Former bankers debuted high-speed crypto trading firm CROSSx

Former TradFi executives Brandon Mulvihill and Anthony Mazzarese have launched a new high-speed crypto trading firm that can complete trades in under 20 microseconds.

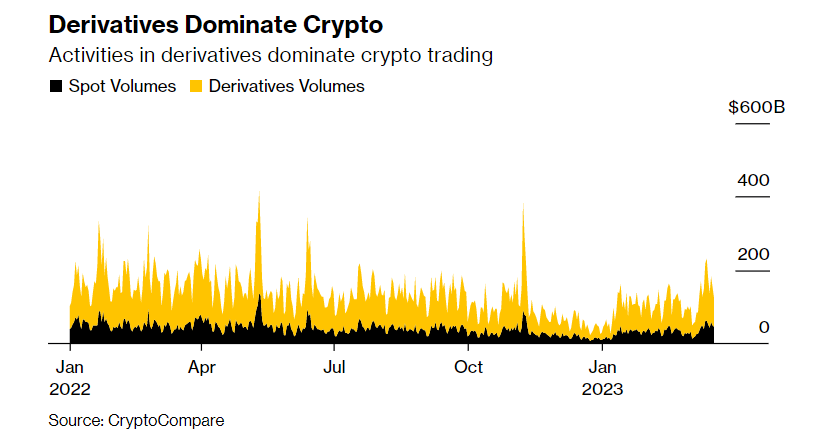

The new firm, CROSSx, will initially offer institutional investors faster matching of buy and sell orders than a traditional exchange. At launch, the trading platform will offer spot trading, with plans for derivatives trading expected later.

CROSSx launch delayed by Crypto Winter

Mulvihill and Mazzarese hope that lower latency will be a selling point for their new venture as crypto markets mature. The firm will run its trading engine from a physical data center in London rather than the cloud to reduce latency. Both executives previously worked for Jeffries Financial Group.

The founders said the crypto winter delayed the launch of CROSSx, as investors took longer to conduct due diligence. Traditional quant trading venue Two Sigma and crypto firm Wintermute were among CROSSx’s investors. These firms and others invested over $6 million during CROSSx’s seed funding round.

High-frequency trading firms execute trades through algorithms that exploit small differences in price gaps. These algorithms typically execute in seconds or less, potentially yielding a profit for traders each time they execute.

Traders can use high-frequency strategies to exploit the price difference between cryptocurrencies on different exchanges. This method of trading is called arbitrage trading.

According to its website, the Gemini exchange, founded by the Winklevoss twins, offers Gemini Active Trader that executes trades in microseconds.

Co-founder of Dexterity Capital says higher trading speeds will win races

Last year, Michael Safai of Dexterity Capital said the race to win institutional high-frequency trading activity is growing.

“And while we didn’t think about it that much earlier because HFTs didn’t matter, with the big guys in, we have to think about it now. We have to think about our internal latency. So we’re at the beginning of this arms race to be faster, to be smarter, to really win,” he told the What Goes Up podcast.

He added that cryptocurrencies started tracking stocks last year because institutions used the same strategies for stocks and crypto.

“When institutions come in, they play by the rules they’ve always played by … as institutions come in, they bring in strategies that they use in mainstream markets, equity markets, and foreign exchange. So, part of what we’re seeing is that when stocks fall, Bitcoin falls and they are linked. And that’s because the same strategies are being adopted by major players in the institutional world across both asset classes,” he observed.

In other exchange news, BitStamp announced the launch of its Bitstamp-as-a-service for institutions in the Asia-Pacific region.

Using Bitstamp’s Exchange, Exchange Plus and Exchange Complete service levels, institutions can fast track onboarding through a plug-and-play Know-Your-Customer and Anti-Money Laundering module.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.