Fintech SPACs struggle to find merger partners, strike deals before time runs out

A number of special purpose buyout companies looking to invest in fintech are having trouble finding merger partners or closing deals.

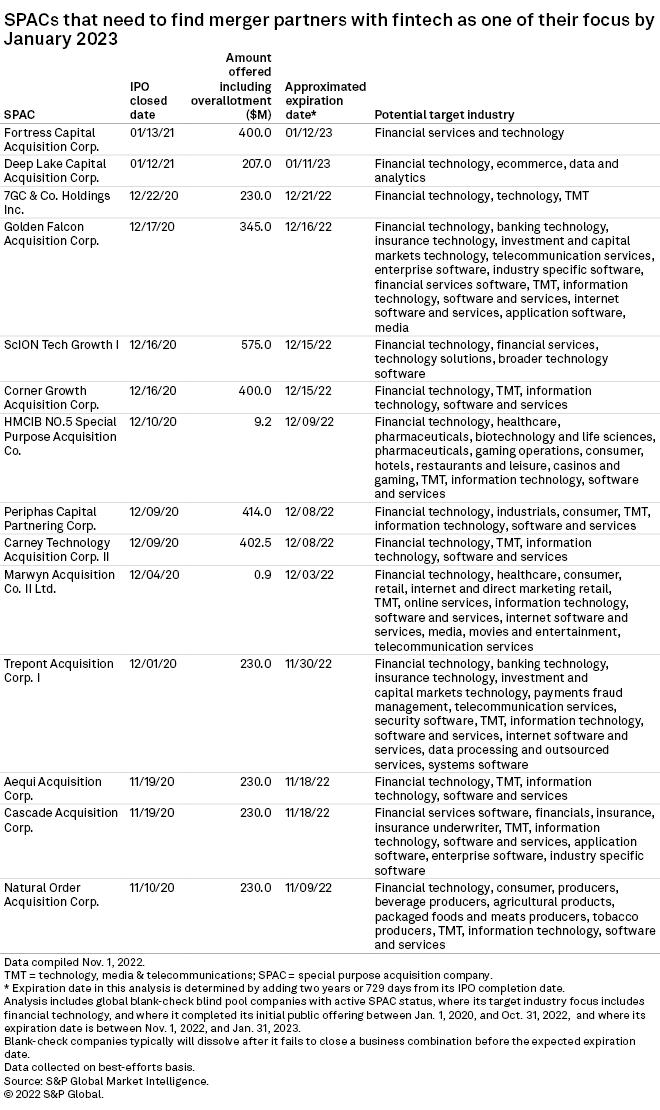

Fourteen SPACs that specified fintech as one of their targeted segments must find merger partners before they reach their expiration dates in the coming months, according to S&P Global Market Intelligence data. These blank check companies will dissolve if they cannot sign agreements within that time unless the shareholders approve extensions.

The fintech industry has been hit by sharp falls in value over the past year, which has resulted in fewer companies wanting to go public. Over the past 12 months, the S&P Kensho Democratized Banking Index and the S&P Kensho Alternative Finance Index, which track technology-enabled financial services, have fallen 51.4% and 57.3%, respectively, as of November 8. The S&P Kensho Future Payments Index has fallen 39.9% over the same period.

US Securities and Exchange Commission officials said in April 2021 that SPACs should have recorded warrants as liabilities instead of marking them as equity on the balance sheet, which has been standard practice for years. This change put a damper on new issuances and deal completions last year.

SPACs without merger partners

Among the 14 companies in this analysis, Natural Order Acquisition Corp. the earliest expiry date with a deadline of 9 November. Aequi Acquisition Corp. and Cascade Acquisition Corp. following with the expiration dates of November 18.

Meanwhile, Fortress Capital Acquisition Corp. continued until January 12, 2023 to find a merger partner, while Deep Lake Capital Acquisition Corp. has until 11 January 2023.

ScION Tech Growth I has the highest IPO of the group at $575.0 million, followed by Periphas Capital Partnering Corp. with $414.0 million. ScION Tech Growth I has until December 15, while Periphas Capital Partnering has until December 8 to find a fintech investment.

Delays Disappear SPAC M&A

Many M&A deals in the fintech sector involving SPACs have longer-than-expected closing times this year, similar to 2021 when extended regulatory reviews delayed deal closings. Only three SPACs have actually completed mergers with fintech companies in 2022, and closing those deals took about six to 10 months, Market Intelligence data showed.

Those three transactions are the EJF Acquisition Corp.-Pagaya Technologies Ltd. deal that closed on June 22, the Motive Capital Corp.-Forge Global Holdings Inc. deal that closed on March 21, and the VPC Impact Acquisition Holdings III Inc.-Dave Inc. deal that wrapped on Jan. 5.

The pending acquisition of Concord Acquisition Corp. of Circle Internet Financial Inc., a stablecoin issuer awaiting regulatory clarity with pending stablecoin legislation is expected to close in December. This deal was valued at $9.0 billion at the time of announcement. Although the transaction still has an expected completion date of December 10, Concord plans to propose an extension to January 31, 2023 at a special meeting.

Digital lender Better Mortgage Corp.’s proposed acquisition of Aurora Acquisition Corp., a SPAC expected to dissolve by March 2, 2023, valued at $6.90 billion at the time of the announcement, also faces a delay. Better mortgage was hit hard by the shrinking mortgage market and has announced several rounds of layoffs since December 2021.

The pace of mergers and acquisitions slowed in the first half of 2022 in the US fintech and payments sector. In the period, there were a total of 221 deals, compared to 258 in the first half of 2021, according to data compiled by Market Intelligence.