For Bitcoin to be real digital cash – Bitcoin Magazine

This is an opinion editorial by Scott Worden, an engineer, an attorney and the founder of BTC Trusts.

“I have been working on a new electronic cash system that is completely peer-to-peer, with no trusted third party.” —Satoshi Nakamoto

It’s one of those perfect fall days in Colorado, and I’m sitting outside a pub in the late afternoon. I meet another bitcoiner, a man I met in Austin at the end of the summer. As the sun dropped behind the mountains, the sky turned orange, setting the perfect backdrop for lively bitcoin conversations.

As we ticked off the typical list of everything we agreed on—censorship is bad, red meat is good, etc.—I made an offhand comment about wanting more businesses to accept bitcoin as payment. “Well I don’t, why would you part with your bet?” was the reply he threw back. The implication, of course, is that a true Bitcoiner values satoshis more than anything else in the world. Why would you trade them for groceries, t-shirts or beer? “Haven’t you heard of Laslo Hanyecz? That fool traded 10,000 bitcoins for a couple of pizzas. I will not repeat that mistake. Talk to me when bitcoin hits $200k, so maybe it would make sense.”

My new friend is not alone in this thinking. It’s a sentiment offered by people like Michael Saylor and others in the HODL community. They will advocate: “The scarcest asset in the world is Bitcoin. It’s digital gold,” “Buying bitcoin is like buying real estate in Manhattan 100 years ago“, and “Don’t sell bitcoin!” But at the same time, there’s an intuitive recognition that if bitcoin can never be traded for a good or service, it effectively has no value, no matter what price flashes on the BLOCK CLOCK in the office. I call this the HODLerence dilemma.

But is this really a dilemma? Are these mantras, as prolific as they are, consistent with the spirit of Satoshi’s innovation? Does the proliferation of the Lightning network and mobile wallets that our parents (or children) can intuitively operate require us to evolve our understanding of Bitcoin’s value proposition? Personally, I think the time has come to stop thinking of bitcoin as just a store of value and start conceptualizing it primarily as a medium of exchange … which also happens to store value better than any asset on earth. In case you weren’t already aware, here are some reasons.

Privacy

“Bitcoin would be convenient for people who don’t have a credit card or don’t want to use the cards they have.” —Satoshi Nakamoto

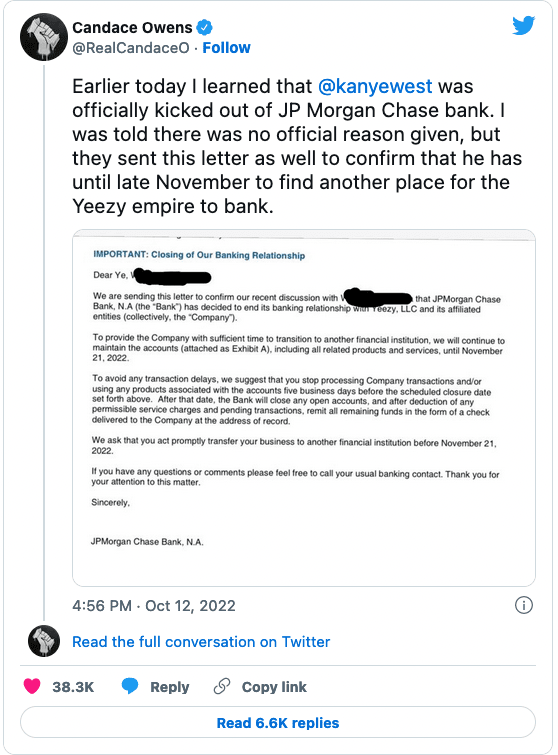

The time to start exiting the system is right now. The signal has never been stronger. Today we live in a world where the fiat system can:

All this is happening Today, and that’s probably just the tip of the iceberg. In a retail system where cash transactions are increasingly scarce and impractical, the majority of major banks, credit bureaus and payment systems have acquiesced to the demands of a government that appears to have an existential stake in controlling our behavior..

Of course, bitcoin is not a panacea against censorship – at least as it is most commonly bought and exchanged today. The Canadian Trucker protest showed us that a government committed to suppressing the voices of its citizens will go to great lengths to do so, and in the process taught us that licensed exchanges and chain analysis techniques can be very effective at blacklisting addresses and even identify donors. These vulnerabilities must be overcome to provide a more censorship-free exchange currency. But by trading in bitcoin with peers and merchants for everyday goods and services as often as possible, we encourage others to both accept and trade in bitcoin. Through numbers alone, we can make the bitcoin economy more robust, decentralized and difficult to censor. A community that values privacy will naturally choose to adopt non-custodial wallets, engage in collaborative transactions and avoid KYC exchanges. Growing and educating this community has never been more important.

