Ethereum Looks Better Than Bitcoin Here (ETH-USD)

Dennis Diatel Photography/iStock Editorial via Getty Images

Summary of the assignment

Ethereum (ETH-USD) has rallied strongly with the broader crypto market, and it appears a bottom may be in store. If this is the case and you feel like you missed the boat, no one is need to worry. History suggests that there will be a chance for investors to get in at more favorable prices.

Furthermore, given today’s fundamental and technical outlook, I believe that Ethereum could outperform Bitcoin (BTC-USD) in 2023, although I still recommend holding both coins for the long term.

EWT Outlook

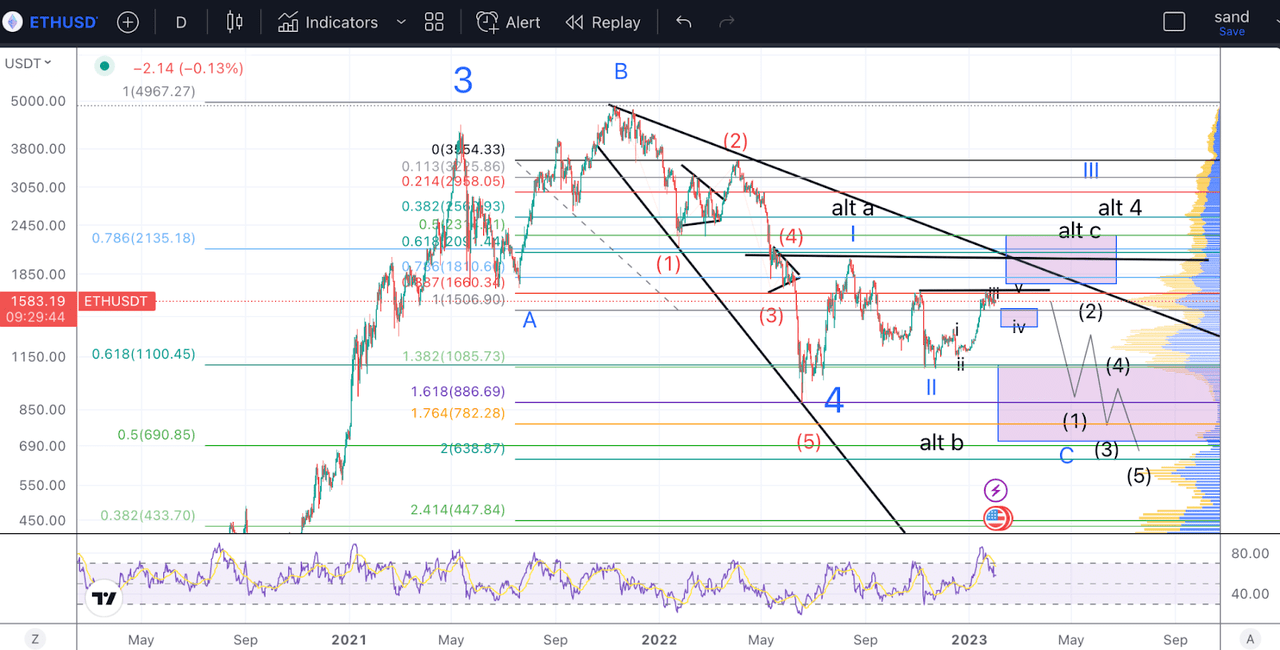

First of all, let’s start by looking at the EWT outlook for Ethereum. Below I present two possible counts:

ETH EWT (author’s analysis)

I will try to be as concise as possible. Since around April 2021, ETH has completed an ABC correction. Back in June 2022, Ethereum fell below $1000, passed the 38.2% retracement level, and gave us sufficient price action to count five impulsive waves to the downside. If this is correct, then the low is in, and what we are now setting up is a 1-2 structure inside a larger wave III marked in blue.

But until the wave I high is broken convincingly, we can also count all the moves since the June low as an ABC for wave 4. This count can be seen in black. This would mean we still have one last leg to go, which could take us down into the $700 region. This represents the next key fib level, the 50% retracement, and will also be near the 2-outside of wave 1 in red as measured from the top of wave 2.

At this point, having no exposure to Ethereum is a risk, although we may still get a good chance to go far in wave 2 of III.

