Five of the worst first-year ETF performers are crypto-related

Latest news about ETFs

Visit our ETF Hub to find out more and explore our in-depth data and comparison tools

Crypto exchange-traded funds account for five of the seven worst debuts in the history of the ETF industry.

The funds were launched in the heady days of 2021 – just in time to face the full force of 2022’s market fury, Morningstar Direct data shows.

The findings, from data provided exclusively to the Financial Times, exclude the performance of leveraged and inverse funds, which are not designed to be held over the long term.

All five focused on the once high-flying cryptocurrency sector or the related field of blockchain, in a new illustration of academic claims that thematic funds tend to launch near the top of their theme, just before returns go south.

“Specialized ETFs are launched just after the peak of excitement around popular investment themes. In the years since launch, the underlying assets have lost some of the initial overvaluation, and so have the prices of specialized ETFs,” Rabih Moussawi and colleagues wrote in an academic paper that was first released last year.

“Specialized ETFs seem to cater to overoptimistic investors,” said Moussawi, associate professor of finance at Villanova University in Pennsylvania.

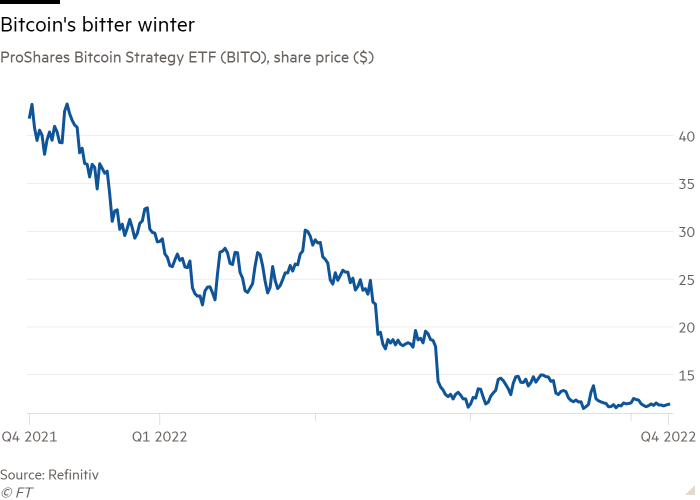

The much-hyped ProShares Bitcoin Strategy ETF (BITO), which lost a record $1.2 billion of investors’ money in the 12 months following its eagerly anticipated arrival in October 2021, has grabbed many of the headlines.

Its work has been far from unique, however, with a number of smaller ETFs still posting larger percentage losses than BITO’s 70.4 percent first-year plunge, even though their losses in dollar terms were smaller because of their tiny size.

The worst performer was France-based Melanion BTC Equities Universe Ucits ETF (FR0014002IH8), which invests in crypto-adjacent companies such as Marathon Digital Holdings, Riot Blockchain and MicroStrategy.

It launched in October 2021, the same month as BITO and just weeks before global markets peaked, only to fall 76.9 percent in the following 12 months.

Similarly, the US-listed Global X Blockchain ETF (BKCH), which entered the fray last July, fell 76.7 percent in its first year of operation.

The Invesco Alerian Galaxy Crypto Economy ETF (SATO), another October 2021 hatch, wasn’t far behind, sinking 73.7 percent, while the First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT) posted 69.4 percent during the 12 months up to this September.

“Blockchain investments are closely aligned with bitcoin and cryptocurrency in general, but they come with increased risk of equity exposure,” said Todd Rosenbluth, head of research at consulting firm VettaFi.

“Companies connected to the broader ecosystem have faced challenges as the price of bitcoin has fallen sharply and demand for the technology has not grown as quickly as investors expected. They are penalized as much or even more than bitcoin futures-based products themselves,” he added.

The only other non-leveraged or inverse ETFs to have a worse first year than BITO are Xtracker’s MSCI Russia Capped Swap ETF (XMRD), which lost 75.1 percent in the year to December 2008 as the commodity supercycle crumbled, and Canada’s Horizons US Marijuana ETF (HMUS), which saw 75.3 percent of its assets go up in smoke in 2019-20.

In a demonstration of the risks of holding leveraged and inverted vehicles over a long period, however, the worst debut year for any ETF, according to Morningstar, was pulled off by Dublin-domiciled Leverage Shares 3x Roku Exchange Traded Commodity ( ROK3 ). ).

Anyone who held the fund for 12 months from ROK3’s launch in June 2021 would have seen 99.92 percent of their money disappear, magnifying the 76 percent drop in the US streaming platform’s share price over the period.

A similar story of the risk of holding products designed for the short term can be found in the fortunes of the Switzerland-domiciled 21Shares Short Bitcoin ETP (SBTC), which took the opposite side of BITO’s bet, but over a different time period. SBTC would have lost investors 86.2 percent in its first year, because its birth in January 2020 was exactly when bitcoin began its dizzying rise, rising by 285 percent.

The Morningstar data also suggests that a terrible first year is not necessarily the death knell for a fund.

The SPDR Portfolio S&P 500 Growth ETF (SPYG) fell 53.8 percent in its first year of trading in 2000-2001, but has since rebounded to become a $12.2 billion fund.

Likewise, the iShares Global Clean Energy ETF (ICLN) fell 56 percent in 2008-2009 but now has $4.5 billion in assets and the Invesco Solar ETF (TAN) fell 68.2 percent in the same year but now has $2.2 billion . Even ProShares has experience with this; UltraPro Short QQQ (SQQQ) now has $4.8 billion in assets, despite a 68.1 percent loss in 2010-2011.

Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, believed that the crypto sector could be another to come back.

“The people I talk to who are investing in bitcoin are still reliably positive because the potential use cases haven’t changed,” Lamont said.

“Many of those involved in the industry have just rallied for the next bull run. Whether or not it will come who knows, but if there is an investment case for bitcoin, perhaps an equilibrium will be found.”

Click here to visit the ETF Hub