Convenience and autonomy

“With e-currency based on cryptographic proof, without the need to trust a third-party intermediary, money can be safe and transactions simple.” —Satoshi Nakamoto

A common counterargument to trading with bitcoin is that it is either too complicated or too slow compared to swiping a credit card. This is simply not true anymore. Today, any entry-level Bitcoiner can download Muun Wallet and within minutes send Lightning invoices to customers for payment via QR code. Coinkite has an NFC device that allows users to sign for transactions with a tap on the card. There are several examples, and many more to come. The beauty of these solutions is that they are completely non-custodial, ie there is no central third party controlling your coins. The software only enables transactions to be broadcast to the network. Lightning transactions disappear instantly, with fees an order of magnitude lower than Visa or Mastercard’s traditional 2-3%. (For example, it recently cost me about $.60 in fees to send the equivalent of $700 USD to Wrich Ranches last week for beef. The same transaction would have cost the merchant about $20 had I used Visa.)

In addition, these transactions promote autonomy on both sides. Lightning transactions, like everything else backed by Bitcoin’s proof-of-work, happen without counterparty risk. Removed from the equation is the risk of a consumer not paying their bill, disputing a charge, not having enough money in their account, or filing for bankruptcy down the road. All this risk manifests as transactional inefficiencies, and the costs are directly or indirectly absorbed by sellers and consumers. A trustless system like bitcoin is thus more efficient, reduces risk for sellers, and makes goods and services cheaper for responsible consumers.

“I’m sure that in 20 years there will either be a very large transaction volume or no volume at all.” —Satoshi Nakamoto

We do well to think of all our transactions in terms of bitcoin. When money is truly a store of value, we take a measured approach to consumption and take into account the potential increase in value that money may have in the future. This is logical, and applies regardless of whether you use stakes or dollars. The website bitcoinorshit.com drives this point home quite simply.

There is also the story of Laszlo Hanyecz, who in 2010, famously bought two pizzas for 10,000 BTC. In fact, Laszlo paid a couple of billion US dollars for pizza, if we consider BTC’s market cap over a decade later. However, it surprises me when bitcoiners jump on Laszlo for being financially naive, and use this example to support their position that bitcoin should never be used. The simple truth is that everyone who bought pizza in 2010 actually spent thousands of bitcoins on it. The only way to avoid this is to eat something cheaper or go hungry. The fact is that every fiat transaction we make is a direct trade-off to potentially increase our stack. When we understand this, the public controversy about using bitcoin for products or services is fundamentally dead.

The overwhelming majority of us need to exchange monetary energy for goods and services to survive in today’s society. The only controversy that remains is which products or services come before the opportunity to acquire more effort. It is a decision that is personal and unique to each of us. The answer should be thought of independently and regardless of whether that money energy is used in rate, dollar or yen – it is only the money energy saved – what’s left over – that’s relevant when it comes to the HODLer’s dilemma.

We will probably all save more BTC if we start trading more in BTC. First, when we shop for good money that is a proven value store, we are more inclined to be discerning in our purchases. Sure, we really want the new iPhone, but is it worth 5 million sat if you expect a sat to be worth a penny one day? We may decide to wait another year before upgrading and keep these efforts for the future. On the other hand, we all need food, shelter and clothing. If I have a choice between buying my meat from Costco with my Visa card, or buying directly from a rancher that accepts bitcoin, why wouldn’t I choose the latter?

Today, the number of merchants accepting bitcoin is relatively small, although they are growing steadily. As bitcoiners begin to understand that their “spend dollars, save effort,” theory may be counterproductive, greater numbers will begin to seek goods from merchants that accept bitcoin for payment. This increase in demand will drive merchant adoption, potentially shifting the timeline of a bitcoin economy significantly to the left.

More exchange equals more value

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; As users increase, the value increases, which can attract more users to benefit from the increasing value.” —Satoshi Nakamoto

This is where we sit today. There are a growing number of speculators and bitcoin enthusiasts who have bought into the idea that Bitcoin is a bona fide store of value. This community further believes that the asset’s scarcity will inevitably lead to a supply squeeze that will send the price soaring. Sure, it’s possible that this could happen just by HODLing, but as Satoshi Nakamoto points out, the value goes up when the numbers on users go up. Does the purchase and possession of an asset qualify as use? If the brilliance behind bitcoin enables peer-to-peer transactions without a third-party intermediary, are we really exploiting this ability by exclusively stacking and not spending?

I believe that bitcoin must become a true medium of exchange for it to fully realize its potential as a store of value. Since value is not derived from scarcity alone – demand is fundamental to bitcoin’s price. If bitcoin is utility becomes the driving force for demand, it is at this moment that its true potential as a store of value will be realised. Today’s economic and political backdrop is perhaps just the motivation we all need. But until bitcoin becomes an important part of our daily economic activity, it is apt to be valued alongside other speculative assets, and subject to the whims of the same fiat system it was meant to replace.

This is a guest post by Scott Worden. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.