Fintech companies acted with ‘unforgivable misconduct’, failed to stop COVID fraud, top them claim.

David Spunt reports on an estimated $100 billion in fraud cases

A new government report paints a damning picture of how easy it was for taxpayers’ money to be fraudulently obtained through Paycheck Protection loans issued during the coronavirus pandemic.

The report, released Thursday by the House Select Subcommittee on the Coronavirus Crisis, shows that several financial technology companies, or fintechs, were either unable or unwilling to perform checks and balances on loans that were issued. The result was the approval of a large number of fraudulent applications – and untold tens of billions of dollars meant for struggling small businesses were stolen.

“Many of these companies appear to have failed to stop obvious and preventable fraud, leading to the unnecessary loss of taxpayers’ money,” the report said.

Even worse, the 120-page report suggests fintechs made billions of dollars through taxpayer-funded fees while telling the government they were conducting due diligence on loan applicants.

COVID-19 FRAUDSTERS WHO FLEE TO MONTENEGRO WHILE AWAITING SENTENCE EXTRADED BACK TO US: REPORT

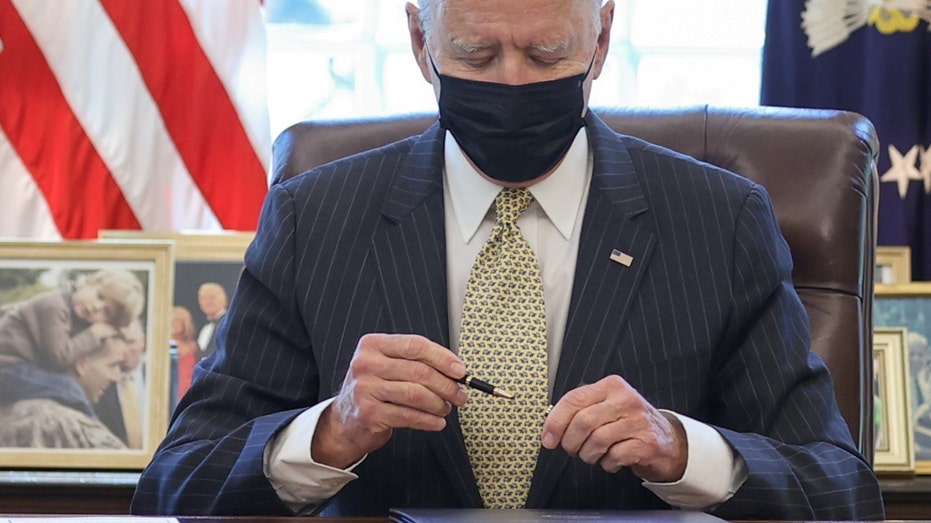

President Biden replaces the cap on his pen as he signs the “Paycheck Protection Program Extension Act of 2021” into law in the Oval Office of the White House in Washington, DC, March 30, 2021. (REUTERS/Jonathan Ernst/File Photo/Reuters)

Subcommittee chairman Rep. James Clyburn, DSC, said many of the fintechs acted with “inexcusable misconduct” and believes further investigative action may be warranted by the Department of Justice.

“As today’s report details, many fintechs, while promising to help pay out billions of the Paycheck Protection Program [PPP] dollars to harass small businesses efficiently and quickly, refused to take adequate steps to detect and prevent fraud despite their clear responsibility to protect taxpayer funds. Although these companies failed to administer the program, they nevertheless accumulated enormous profits from program administration fees, much of which was siphoned off by the companies’ owners and managers, Clyburn said in a statement.

“On top of the windfall gained by allowing others to engage in PPP fraud, some of these individuals may have compounded their ill-gotten gains by engaging in PPP fraud themselves,” he added.

The report singled out two “uncontrolled and unregulated” fintech companies, Womply and Blueacorn, which together were responsible for nearly one in three PPP loans funded in 2021.

SBA AWARDED $684M in OPP Loans to ‘POTENTIALLY NOT QUALIFIED’ Nonprofits

House Majority Whip Jim Clyburn, D.S.C., listens to DeAndrea Gist Benjamin of South Carolina, nominated to be a US Circuit Judge for the Fourth Circuit, testify during his confirmation hearing in the Senate Judiciary Committee on Tuesday, November 15, 2022. (Tom Williams/CQ-Roll Call, Inc via Getty Images/Getty Images)

Blueacorn, a company founded during the pandemic to help small businesses access PPP loans, received more than $1 billion in taxpayer-funded processing fees but spent less than 1% of its revenue on fraud prevention, investigators found. The company also pushed employees to spend less than 30 seconds reviewing loan applications, instructing workers, “the faster the better.”