An eerie resemblance

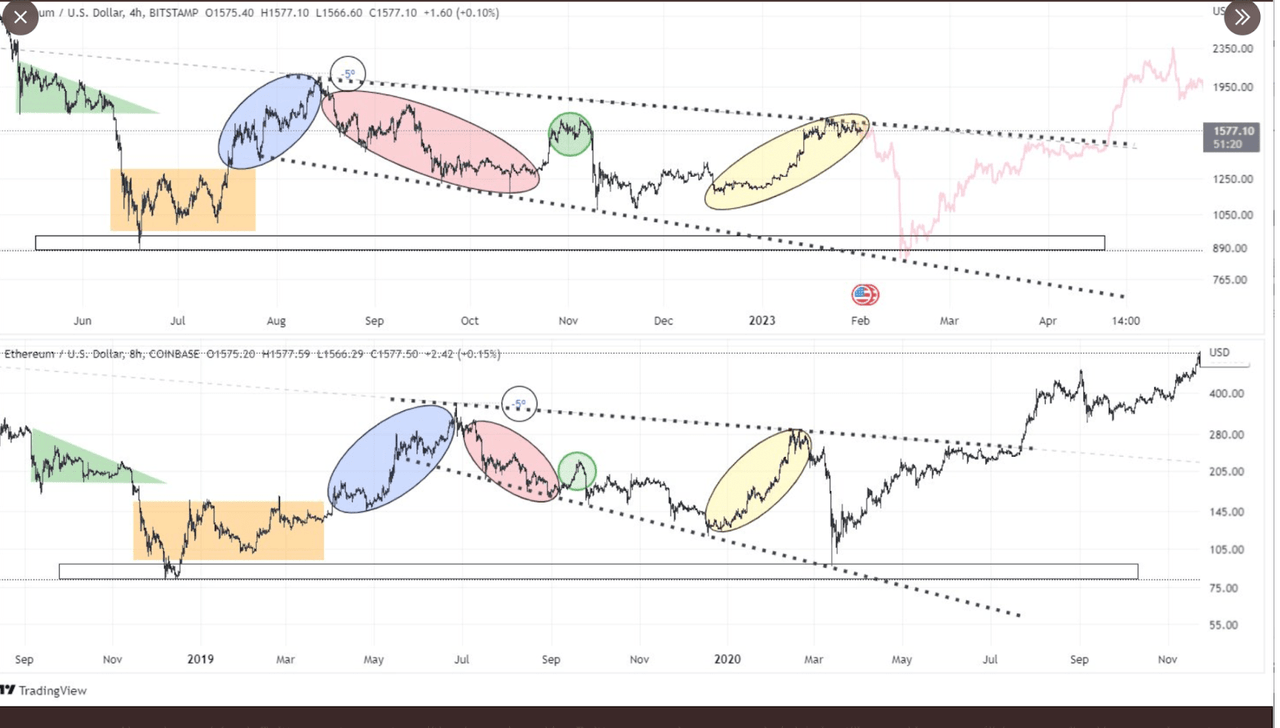

History doesn’t repeat itself, but sometimes it does, and if it does, the chart below is definitely worth a look,

Ethereum Comparison (TradingView)

This chart compares the dynamics that played out in the 2019-2020 correction and what we see today, and we can see that some similar dynamics are at play. This dynamic is a result of supply and demand distribution and market testing of resistance and support levels.

In 2020, ETH sold off and almost broke the recent lows, and if this plays out again, we should see Ethereum now close to $1000 again. However, this will largely depend on the macroeconomic outlook, which I have discussed in more depth in my marketplace.

In 2019, the COVID crash contributed to a selloff. Another event of this magnitude seems unlikely at this point, but numbers suggest the economy may be heading into a recession and the Fed is not done tightening.

Will Ethereum Outpace Bitcoin?

The big question, if you are already invested in crypto, is which of the two major coins will perform better in 2023.

