Europe Debt Bubble And Hyperbitcoinization – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, subscribe now.

European energy crisis is ongoing

In last Thursday’s dispatch, we covered the dynamics of this inflationary bear market, where conditions in the global macro landscape are quickly re-driving global interest rates higher. Similarly in our “Energy, Currency & Deglobalization” series,

“Energy, Currency and Deglobalization, Part 1”

“Energy, Currency and Deglobalization, Part 2”

Since our last release, the response from European authorities to ‘fight’ rising energy costs has been astonishing.

In the UK, newly appointed Prime Minister Liz Truss has already released a draft plan as a response to rising energy bills. The policy plan could cost £130bn over the next 18 months. The plan describes the government’s commitment to setting new prices, while at the same time guaranteeing funding to cover the price differences to energy suppliers in the private sector. Using 2021 annual figures, the plan would be about 5.9% of gross domestic product. The UK’s 5% of GDP stimulus would be roughly equivalent to a US$1 trillion stimulus package.

There is also a separate plan costing £40bn for UK businesses. With both, they represent about 7.7% of GDP for what is likely to be a conservative first pass of stimulus and spending to offset a longer, sustained period of much higher energy bills across Europe over the next 18-24 months. The first policy scope does not appear to have a cap on spending, so it is essentially an open short position on energy prices.

Ursula von der Leyenpresident of the European Commission, tweeted the following:

The supposed Russian oil price cap is important for several reasons: The first is that with Europe’s solution to the current energy crisis appearing to be fiscal stimulus packages and energy rationing, what this is doing to the euro and pound, both energy import sovereignties, only reinforces the problems.

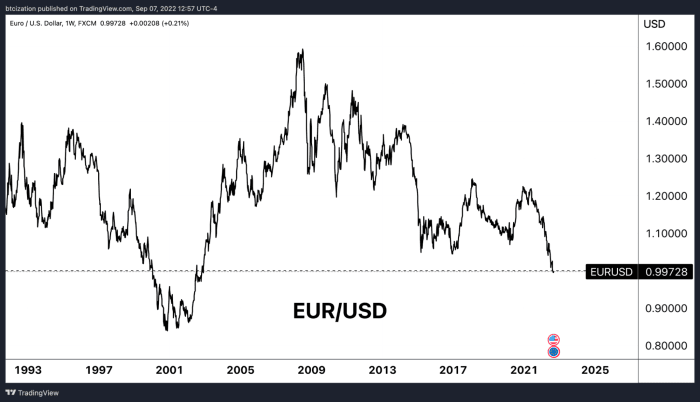

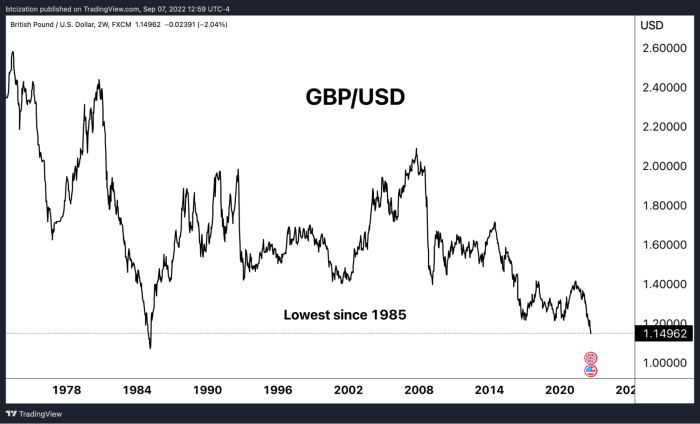

Stimulus fiscal packages and energy rationing as solutions to the current energy crisis have affected the euro and the pound.

Stimulus fiscal packages and energy rationing as solutions to the current energy crisis have affected the euro and the pound.

Even with the European Central Bank (ECB) and the Bank of England supposedly rolling back pandemic-era programs, the solution Western voters are likely to demand is “energy bailouts.” Some are calling this Europe’s Lehman moment, reports yesterday from Bloomberg, “Energy Trading Stressed By Margin Calls Of $1.5 Billion.”

– There is a need for liquidity support, said Helge Haugane, Equinor’s senior vice president for gas and power, in an interview. The issue is focused on derivatives trading, while the physical market works, he said, adding that the energy company’s estimate of $1.5 trillion to support so-called paper trading is “conservative.”

– Bloomberg

Similarly, Goldman warned of a gloomy outlook for the markets.

