Exploring the benefits and challenges of Blockchain in trade finance

Blockchain simplifies trade finance processes such as issuing letters of credit, managing the supply chain, verifying documents and keeping records.

Trade finance is a critical component of global trade, but the traditional system has limitations that prevent it from achieving its full potential.

Blockchain technology has the potential to address these limitations and transform the trade finance industry. With digitization seeping into various industries, businesses have experienced a digital revolution in recent years. Blockchain in trade finance offers a number of benefits, ranging from streamlining paperwork to seamless execution of payments.

What is Trade Finance and how Blockchain works?

Trade finance refers to the financial instruments and products that facilitate international trade transactions between importers and exporters. It is a crucial aspect of international trade as it helps businesses reduce the risks associated with cross-border transactions, including currency fluctuations, political instability and payment defaults. Trade finance includes a range of financial products, such as letters of credit, trade credit insurance and supply chain finance. It aims to provide financial security and ensure timely payment for goods and services exchanged in international trade.

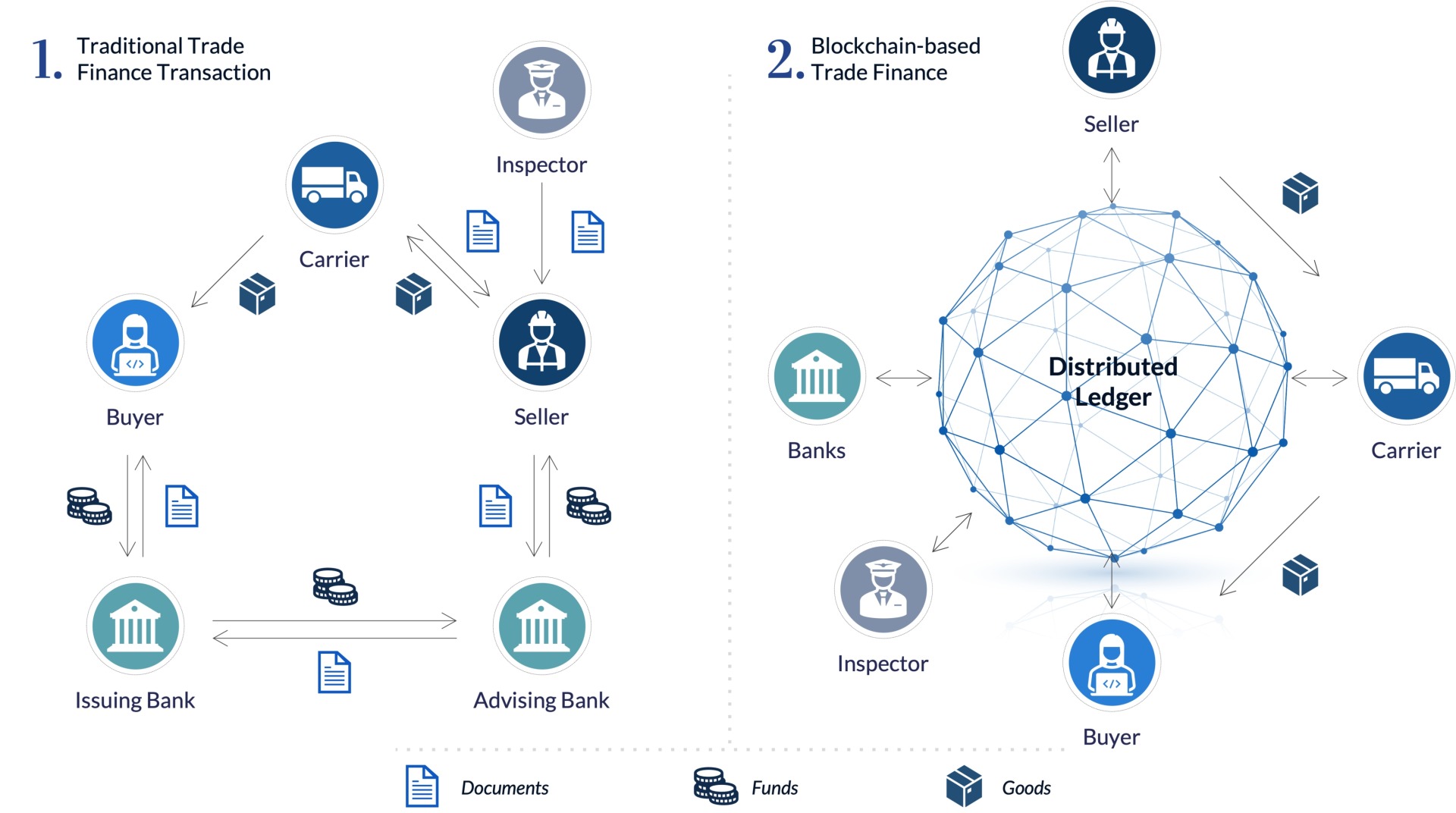

Source: Mahanakorn Partners

Blockchain is a distributed ledger technology that uses cryptography to secure and verify transactions. Each transaction is recorded on a block, which is then added to a chain of blocks, creating a permanent and immutable record. The blocks are linked together in a chronological order, forming a chain of transactions that cannot be changed without changing the entire chain. The blockchain is maintained by a decentralized network of computers, also known as nodes, which validate and verify each transaction using complex algorithms.

Once a transaction is verified by the network, it is added to the current block, which is then cryptographically sealed and added to the chain. The use of cryptography ensures the security and integrity of the data, making it virtually impossible to tamper with the information stored in the blockchain.

Advantages of Blockchain in Trade Finance

Blockchain has the potential to increase efficiency, reduce costs, improve security and improve transparency in trade finance. By eliminating intermediaries and streamlining documentation, blockchain can simplify the trade finance process and reduce the risk of errors and fraud.

