FINX: Volatility risks the cloud potential for growth in e-commerce

Viorika

Global X FinTech Thematic ETF (NASDAQ:FINX) is a potentially attractive option for its exposure to the fintech industry, which is continuously expanding and innovating. However, due to the high-risk nature of certain fintech models and strategies, I think FINX is in favor volatile for the current uncertain, highly charged market environment, which leads me to consider it a long-term hold.

Investing in fintech can be particularly challenging as its rapid and continuous innovation makes it more difficult to allocate investments with knowledge. Rapid innovation also generates significant volatility that has resulted in huge moves and lost profits for many. Furthermore, new-age fintech models such as “buy now, pay later” (BNPL) are exposed to unhealthy levels of credit growth and higher consumer defaults. This, in turn, could create long-term financial difficulties that could harm the profits of companies held in FINX.

Despite the high risk and poor performance in recent years, FINX can still benefit from the expansion of broadband and mobile internet in the financial sector, especially in digital banking. The number of digital banking users are predicted to reach $3.6 billion internationally by 2024, with approximately 94% of participants using digital banking services at least once a month. FINX is also potentially well positioned to benefit from the expansion of digital financial services beyond just banking, such as insurance and third-party lending.

FINX can be a good option for those willing to face higher risk in exchange for potentially higher long-term returns. This ETF is likely to be subject to significant moves before signs of long-term growth emerge, hence my Hold rating.

Strategy

FINX tracks the Indxx Global Fintech Thematic NR USD Index. This ETF tracks its respective index using full replication technique. The full replication technique involves holding all the same securities that make up the underlying index, also with the same weighting as that index. FINX invests in both value and growth stocks. FINX was launched and is currently managed by Global X Management Company LLC.

Inventory analysis

FINX primarily invests in technology, industry and healthcare. Non-technology companies account for less than a quarter of total assets, making this ETF highly concentrated in the technology sector. Fintech is a hybrid between finance and technology, but it is generally more focused on technology. Therefore, investors should be aware that despite having “FIN” in the name, FINX mostly only provides exposure to the technology sector while financial exposure is smaller and more indirect. Specific industries that FINX invests in include mobile payments, peer-to-peer (P2P) lending, alternative currencies and financial analysis software.

FINX is decently top-heavy, with the top 10 holdings accounting for 54% of assets, and the top 25 accounting for 83%, in a 71-company fund. This creates a concentration risk and can deter those seeking greater diversification. However, FINX is not heavily reliant on a single company, with no single holding accounting for more than 8% of total assets. About a quarter of the holdings reside in the United States, and no other country accounts for more than 6% of the geographic representation.

Strengthens

FINX can potentially hedge against intense competition in the fintech space, which could make it advantageous compared to investing in individual fintech stocks. Fierce competition in the fintech space creates an aura of uncertainty about which companies will profit in the long term and which will fall behind.

For example, PayPal (PYPL) was revolutionary during its inception in 1998, but is now threatened by similar systems such as Apple Pay and Shop Pay. Consequently, PayPal stock is trading about 75% lower than its peak. That was less than two years ago. For this reason, investors can buy fintech ETFs like FINX to concentrate risk and gain confidence that one fintech company falling behind the competition will not reduce returns.

FINX is also quite liquid. This ETF has an average daily share volume of almost 150,000 shares, which equates to over $3mm.

Weaknesses

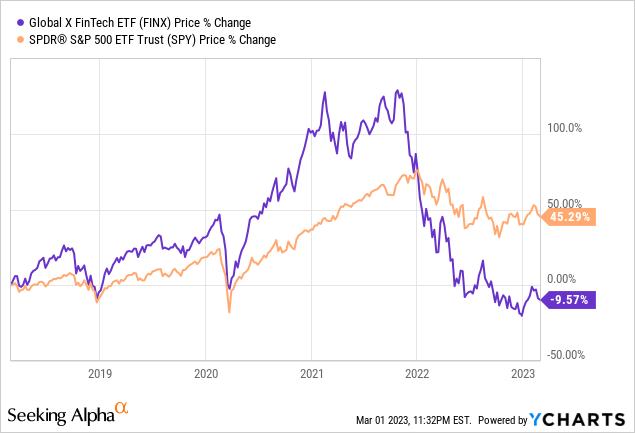

FINX practices a highly volatile strategy, which is reflected in the standard deviation of 36 compared to 24 in the rest of the market and an annual volatility of 43% compared to 22% in the rest of the market. In the chart below, FINX endures several price swings, with the largest drawdown of over 60% despite outperforming the S&P from 2018-2022.

Although FINX has a propensity for long-term growth and outperforms the market, it is also likely to expose investors to huge price swings and downturns in the process. FINX’s low dividend yield of just 0.25% also confirms that this ETF is focused on capital growth, not an income payout.

Possibilities

The expansion of mobile and broadband components in financial services such as insurance and lending could facilitate growth in the e-commerce industry, from which many companies held in FINX could benefit. The economic and social deterioration from COVID-19, especially during 2020-2021, catalyzed the popularity of external services such as online shopping and other digital payment mechanisms. The e-commerce industry continues to grow in 2023, as it is expected to reach over $4 billion in revenue by the end of the year and over $6 billion in 2027, with a CAGR of 12%. Income increases in the e-commerce industry can benefit many of the companies in FINX.

FINX can potentially benefit from persistent inflation and the possibility of more rate hikes in the future, as they invest in lending services and insurance companies that can profit from such conditions. Commercial banks and other lending services may benefit from increased interest income and higher demand for loans as consumers may need financing to obtain goods that were affordable in the pre-inflation period but are no longer so. Alternatively, insurers may also benefit from increased demand for insurance as the cost of potential damage or loss is now more crushing.

Threats

While some fintech companies may benefit from extended interest rates, excessive economic slowdown or a possible recession could put the returns of those same companies at risk. Fintech companies often rely on debt financing to fuel growth and expansion, which means excessive interest rate hikes can lead to higher borrowing costs for these companies. Borrowing costs that become excessive can increase the credit risk and reduce the profitability of many companies held in this ETF.

The buy now, pay later model is somewhat revolutionary, but also quite risky for both companies and consumers. Popularizing this model can tempt consumers to take on more debt than they can afford, potentially leading to high interest charges, missed payments and poor credit scores. For businesses, having more customers who settle under debt pressure can increase crime and lead to tighter regulations, which together can harm profits.

Conclusions

ETF quality statement

FINX has a decently diversified portfolio with many companies that can benefit from innovations in the fintech space. In particular, the development of e-commerce within digital banking, third-party lending and insurance can increase the return of this ETF. However, I think the fierce competition and models like BNPL in the fintech industry generate uncertainty that many investors may not be comfortable with.

ETF Investment Statement

I consider FINX a long-term hold. I believe that this ETF can benefit from digital financial services over the next 5 years. This industry can benefit from new customer bases that previously had limited access to traditional personal services. However, FINX is probably not the ETF of choice for even highly risk-averse investors. It is quite volatile and subject to significant drawdowns. Therefore, those who invest for long-term growth may eventually reap the benefits, but the journey will probably not be smooth sailing.