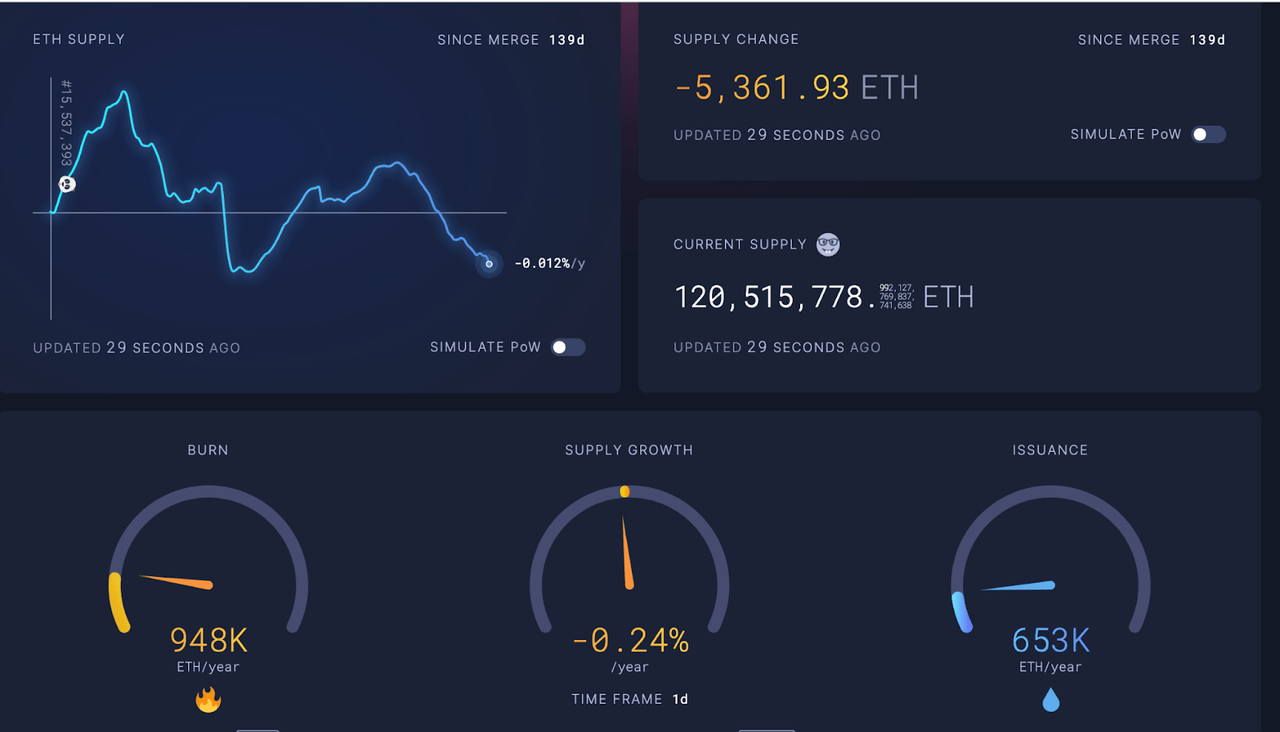

From a fundamental side, there is a lot to be said in favor of the Ethereum network. It has multiple use cases, an expanding ecosystem, and a deflationary currency:

ETH Supply (Ultrasoundmoney)

The only real concern for Ethereum is regulation, as this cryptocurrency can be treated as a security going forward. This seems less likely with Bitcoin, which is considered more of a commodity.

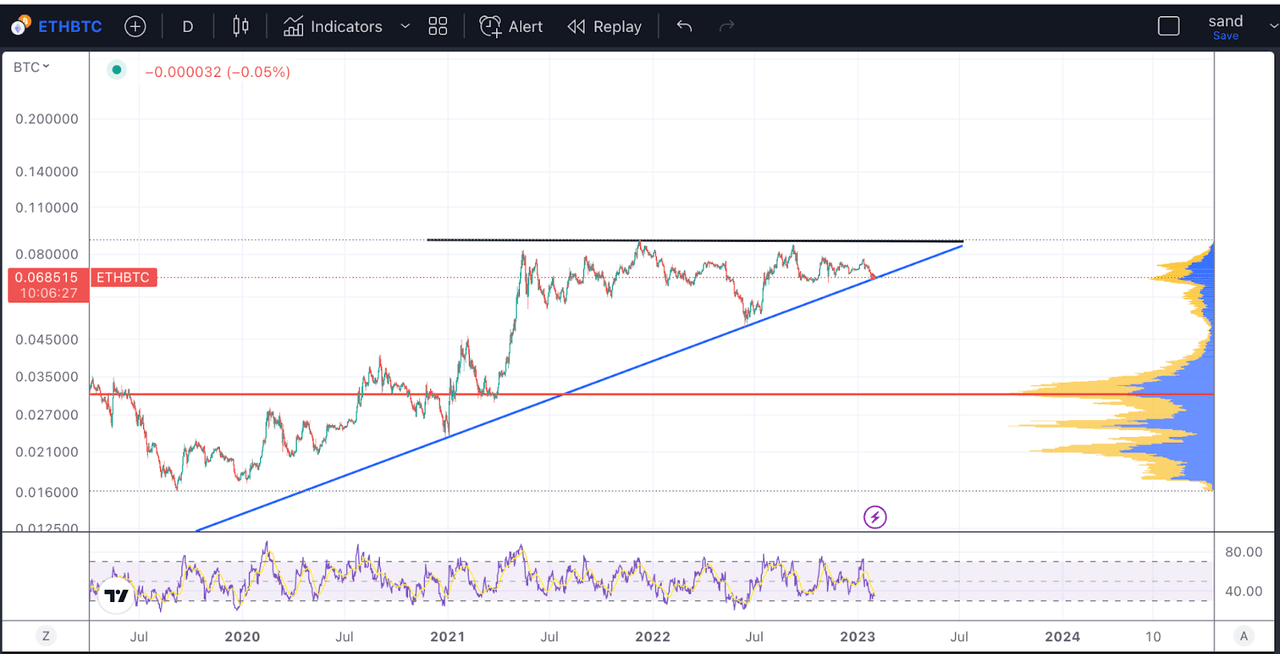

Now, from a technical perspective, the ETH/BTC chart also looks to be heading higher:

ETHBTC (TradingView)

We are hovering just above the trendline in ETHBTC, which suggests that we should at least be able to rally into the upper resistance. From a charting perspective, this can arguably be identified as a “cup and handle” structure, which would also imply a breach of the upside inherent in the cards.

Remove

In conclusion, Ethereum looks like a bottom may be in. For those who missed the train, history suggests that we may get another chance to lay much closer to the bottom, but much of this depends on the macroeconomic outlook.

Looking into 2023, it could be argued that Ethereum could outperform Bitcoin. Nevertheless, I recommend holding both, as I see these cryptocurrencies as complementary. And of course tokens needed for Ethereum scaling should also work well if/when Ethereum rallies. A clear example of this is Polygon (MATIC-USD).