Even Neal Stephenson doesn’t seem that into crypto anymore

Here’s a head scratcher for you: what happens when a science fiction author who co-founded a web3 metaverse company built on the blockchain doesn’t buy into cryptocurrency anymore?

That was our question when science fiction author Neal Stephenson took the stage at DICE 2023. Apparently his talk was meant to be a rumination on the metaverse, but in a quirky twist he instead spent most of the time talking about… . Jack and the Beanstalk.

What was the point of Stephenson’s dive into an old folk tale? It’s a story that centers around a transaction for “worthless” currency (the magic beans), and, according to Stephenson’s reading, a decent point of comparison for analyzing why someone would want to invest in cryptocurrency to buy and sell in-game items.

This was a remarkable speech for the founder of a web3 metaverse company to give. It could signal not only what kind of metaverse product his studio Lamina1 might create, but also how millions of dollars of venture capital invested in similar ventures might swing in the crypto winter.

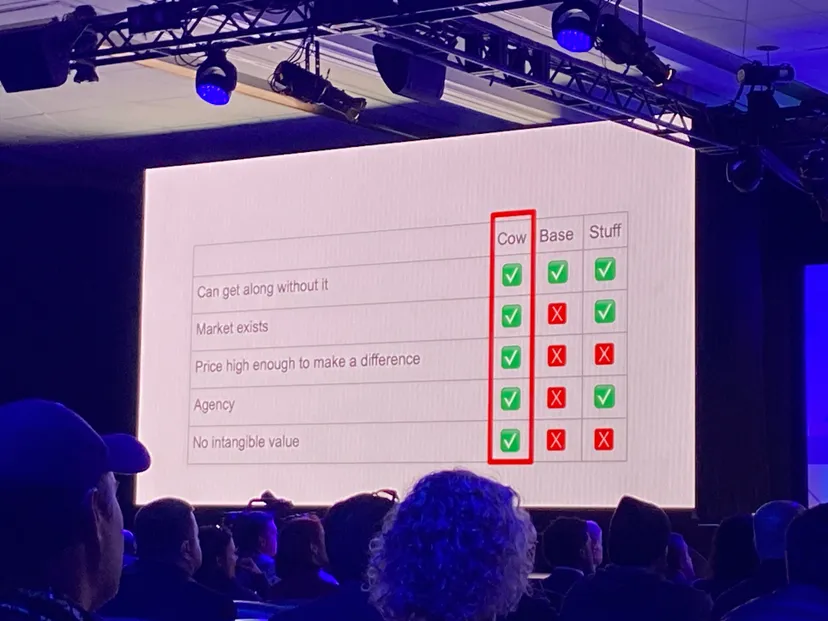

Stephenson’s call to the audience was this: when building in-game economies for virtual worlds, developers cannot lose sight of the intrinsic value of objects—what gives them their value beyond mere artificial scarcity. Here’s a quick overview of his thought process.

Magic beans as a metaphor for cryptocurrency

In Stephenson’s analogy, the magic beans Jack sells the cow for (when he was sent to get … er, FIAT currency) are a good stand-in for cryptocurrency. They’re supposed to be able to do all these wonderful things, but in the end they just lead Jack to a violent world of wealth, power, and ultimately doom and gloom.

But Stephenson seemed less interested in the magic beans themselves and more in what Jack used to obtain them: the cow. What made this cow so valuable in Stephenson’s analysis?

The answer is clear in the context of history. Jack’s family is poor, the cow is starving, they can survive without owning it, there is a market for cows and selling it will give them money to use to buy food.

Even before the blue-faced “crypto bridge” enters the story (Stephenson was referring to a 1933 Comicolor animation of Jack and the Beanstalk) the incentive for Jack and his family to sell the cow was clear, and the heady promises of cryptocurrency (magic beans) made him sell the cow for bigger dreams than a simple coin that could feed his family.

Stephenson then compared the cow to objects in the game—especially the ones he had acquired in the Viking survival game Valheim. IN ValheimStephenson and his friends have built a modest base, crafted some fancy weapons and armor, and earned trophies that hang on the base’s walls.

Now Stephenson thought, why would he and his friends want to sell this base? And more importantly, what made these respective items valuable?

Comparing it to the cow yielded only one key overlap: if he and his friends sold theirs Valheim items through an in-game digital market, they would be able to live without them. None of the incentives to sell these items exist in any way.

That’s because the value of these items in the game is mostly sentimental. The sense of personal ownership that came from building the base, the satisfaction of killing monsters to craft items—that is what gives these items value. Their rarity or difficulty of acquisition is only part of the equation. If items in the game aren’t really worth that much to anyone else—How can you build a functioning economy on top of them?

Compare in-game items with used books

You can understand that a famous science fiction author might have opinions about the book market. After running through the comparison of magic beans, he started talking about used books.

For most book lovers, a used book represents a love of the story within its pages, or a cherished memory of having read it when they were at school or at a certain point in their lives. Shelving used books is an acknowledgment of their value, and for a number of reasons this value can become apparent if you decide to sell it to a used book dealer.

Here, Stephenson pivoted to harass a certain segment of the used book market: those who sell on the basis of an artificial lack of aesthetics (think booksellers who sell books to be displayed when arranged by cover color, or sold with paper wrappers on them for a monochromatic choice ). These vendors don’t sell a product based on the words on the page, they sell books based on how someone might react to seeing them on a shelf.

Stephenson described this model as being totally disconnected from the world of the book market—and argued if it were to swallow the entire book business, it would create volatility like the kind that caused cryptocurrencies to crash in 2022.

And while volatility is good for get-rich-quick types or scammers, it’s not good for sustainable online economies. And for this metaverse company’s co-founder, the sustainability of online worlds trumps the need for everyone to profit from the sale of digital goods.

A cooling on crypto fever

When Stephenson and his colleagues took Lamina1 out of stealth mode, he told cryptocurrency outlet Decyrpt that he was a latecomer to the crypto field, but that he envisioned something like part of the online world he envisioned in Snow Crash.

“I think it’s implicit in Snow Crash that none of what you see there could really exist as described without some kind of decentralized payment system,” Stephenson told the outlet in 2022. “There’s no, like, one big bank sitting there processing everybody these zillions of transactions.”

But if the cryptocurrency world took Stephenson’s arrival on the scene as a blessing, a speech like this definitely indicates that he is not fixated on pumping up the value of a digital commodity. He ended his talk by referring back to his treasures Valheimor the real purpose behind salable in-game items in in World of Warcraft.

“Most people play Warcraft for the joy of it, and for the experiences they have with friends and enemies,” he mused. “They are not particularly eager to liquidate their stocks of virtual goods because the magic swords in those stocks have utility as well as intangible qualities—the memories associated with pride and achievement.”

At some point in the future, there may be good reason to have digital goods in the game as easy to sell as our real physical things are. But “things” only have value if people give them value.

“It is not just the currency that sets the value of the goods. It is the goods in the aggregate that sets the value of the currency.”

And that makes the rest of Stephenson’s thought experiment a familiar one that has ever sat down and wearily heard the pitches of the crypto crowd: if a digital world or a digital game isn’t fun or compelling on its own, why should anyone care what kind of database it user to let you buy and sell items in the game?

Focus on the intrinsic value of those experiences, Stephenson said, and you’ll be better off than trying to convince the world that a digital gun or hat has real financial value.