Family Bitcoin Update – Bitcoin Market Journal

Summary: I’m talking about the mental game of investing, especially when it comes to crypto markets. Subscribe here and follow me for weekly updates.

Dear Family:

If you are receiving this letter, it is because you asked me to buy bitcoin for you in 2014.

First, the good news: $1,000 worth of bitcoin is now worth $26,803. It’s one of the biggest investments you’ll ever make: a 2,500% increase in less than 10 years.

(Compare that to the overall stock market, which has increased 113% over the same period.)

I’m writing to give you an update on your investment, kind of like Warren Buffett’s annual shareholder letter, but just for you…and 50,000 of my close personal friends.

Why did Bitcoin go up?

All the bitcoin in the world is worth about $420 billion today. Why?

I do not know.

In the beginning, bitcoin was meant as a kind of digital money (that’s where we get the word “cryptocurrency”).

It clearly hasn’t worked: although a few oddballs use it to pay for things, bitcoin hasn’t caught on in the same way that, say, Venmo has.

Back then, we all thought bitcoin was some kind of “digital gold.” Since bitcoin, by design, will only have 21 million “mined”, with the last mined around 2140, it will become more valuable as it becomes more scarce.

Well maybe.

We will not be alive to see that day, unless our heads can be frozen and attached to robot bodies. Possibly we could pay for that procedure with our bitcoin – but again, the cryo labs probably won’t accept that as payment.

Another theory is that bitcoin is non-state-controlled money, which is useful in countries where the national currency becomes worthless due to overspending or corruption. (The recent debate over our debt ceiling has some questioning whether the US dollar may suffer the same fate.)

Again, however, bitcoin is not useful as an alternative currency when its price can fluctuate 50% in a few months: it’s as bad as the government money you’re trying to replace.

So why is the price of bitcoin going up? The short answer: nobody knows.

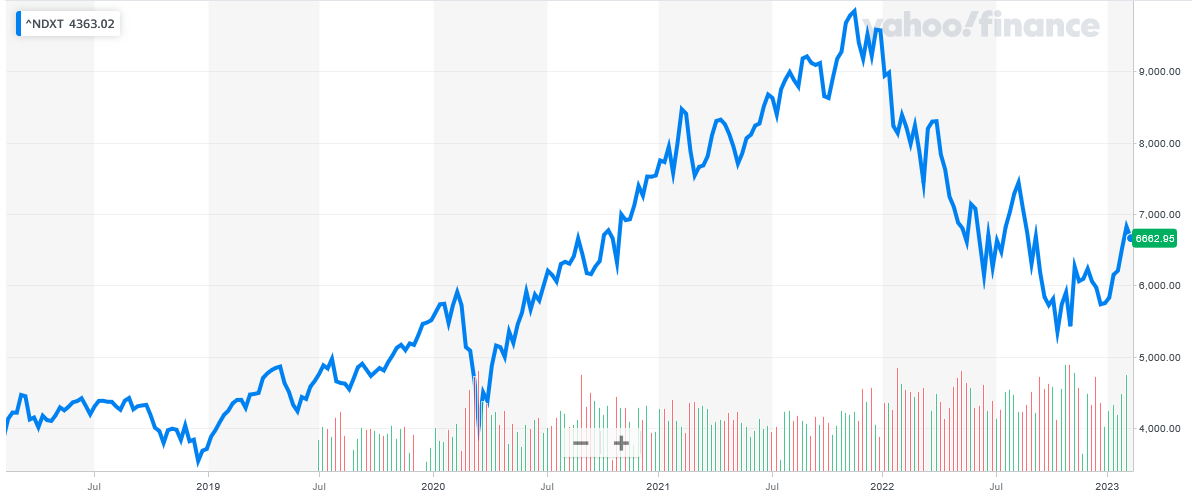

I have concluded that bitcoin is more like a technology tradek than anything else. Here is a comparison of tech stocks against the price of bitcoin over the past 5 years:

They are not identical, but you can see similar peaks of investor excitement. Bitcoin is a technology, and investors think of it as a technology company.

“Hold on,” you say, “bitcoin is not a company. There is no income! No employees! It’s not like buying Apple or Tesla stock, which have real buildings with real people trapped inside.”

Genuine! But there are “revenues” (the transaction fees paid to the miners who run the bitcoin network) and “employees” (the team that develops and maintains the bitcoin network): both revenues and expenses.

“Sure,” you reply (I’m putting a lot of words in your mouth), “but State Farm sells insurance. ExxonMobil sells gasoline. Toyota sells cars. What exactly does bitcoin sell?”

Um…a dream?

The dream of Bitcoin

Today, of course, there are thousands of digital assets besides bitcoin (these are also called “cryptos” or “cryptoassets”; I will use the terms interchangeably).

All of these cryptoassets are created on the same premise: the transfer of a unit of value over the internet. Combined, these assets are currently worth a lot of value: over 1 trillion dollars.

Bitcoin remains the OG, the grandfather of this thriving ecosystem. It is the original dream that is now becoming a financial reality.

Although these cryptoassets are not substitute money, they certainly are supplements money. The regular economy and the digital economy are becoming more and more intertwined.