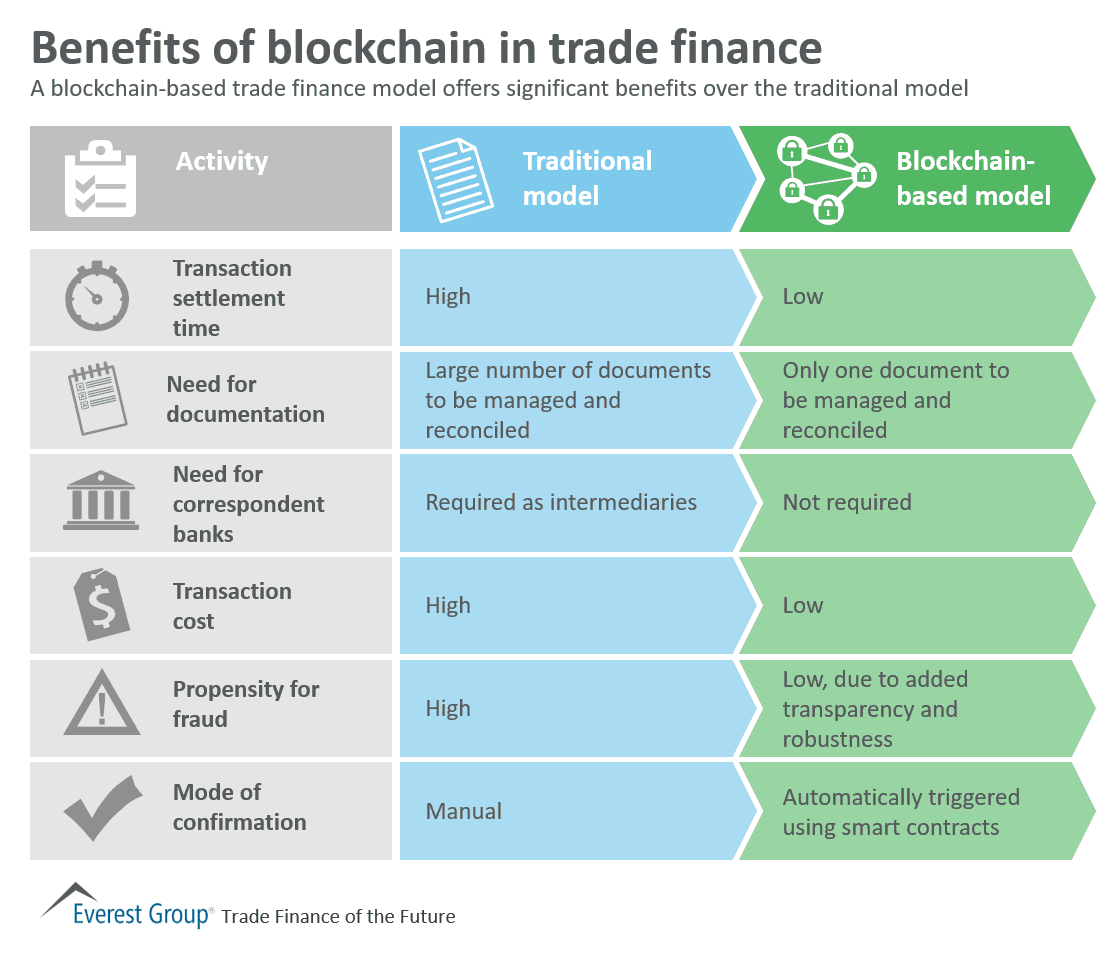

Source: Everest Group

Since blockchain technology is decentralized, it provides a high degree of transparency and accountability, as all parties in the network have access to the same information. This makes blockchain technology particularly suitable for industries that require secure, transparent and efficient transactions, such as finance, healthcare and supply chain management.

Applications of Blockchain in Trade Finance

Blockchain is already being used in several areas of trade finance, including supply chain finance, invoice finance and letter of credit processes. By digitizing and automating these processes, blockchain can improve efficiency and reduce costs for all parties involved.

Blockchain technology has real-world applications in trade finance that could revolutionize the way businesses operate. Here are some notable examples:

-

Streamlining the letter of credit process: Blockchain can help simplify and automate the letter of credit process, reducing the time and costs involved. By using smart contracts, the terms of the letter of credit can be executed automatically when the conditions are met.

-

Reduce fraud: Blockchain’s transparent and immutable nature can help reduce trade finance fraud. It can prevent fraudulent activities, such as invoice fraud, by enabling real-time tracking and verification of transactions.

-

Improving supply chain management: Blockchain can help improve supply chain management by providing real-time visibility into the movement of goods. This can reduce the risk of disputes and errors, and enable faster and more efficient trading.

-

Facilitating cross-border payments: Blockchain can enable faster, cheaper and more secure cross-border payments by eliminating intermediaries and reducing transaction times. This can help reduce the costs and time involved in international trade.

-

Improving transparency: Blockchain’s transparent nature can help improve transparency in trade finance by enabling all parties involved to have access to the same information. This can reduce the risk of errors and disputes, and enable faster and more efficient trading.

Challenges in adopting blockchain in trade finance

Adoption of blockchain technology in trade finance can bring several benefits, such as increased transparency, security, efficiency and cost reduction, but there are also several challenges that need to be resolved before widespread use can occur.

