Falling valuations make Fintech and AI accessible again

The heyday of venture capital fueling innovative technology companies is far from over.

HarbourVest Partners argues that the tough environment of the past year will ultimately offer investors a better entry point, particularly in fintech and artificial intelligence.

“I think there are business cycles and economic cycles that you can correlate with private market performance. But especially for venture capital, the cycle that matters the most is the innovation cycle,” HarbourVest CEO Scott Voss told Institutional investor.

Today’s tech era is ripe with innovations in fintech and AI, where advanced platforms and business models allow new players to enter and challenge established ones.

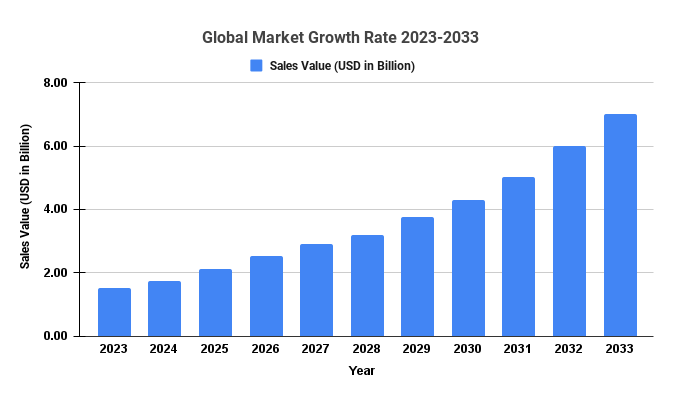

“We continue to see fintech as an expanding market segment. The industrial sector has seen a boom in innovation given a highly fragmented global supply chain and legacy systems that struggle to work together,” Voss wrote in an excerpt from a yet-to-be-published report. “Automation and AI provide a universal set of tools to improve existing processes. We see these applications being used across industries in everything from talent recruitment to cybersecurity to drug development.”

The price corrections in the technology sector should not surprise investors.

In the last two years, allocators have invested in the top of the market. Over the next 12 to 24 months, Voss expects prices to become more rational, with investors gaining access to high-quality companies based primarily on realistic economics as opposed to inflated growth forecasts.

“Ahead of the decline in 2022, there was increasing speculation…in both public and private markets. It was moving away from fundamentals – growth, profitability, cost of capital, duration, etc., which makes sense when interest rates are zero and money is effectively free,” Voss wrote. “As we move into a more normal interest rate environment, valuation methodologies will weight fundamentals more heavily.”

It is a reflection of what is unfolding in the public markets.

“Amazon became the first company ever to lose a trillion dollars in value,” Voss said in the interview II. “And Amazon is still a market-leading and market-defining company, but how you value future cash flows has changed because the discount rate has gotten bigger.”

Investors can expect to see falling valuations in the private markets, albeit with a lag, where the adjustments are applied quarterly. But a mark-to-market criterion should not be the only reference point, according to Voss, who says it is difficult to compare private companies with their listed peers when day-to-day volatility is so high.

“We believe in private equity [and venture capital] should not try to time the market, which is in line with the logic we use when making investment decisions,” Voss wrote. “We diversify our portfolios over time, just as we diversify our investments by strategy, industry, geography, stage and size. This strategy moderates systemic risk associated with poorly timed investments and makes the overall performance of portfolio investments more dependent on each manager’s experience, investment choices and ability to add value.”