So bitcoin’s dream—a financial system not controlled by any single government—is coming true. Just not with bitcoin.

This is common in technological revolutions: early believers think it will go one way, but it turns out to be something else entirely. (Amazon used to be a bookstore.)

Hardline “bitcoiners” believed there was room for one, and only one, digital currency. Bitcoin, they thought, would take over the world.

But of course the world can operate with many different types of money: dollars, euros, pesos and so on. Not to mention many types of “stored money” such as frequent flyer miles, Visa gift cards, gold and the like.

In the crypto economy, everyone is replicate these types of values, online – and create new ones too.

We extend the existing economic system to these new digital technologies.

Read that sentence again. We are not substitute the economy, as the bitcoiners believed. We are extension it.

So hardcore bitcoiners are wrong. This much is obvious: no one seriously uses bitcoin as payment.

But the hardcore crypto-skeptics are also wrong. This is also obvious: when the government discusses how to regulate digital assets, they are here to stay.

The dream of bitcoin is coming true, just not in the way that some originally thought. It’s not bitcoin, it is everything that bitcoin inspired.

So back to the original question: why does bitcoin continue to have value? For this we have to go back around 400 years.

The Dutch East India Company

The first joint-stock company was started in the Netherlands at the beginning of the 17th century, when the Dutch East India Company gained a state-sanctioned monopoly on the growing spice trade between Europe and Asia. This sweet deal just got even sweeter: ordinary investors could buy shares in the company.

The Dutch East India Company was very profitable for many years to come, greatly enriching its shareholders, but it was the idea of a listed on the stock exchange stock that was the real innovation.

Companies owned by the people.

By the 18th century, the market for these public stocks was so large that a stock exchange was established in New York, and the rest is history.

Similarly, it may be that idea of bitcoin – i.e. the new digital financial system it represents – will be bitcoin’s lasting legacy, more so than bitcoin itself.

Cryptos, owned by the people.

In summary, bitcoin has not fulfilled the promise of digital money. The idea of bitcoin (digital money, digital finance, owned by the people) has become more important than bitcoin itself.

So, should you sell bitcoin?

It is of course yours to do with as you wish. I cannot make any claims about the future price of bitcoin (and please ignore those who do).

But I’m holding onto mine for now, because there’s still hope that bitcoin can become more useful in other ways, fueling the next wave of growth.

Also, bitcoin is still the way most people get involved with crypto in the first place. It is the most recognized. It has the most support. It has a first-mover advantage.

But if you are looking for new investment opportunities, I think there are better options than bitcoin.

The new crypto companies

Just as the Dutch East India Company created a wave of new public companies that changed the financial system forever, these new crypto “companies” are evolving our current financial system.

Ethereum (ETH) is the most exciting project, because it not only makes it possible to build new financial applications on top of it, but it is led by a strong team of developers who are constantly upgrading and improving it. I expect that the total value of Ethereum will eventually surpass bitcoins (as that date approaches, I will gradually turn over my holdings).

Uniswap (UNI) is another amazing “company”, because it solves a real-world problem: it allows investors to exchange one crypto-asset for another, like exchanging currency. The design is elegant, the team is constantly enjoying themselves, and the product actually works.

Binance Chain (BNB) is the digital resource started by Binance, the largest digital exchange in the world. Since Binance is not publicly traded, owning BNB is a bit like owning shares in the company. At the same time, like Ethereum, it can be used as a platform for building new financial applications. Like Binance, BNB seems well managed with a potentially dazzling future.

Open sea is the largest NFT platform: you can think of it as an early eBay for digital goods. Unfortunately, OpenSea is not a publicly traded company, although you can buy shares through secondary markets if you meet certain criteria. I’m sure there will be some kind of public offering: this company is going to be a powerhouse.

Finally, Coin base (COIN) is the largest US digital exchange, the gold standard for a new type of “bitcoin bank”. It is fully regulated, meaning it is the rare crypto company that works within the US banking system, meaning its stock is publicly traded (no crypto required).

I am a big believer in the long-term growth prospects of these companies and cryptos…with one important caveat.

Crypto is still risky

Remember: I’m not a financial advisor, just a guy who writes and talks about these technologies to a global audience.

But your financial advisor and I probably agree on one thing: crypto is still very risky, so invest only a small amount (no more than 10% of your total portfolio) and be willing to lose it all.

To me, the biggest risk to crypto investments is the possibility that the government could shut them down. It seems unlikely that they will be outlawed, but governments could restrict them through excessive taxation or cut off access to their banking services.

However, the duck is out of the bottle. He is unlikely to re-enter.

Bitcoin invented a new way to make money. And while bitcoin hasn’t become world-changing money, it is hair changed the financial system. We are still in the early days of this change (remember the Dutch East India Company lasted over 150 years).

Crypto is the extension of our existing financial system. Money is moving from paper to digital. Just like email. Just like contracts. Just like everything.

This presents huge opportunities for those of us willing to put our money where our mouth is: to invest long-term in these new digital assets.

I’m holding. Are you?

50,000 crypto investors get this column every Friday. Click here to subscribe and join the tribe.