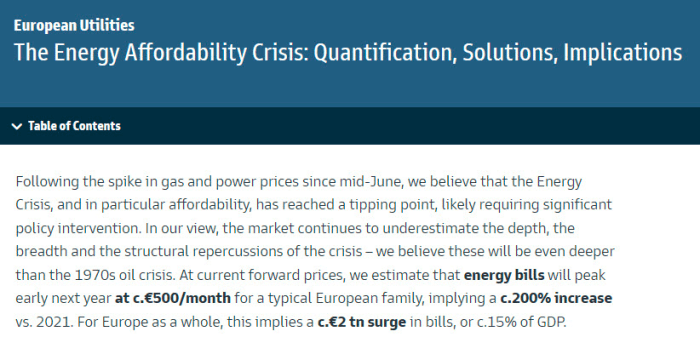

“The market continues to underestimate the depth, breadth and structural consequences of the crisis,” the Goldman Sachs analysts wrote. “We think these will be even deeper than the oil crisis of the 1970s.”

The energy crisis is currently estimated to cost the European continent approximately 2 trillion euros, or 15% of GDP.

“At current forward prices, we estimate that energy bills will peak early next year by around €500/month for a typical European family, which represents an increase of around 200% compared to 2021. For Europe as a whole, this means an approx. 2 TRILLION euros increase in the energy bill, or approx. 15% of GDP.”

Although this number is likely to be reduced by the fiscally subsidized prices, the currencies are falling meaningfully against the dollar (still the current unit of trade for global energy), while the dollar itself has been priced lower in terms of energy.

However, business is one of the losers, as energy rationing and soaring costs hammer European industrial producers.

“Metal plants feeding Europe’s factories face an existential crisis”

“Europe’s best aluminum plant will cut production by 22% on energy costs”

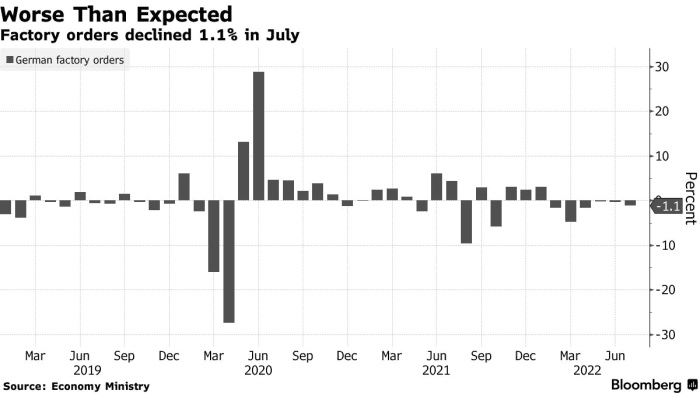

“German factory orders fall for sixth month amid energy crunch”

The table above shows German factory orders by month heading into the autumn.

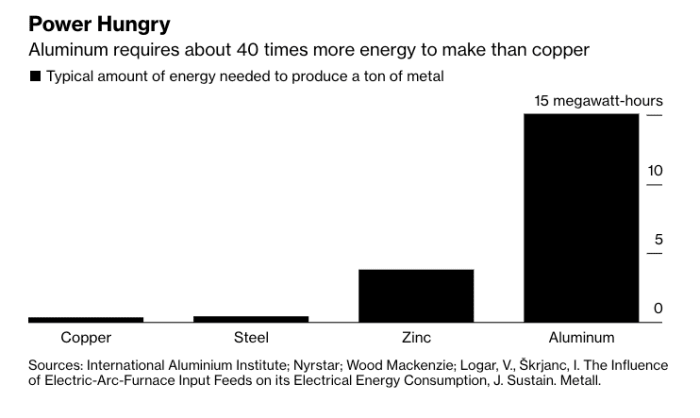

“European aluminum cuts deepen by the day as the power crisis bites

– The restrictions increase the extreme burden the energy crisis has on Europe’s metal industry, which is one of the largest industrial consumers of power and gas. A group representing the region’s biggest producers wrote to EU politicians warning that the energy crisis could cause “permanent deindustrialisation” in the bloc unless a package of support measures is implemented.”

Aluminum, which requires about 40 times more energy than copper to produce, is quite energy intensive.

“This is a genuine existential crisis,” said Paul Voss, director general of European Aluminum, which represents the region’s biggest producers and processors. “We really need to sort something out pretty quickly, or else there will be nothing left to fix.”

–Bloomberg

What is in demand due to the structural energy deficit in Europe is the wealthy and the business community who demand that the public balance sheet take the risk. Energy bill subsidies or price caps do nothing to change the absolute amount of high energy density fossil fuel molecules on the planet. The price hikes and subsequent response from Russian President Vladimir Putin is what makes all the difference, and it has the potential to create potentially devastating outcomes in financial markets.

