Famous crypto traders give their Bitcoin (BTC) price predictions

We look at three well-known crypto traders and analyze their reasons for being bearish on Bitcoin (BTC) to present. The reasons vary, ranging from wave numbers, horizontal levels and emotional bias, to comparing their previous predictions.

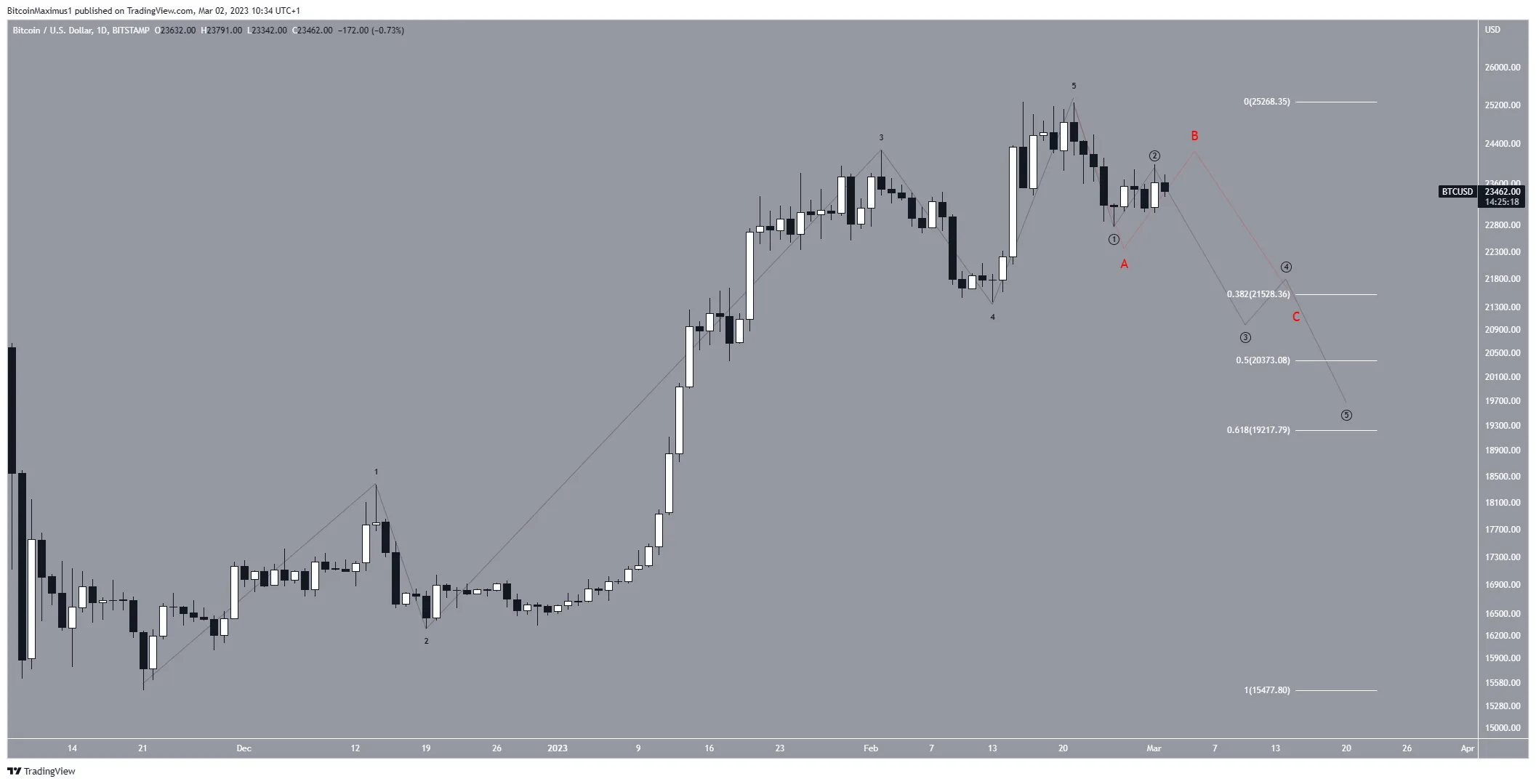

Wave numbers provide Bearish Bitcoin (BTC) price outlook

Well-known trader @cvotrades believes that a downward wave one (or A) has been completed and wave two (or B) has now begun. Both scenarios would lead to more strife before any reversal.

According to the count, the Bitcoin price completed a five-wave upward movement (black) and has started to decline. There are two possibilities for release. The first suggests that the price has now begun a five-wave downward movement (black). If so, it is likely to find support between the 0.5-0.618 Fib retracement support levels of $19,200 – $20,400. Afterwards, an upward move could follow.

The second is that price completes an ABC correction (black). In this scenario, the price is likely to find support at the 0.382 fib retracement support level at $21,528.

An increase above the annual high of $26,270 would invalidate this count. If so, the BTC price could rise towards $27,000.

Range High bounce can lead to falls

@CryptoCred uses long-term ranges to determine the direction of the trend, without using any indicators. Therefore, his prediction says that a close above the Summer Range High (red line) could lead to a rise towards $30,000, while failure to do so could lead to a fall towards the Summer Range Low of $19,400 (white line).

Since the tweet, the digital asset failed to close above the former and thus a drop towards $19,400 seems to be the most likely scenario. A weekly close above $25,000 would invalidate this.

This technical analysis is consistent with the wave count of the previous successful crypto trader, @cvotrades.

Emotional bias affects crypto traders

Finally, the most famous of the crypto traders is among the three @CryptoCapo_. He gained a significant following and fame after correctly predicting the drop from over $40,000 to $20,000. But since then, he has been calling hard for a continued decline to at least $12,000.

Over the past month, he has greatly reduced his Twitter interaction, and his Last post was on February 17, where he explains that this is the “biggest bull trap ever” and the trend remains bearish.

However, there is no chart to support his claims beyond saying that “the move has been artificially pumped with BUSD and USDC.”

Therefore, this seems like a case where a trader refuses to let go of his previous prediction even though it has become invalid.

For BeInCrypto’s latest crypto market analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.