The company relied “almost exclusively on third-party companies and contractors” to process PPP loan applications as well, and did not provide proper training to verify the authenticity of loan applications, the report said. Internal communications also revealed that Blueacorn’s management rejected prospective borrowers who were eligible for PPP financing in pursuit of “monster loans” [that] will get everyone paid.”

In addition, the committee said Blueacorn founders Nathan Reis and Stephanie Hockridge received nearly $300,000 in PPP loans while collecting more than $120 million in taxpayer-funded processing fees as “signs of potential fraud.”

Meanwhile, Womply’s CEO — who was convicted of insider trading in 2014 — was personally responsible for the company’s fraud prevention efforts and allegedly withheld information from federal investigators of PPP fraud, the report said.

COVID-19 AID FRAUD LEAD TO BILLIONS IN TAXPAYER-FUNDED PAYROLL PROTECTION PROGRAM LOANS LOST

A Free People store in the Perkins Rowe shopping district in Baton Rouge, Louisiana, U.S., Saturday, Aug. 13, 2022. Baton Rouge, Louisiana, is an example of a place where Paycheck Protection Program (PPP) loans increased in lower-income areas in 2021 , (Bryan Tarnowski/Bloomberg via Getty Images)

Companies such as Capital Plus, Harvest and other fintech partner PPP lenders admitted to having no formal program to oversee Womply and Blueacorn’s activities.

Other companies including Kabbage and Bluevine “missed clear signs of fraud in numerous PPP filings” and deflected blame for failing to stop fraud to the Trump administration and the Small Business Authority.

“At the end of the day, it’s the SBA’s s—ty rules that created fraud, not [Kabbage]”, the company’s chief policy officer wrote in a September 2020 email obtained by the committee.

RAND PAUL DEMANDS SBA EXPLAINS WHY PPP MONEY WAS WRONGLY GIVEN TO PLANNED PARENTHOOD

Kevin Chambers, Director of Covid-19 Fraud Enforcement, Department of Justice; Hannibal “Mike” Ware, Inspector General, Small Business Administration; Michael Horowitz, Chair, Pandemic Response Accountability Committee; and Roy D. Dotson Jr., actor (Joe Raedle/Getty Images/Getty Images)

Clyburn requested that the SBA and the SBA Office of the Inspector General conduct their own investigations into waste, fraud and abuse, and referred potential criminal conduct discovered by the committee to the Department of Justice.

The Select Subcommittee investigation reviewed more than 83,000 pages of internal documents from Kabbage, BlueVine, Cross River Bank and Celtic Bank, Blueacorn and Womply, as well as information and documents from fintech PPP lending partners Harvest, Capital Plus, Prestamos, American Express, KServicing, Fountainhead, Benworth, Wells Fargo, Bank of America and CDC Small Business Finance.

Watchdog groups and Covid-fraud researchers say reforms are needed to ensure future emergency government programs are not abused as easily.

Bluevine told FOX Business that it “appreciates the subcommittee’s inquiry on the pandemic assistance program.”

“We are proud to have participated in the PPP program at a time that was truly extraordinary,” the company continued. “As the subcommittee noted, not all fintech companies are equal, and Bluevine ‘adapted to the ongoing threats better’ than any of the other fintech companies examined in the survey. Bluevine played a unique role in partnering with two licensed SBA lending banks to provide third-party services under PPPs. As service providers, Bluevine facilitated access to PPP loans, providing critical assistance to over 300,000 small businesses, and helping to save more than 700,000 jobs, while following evolving SBA guidance and program guidelines. Since Founded in 2013, Bluevine remains committed to establishing and maintaining robust internal controls and governance processes.We were pleased to share with the subcommittee information about the processes and controls used to issue much-needed small business loans in this unprecedented time.We are also very proud of the countless hours our employees put into implementing this program and having tje nt thousands of small businesses and communities that were heavily affected by the pandemic.”

CLICK HERE TO READ MORE ABOUT FOX BUSINESS