures