Ethereum NFTs surrender to crypto winter; will ETH suffer the same fate

- Ethereum witnessed a decline in NFT transactions, but blue-chip fundraising did well

- Ethereum observed support from retail and large investors

NFT transactions on Ethereum have fallen significantly, from 22% NFT dominance to 8.3% according to crypto analysis firm Glassnode. On the other hand, stablecoin transactions grew and took up the space originally conquered by NFTs. This waning interest from traders could negatively impact the overall NFT market.

NFTs on #Ethereum accounted for 18% to 22% of transactions during the first half of 2022.

However, NFT dominance has since fallen to just 8.3%, as interest in the space wanes during the bear market.

Stablecoin dominance has increased since FTX from 10% to 12.5%.

Diagram: pic.twitter.com/PgImnSIkRK

— glassnode (@glassnode) 5 December 2022

Read Ethereum’s [ETH] Price prediction 2023-2024

NFT blue chips remain unaffected

Despite the falling NFT transactions, blue chip NFT collections on the Ethereum network performed relatively well. According to data provided by NFTGO, gatherings such as the Bored Ape Yacht Club [BAYC] witnessed a massive increase of 337% in terms of volume.

In addition, the number of sales increased by 325% in the last week. Mutant Ape Yacht Club [MAYC]another collection, also witnessed a similar growth in terms of volume and sales.

This indicated that the lower transactions on the Ethereum network had not affected blue chip NFTs, but may have affected smaller and upcoming collections.

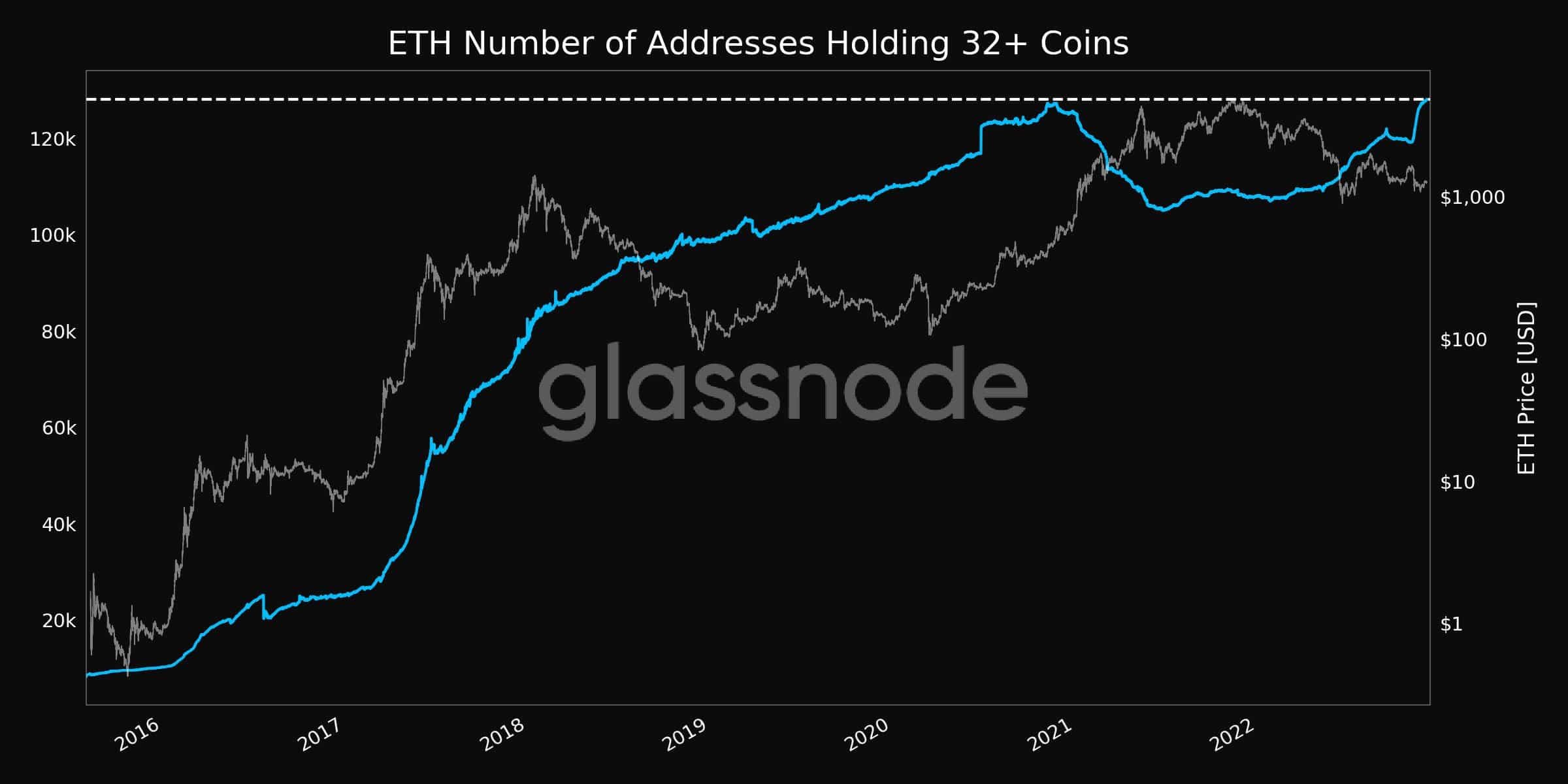

Thus, at the time of writing, large addresses continued to support ETH. As can be seen from the image below, the number of addresses with over 32 coins reached a record high of 128,000 addresses at the time of writing.

