Flexible Spending Accounts (FSAs) in 2022: Reimbursement of health care costs

What is an FSA?

Flexible spending accounts are an employer-sponsored benefit that allows workers to set aside pre-tax dollars to pay for qualified medical expenses. Using an FSA account can have a significant impact on tax liability, as consumers are not required to pay taxes on the money spent. According to December 2020 ConnectYourCare release Flexible checking account trends in 2020was an estimated $30.7 billion saved in FSAs in 2020, an increase of 8.7 percent from 2019.

Since 2020 has Internal Revenue Service (IRS) has allowed contributors to set aside up to $2,750 for a medical FSA and up to $5,000 per year for a dependent care FSA.

Too good to be true?

Unfortunately, there is a catch that has set many of the FSAs. Funds do not remain in this tax-free state forever. In fact, if they were not used during the calendar year, all the remaining money was forfeited to the employer. At least that’s how they worked. Today, most accounts have some form of rollover service or grace period if all the funds are not used in time.

Due to covid-19, contributors’ 2021 balance was rolled over for all of 2022. However, they must have declared that they still wanted to use the service in 2022. According to AvacareMedical, there was still $1 billion in FSA funds waiting to be used in December 2022.

FSA funds for medical supplies and equipment

Specifically, FSAs are an effective way to save money on medical supplies and equipment. In fact, both of these are among the most common purchases made with FSA funds. Medical equipment and supplies rank as the third most common type of FSA expense.

according to National industry group for health survey, the most common items purchased with FSA funds are doctor visits (42 percent), over-the-counter medications (38 percent), medical supplies and equipment (34 percent), and prescriptions (32 percent).

In a similar survey conducted by National Association of FSA Administratorsconsumers were said to be most likely to use their FSA funds to purchase over-the-counter medications (61 percent), vision care products (35 percent), and medical supplies and equipment (35 percent).

More specifically, popular items include:

- pain reliever

- acne treatment

- heat therapy

- sunscreen

- blood pressure monitors

- first aid kit

- allergy relief

FSA restrictions

Consumers should be aware of certain limitations when purchasing medical equipment and supplies with FSA funds. For example, while most products are eligible for reimbursement from the FSA, there are certain items that are not covered. This includes items such as over-the-counter vitamins, health supplements and cosmetic products. In addition, consumers should be aware that FSA funds can only be used to pay for medical expenses incurred after the funds were deposited into their accounts.

Increased contribution limits

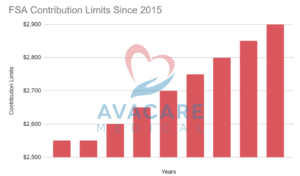

According to the IRS, the average contribution limit for FSAs is set to increase in 2023. This is because the IRS adjusts FSA contribution limits for inflation, as stated in their “Cost of Living Adjustments” from 2020-2023.

The following graph shows the increase in contribution limits since 2015:

Increased consumption

At the same time, the dollar amount that individuals and businesses put into FSAs is also increasing. According to data from the IRS and Bureau of Labor Statistics (BLS), the average amount of money placed in FSAs has increased every year since 2015. In 2022, the average amount placed in FSAs was estimated to be $2,400.

Increased popularity

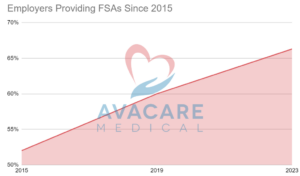

In recent years, more employers have offered FSAs to their employees. They have recognized the potential for tax savings and other benefits. Studies have shown that employers who offer FSAs to their employees often have more satisfied and productive workers.

A study conducted by the National Business Group on Health found that the percentage of employers offering FSAs increased from 52 percent in 2015 to 60 percent in 2019. This trend is expected to continue into 2023, with 66.3 percent of employers offering FSAs doing for an increase of 27 percent in less than a decade.

Increased healthcare costs

Finanstilsynet has always offered tax savings and other benefits for individuals and companies. They are seeing increased popularity due to the rising cost of healthcare. according to Centers for Medicare and Medicaid Services, healthcare costs are expected to increase by an average of 5.4 percent in 2023. Fortunately, the maximum allowance for FSAs is also going up. The money saved in these accounts can be used to offset the higher costs.

With their tax-free benefits and ease of use, FSAs are an excellent way to save money. All the while providing much-needed medical supplies and services. As the data indicates, flexible spending accounts are becoming increasingly popular and the amount of money placed in these accounts is growing. By being aware of the restrictions and deadlines associated with their FSA accounts, consumers can make the most of their FSA funds before they expire.