Evaluating Bitcoin as a Store of Value

Join the most important conversation in crypto and web3! Secure your place today

It’s a common question: Is bitcoin (BTC) a store of value? While proponents say “Yes” without hesitation, skeptics note its historically large drawdown. And that’s fair. Not long ago, in November 2021, bitcoin reached almost $70,000, but is now around $20,000. That said, BTC also used to trade below 1 cent, so using just prices, the answer to the first question is, “It’s hard to say.”

For an asset in its speculative, price discovery phase, volatility should be expected. New opportunities and technologies often capture the attention of speculators and traders, often resulting in wild swings as participants seek to determine true value.

You read Crypto long and shortour weekly newsletter with insights, news and analysis for the professional investor. sign up here to get it in your inbox every Wednesday.

Couple that growing interest with the skepticism, controversy and industry speed bumps experienced so far, and the rollercoaster of highs and lows makes sense at just 14 years old.

While the asset exhibits qualities of sound money (it is durable, portable, scarce, uniform and divisible), acceptance is the ultimate uncertainty.

Through the following on-chain calculations, I aim to prove that bitcoin’s users believe it is a store of value (SoV), despite its volatility.

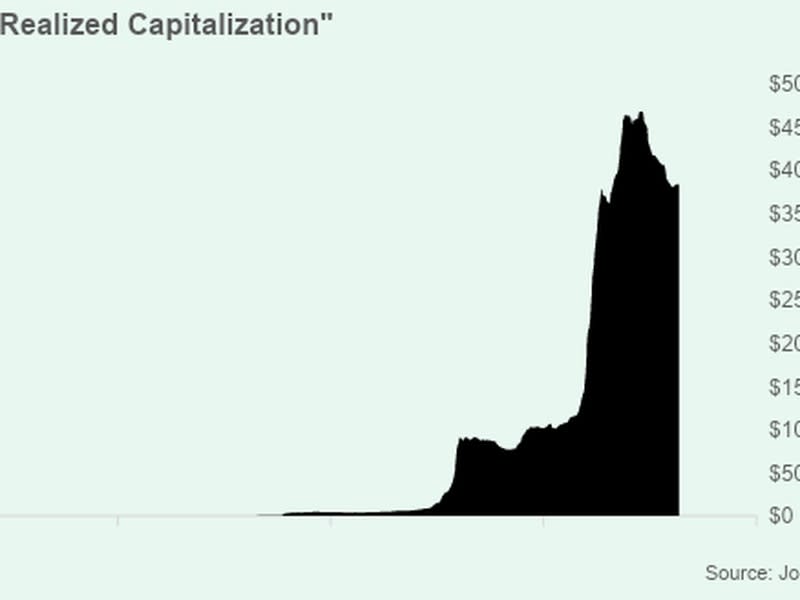

Realized capitalization

A measure of bitcoin’s use as an SoV is its “realized capitalization.” Different from traditional market value, this option considers the last transfer price of each bitcoin instead of the current market price.

By doing this, realized capitalization is an aggregated cost base for bitcoin’s on-chain users. Total realized cap is the amount of money that has been stored in the network over time.

To me, this is a proxy for influx. Realized capitalization rises when transfers are made at higher prices than previously and decreases when transfers are made at lower prices.

According to Glassnode data, bitcoin stores a total of about $380 billion in value, down from a peak of $460 billion. But, importantly, this is four times more than in December 2017 – when bitcoin was priced around where it is today. So money has flowed into the network – to store value.

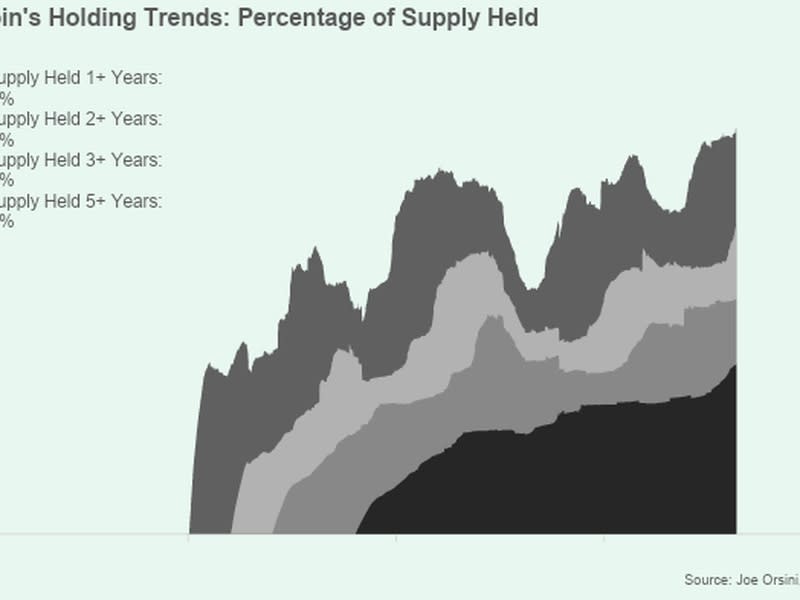

Team trends

Not only that, but bitcoin users also hold the asset longer and longer. Just last week, the percentage of supply that has been held for long periods reached all-time highs despite the price drop since the end of 2021. As of March 7, according to Glassnode data:

-

% supply held for 1+ years: 67.7%

-

% supply held for 2+ years: 51.4%

-

% supply held for 3+ years: 39.2%

-

% supply held for 5+ years: 28.3%

Conclusion

There is a saying that “perception is reality.” Remember that bitcoin has essentially been willed into existence. Despite the noise and skepticism, money continues to flow into the network and users keep their assets for longer periods of time.

The next time someone questions bitcoin’s use as a store of value, show them these charts. As Satoshi Nakamoto wrote: “If enough people think the same way, it becomes a self-fulfilling prophecy.”