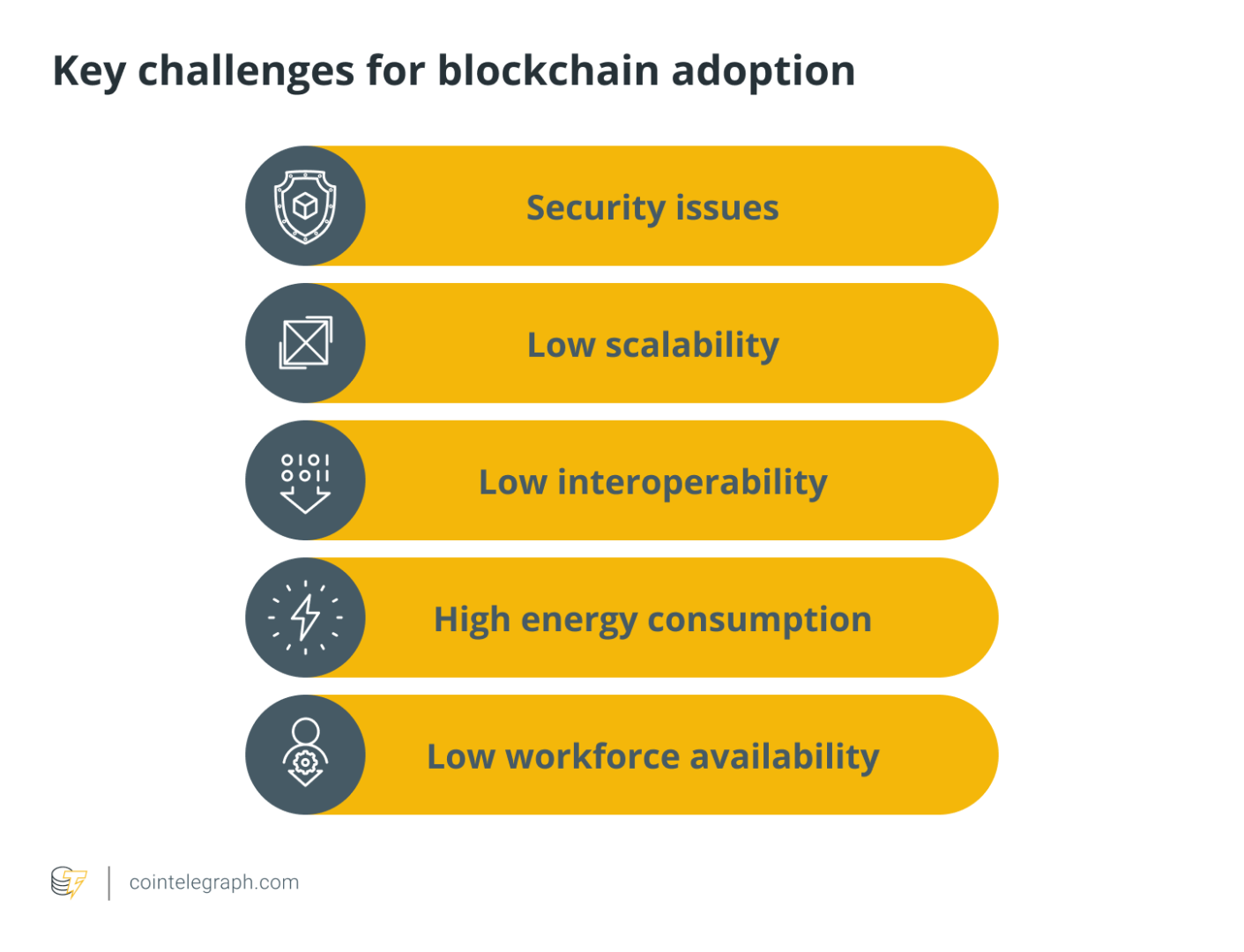

Source: Coin Telegraph

Here are some of the main challenges:

-

Regulatory Obstacles: Trade finance is a highly regulated industry, and the use of blockchain technology may be subject to regulatory scrutiny. Regulators must be satisfied that the use of blockchain technology is safe, secure and compliant with applicable regulations.

-

Standardization: Trade finance involves multiple parties, including banks, exporters, importers and freight forwarders, each with their own systems and processes. To implement blockchain technology effectively, there must be standardization across all parties, including the development of common protocols, data formats and interfaces.

-

Interoperability: To achieve the benefits of blockchain, different blockchain networks must be able to communicate with each other. However, there is currently no widely accepted standard for interoperability, and different blockchain platforms may have different protocols, making it challenging to integrate them.

-

Scalability: Blockchain technology is still relatively new, and it can be challenging to scale it up to handle large transaction volumes. This can be particularly challenging in trade finance, where there are often large transaction volumes that need to be processed quickly.

-

Data privacy: Trade finance involves sensitive and confidential data and there may be concerns about data privacy and security. It is important to ensure that blockchain networks are secure and that data is protected from unauthorized access.

-

Education and Awareness: There is still a lack of understanding of blockchain technology among many stakeholders in the trade finance industry. It is important to educate stakeholders about the benefits of blockchain and how it can be integrated into existing trade finance processes.

While there are many potential benefits to adopting blockchain technology in trade finance, there are also several challenges that need to be addressed to ensure widespread adoption. These challenges can be solved through cooperation between various stakeholders in the industry, and through the development of common standards and protocols.