Fidelity National Information Stock: Cheap Fintech Play (NYSE:FIS)

Gian Lorenzo Ferretti Photography/E+ via Getty Images

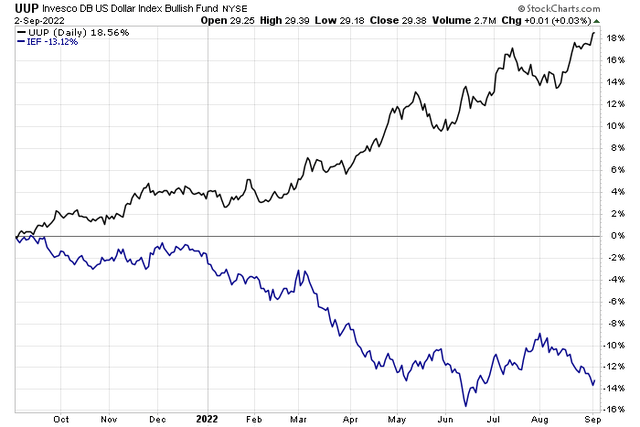

Inflation, currency movements and higher interest rates have eroded the company’s earnings this year. Many pundits say EPS estimates need to fall further, especially for the technology space which has significant exposure to all three of the aforementioned market headwinds. An established fintech the firm has decent expected earnings growth, but many macro risks are at the top of investors’ minds. Shares have fallen as a result.

1-year movements: Dollar +19%, Treasurys in the medium term -13%

Stockcharts.com

According to Bank of America Global Research, Fidelity National Information Services (NYSE:FIS) employs more than 47,000 people worldwide. FIS supplies software, services and technology outsourcing to a wide range of institutions in the financial industry. In 2021, FIS generated revenue of $13.88 billion, adjusted EBITDA of $6.1 billion, EPS of $6.55 and $3.6 billion in free cash flow. Recently, FIS announced that Erik Hoag will succeed Woody Woodall as the new CFO with effect from 4 November.

The Jacksonville, Fla.-based IT Services industrial company in the information technology sector, listed on the S&P 500, trades at a high 65.3 trailing 12-month GAAP price-to-earnings ratio and pays a dividend yield of 2.1%, according to The Wall Street Journal. The firm’s non-GAAP earnings are much higher, resulting in a lower earnings multiple of 11.4 using estimates of future operating income.

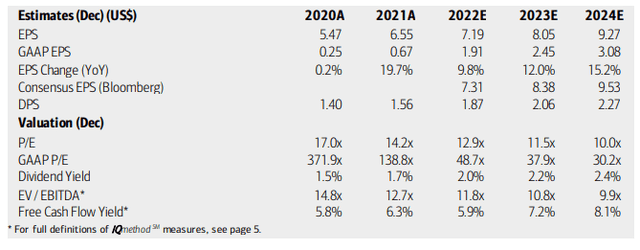

Analysts at BofA see earnings rising at a healthy pace through 2024. Bloomberg’s consensus forecast is even more optimistic about the profitability of FIS in the years ahead. Dividend investors should also be optimistic, as the payout amount is considered to increase by more than 20% over the next two years.

With earnings growth and increasing returns, fundamentals look solid. Also, FIS’s EV/EBITDA multiple is not too high given the rate of growth, and the return on free cash flow is decent and rising.

FIS: Earnings, dividends, valuation forecasts

BofA Global Research

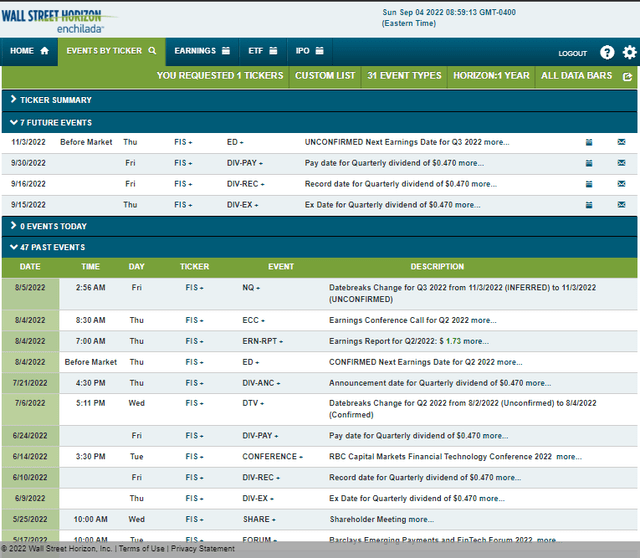

Looking ahead, Wall Street Horizon reports that FIS has an ex-dividend date of September 15th. It will be paid out on 30 September before the company’s third quarter results date on Thursday 3 November BMO.

FIS: Corporate Event Calendar

Wall Street Horizon

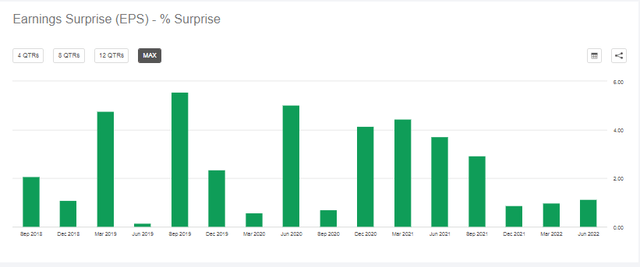

Notably, FIS has beaten analysts’ EPS expectations in each of the past 16 quarters, according to Seeking Alpha.

FIS: A Strong Earnings Beat Rate History

Seeking Alpha

The technical assessment

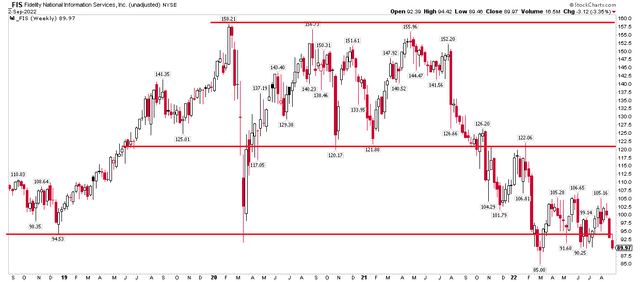

While the fundamentals and valuation look ideal for FIS, the stock chart warrants caution. Shares are hovering near 4-year lows after falling more than 40% from an all-time high notch in early 2020. The stock had a bearish triple top pattern for more than a year, but then finally fell during the tech selloff that started in 2021 $160 was the top, then broke support at $120-$125 and failed at a recovery attempt earlier this year.

Fast forward to today, and the stock is seeing new lows. The bears are shown in control. I see support in the $73 to $80 range based on a measured move price target outside the $120 to $160 prior range ($160 – $120 = $40, $120 – $40 = $80) and a key pivot point from 2015 and 2016 at $73.

FIS: Shares threaten fresh lows amid bear market off $160 peak

Stockcharts.com

The bottom line

FIS has a solid valuation and has been hit by macro forces beyond their control. I see it as a great value stock at the moment, although the technicals suggest more bearish price action to come. Long-term investors should build a position expecting 10% to 15% more downside. In this case, the fundamentals outweigh the charts. The stocks look good here.