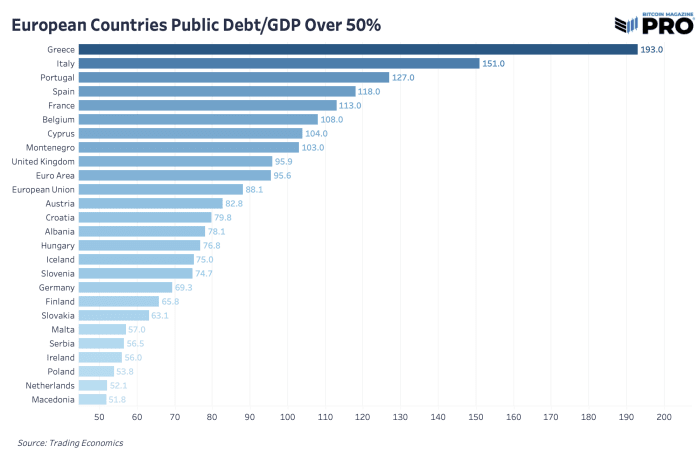

No government is going to let its citizens starve or freeze; it is the same story throughout history with sovereign nations loading up on future debt obligations to solve current problems. This happens to come at a time when a handful of European countries have astronomical public debt-to-GDP ratios well above 100%.

A sovereign debt crisis is looming in Europe, and the overwhelmingly likely outcome is that the European Central Bank intervenes to limit credit risk, maintaining the devolution of the euro.

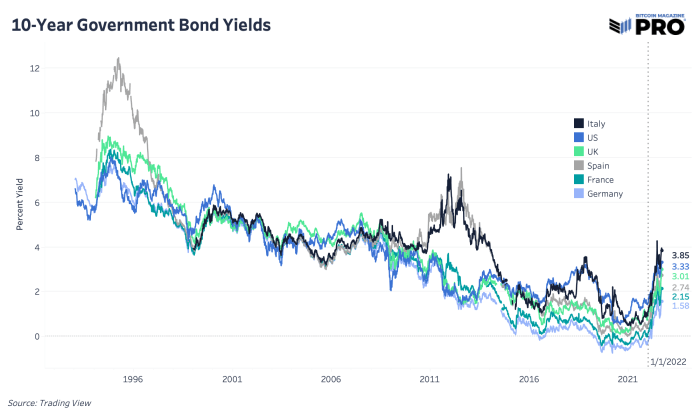

We have talked at length about the drastic rise and rate of change in 10-year yields in the US, but it happens to be the same picture in all major European countries despite slower actions by various central banks to raise interest rates.

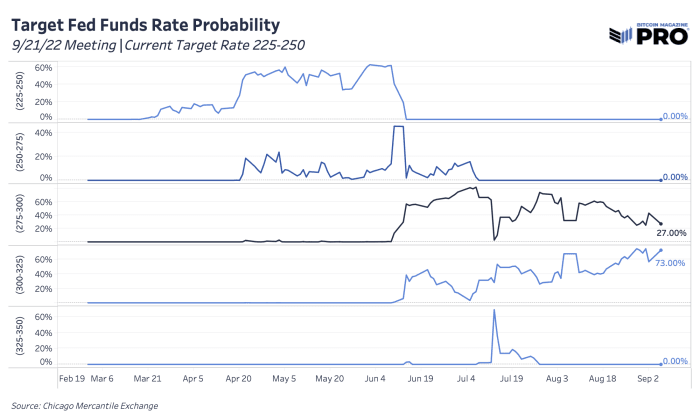

European debt interest rates, which also represent future inflation expectations, still show no signs of abating. The Bank of England is projecting 9.5% CPI inflation through 2023 (read “Bitcoin’s Seven Daily Candles” where we cover their latest August monetary report) and the European Central Bank is expecting a 75 basis point rate hike in their announcement tomorrow, after just recently raise from negative prices. For what it’s worth, the probability of a Federal Reserve rate hike to 75 basis points ahead of the Federal Open Market Committee meeting two weeks away is currently 80% (intraday pricing vs. 73% for September 6).

With increasing political pressure, high inflationary pressures, although showing little signs of slowing down recently, continue to leave central banks with no other viable options. They must “do something” in an effort to maintain the 2% inflation target even if it only partially leads to sufficient destruction of demand. This is largely where investors who have a thesis around top interest rates and “the Fed can’t raise interest rates” have been crushed. Although rising government interest rates are not sustainable for servicing debt interest payment burdens in the long term, we are still waiting for the tipping point that forces a change in direction.

The second-order inflationary effects of easing more fiscal stimulus and/or a seizure in US financial markets are what you should be looking for.

Look for the second-order inflationary effects of easing more fiscal stimulus and/or a seizure in US financial markets.

Look for the second-order inflationary effects of easing more fiscal stimulus and/or a seizure in US financial markets.