In addition, retail investors also showed faith in the altcoin. In accordance Glass node‘s data, the number of addresses containing 0.01 coins increased significantly and had reached a three-month high of 22.3 million addresses.

Source: Glassnode

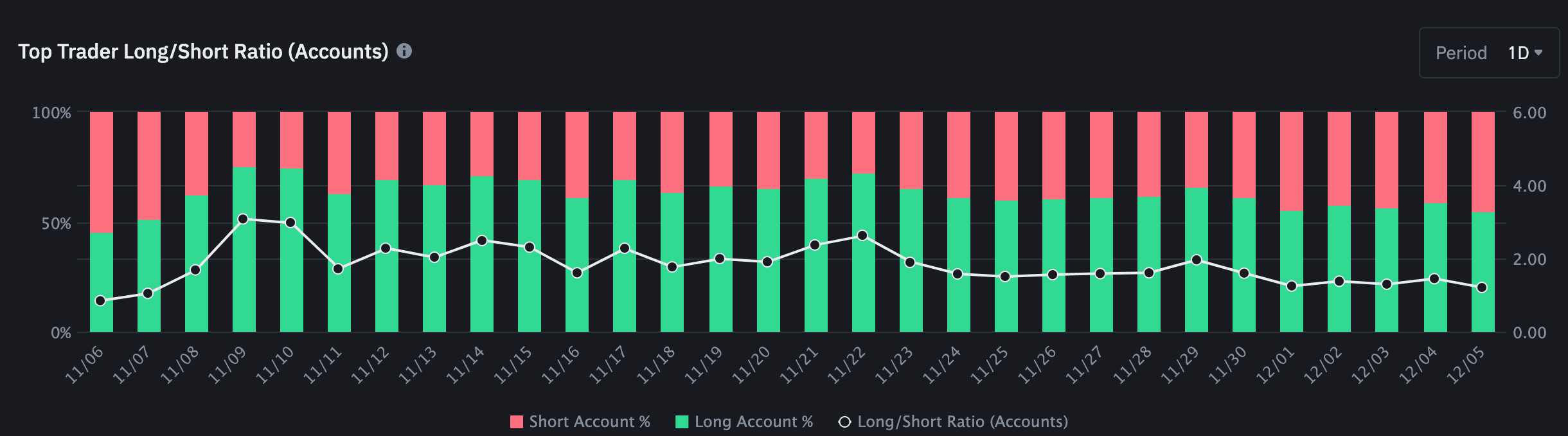

Traders are starting to “long” for Ethereum

Traders have always shown faith in Ethereum. Top traders on the Binance exchange took advantage of a falling ETH and went long on Ethereum.

At the time of writing, over 50% of the total traders on the Binance exchange had held long positions on Ethereum.

Source: Binance Futures

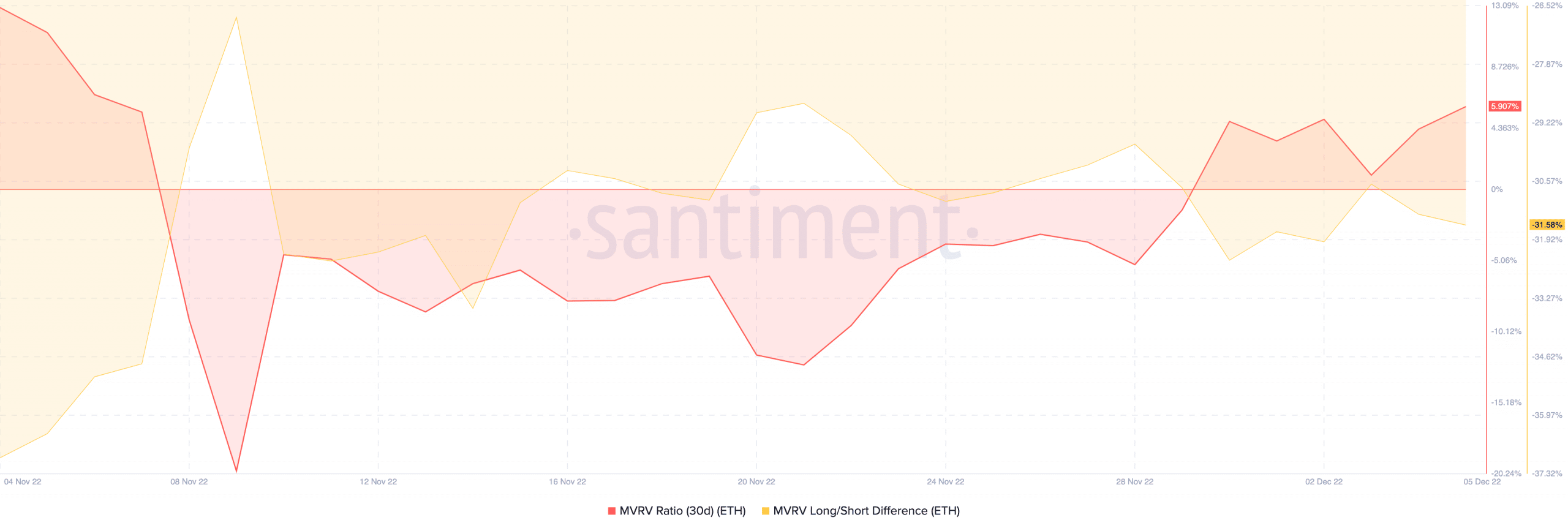

Moreover, Ethereum’s market capitalization to realized value (MVRV) ratio suggested that the tide was turning in favor of addresses with ETH. This suggested that some Ethereum holders could take a profit if they ended up selling their position.

However, the long/short difference indicated that it would mostly be short-term holders who would end up making money if they decide to sell their ETH.

Source: Sentiment