Ethereum jumps 12% as the merger approaches

Important takeaways

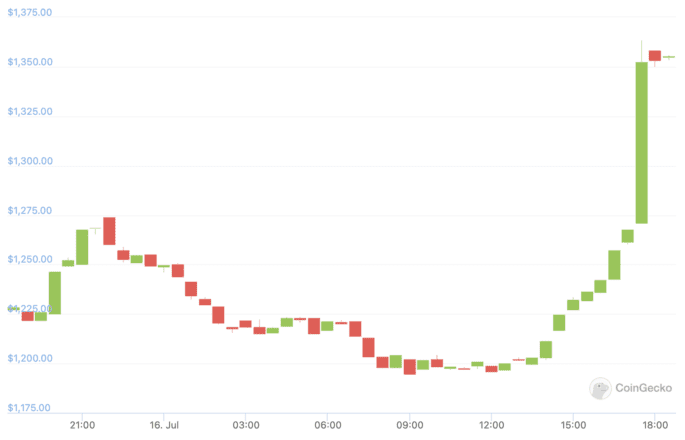

- ETH performs better in the market. It reached $ 1363 today after a 12% increase.

- The latest rally comes days after the Ethereum Foundation set a preliminary launch date of September 19 for “the Merge”.

- Ethereum’s Merge to Proof-of-Stake is the network’s most anticipated update in history.

Share this article

The rally comes two days after Tim Beiko proposed a tentative launch date on September 19 for Ethereum’s long-awaited merger of proof-of-effort.

Ethereum rally in the middle of a merger hype

Ethereum erupts.

The number two crypto entered a 12% rally on Saturday, briefly reaching $ 1,363 for the first time in a month. Since then, it has posted a slight chill, and is currently trading at around $ 1,355.

The ETH rally has led to a bounce across the market, and has helped assets such as Synthetix and Avalanche with double-digit gains. The Lido rate ETH also jumped by about 12.6%, while LDO, the governing symbol for Lido DAO, is up 22.8%. Interestingly, BTC increased by around 3.2%, indicating that Ethereum is leading the current rally despite Bitcoin’s dominance over the market.

Although the exact reason for the jump is unclear, improving sentiment around Ethereum and its upcoming “Merge” to Proof-of-Stake may be a factor. On Thursday, the Ethereum Foundation held its last Consensus Layer Call where the merger was discussed. Ethereum Foundation member Tim Beiko suggested a preliminary launch date of September 19, leaving the strongest hint so far that the merger may be just a few weeks away.

Before the merger can take place on the mainnet, Ethereum is set to go through a final test run on the Goerli network over the next few weeks. The final launch will follow, although Beiko has pointed out that the date in mid-September is only preliminary and can be changed.

The merge update involves merging Ethereum’s execution layer and consensus layer to move the network away from Proof-of-Work and onto Proof-of-Stake. This is expected to reduce the network’s energy consumption by 99.95%, but the merger has also been seen as a bullish catalyst for ETH as it is set to reduce the network’s issuance by around 90%. By switching to Proof-of-Stake, the network will no longer pay miners and instead offer fees exclusively to validators. As Ethereum also burns part of its supply in gas charges via EIP-1559, it is estimated that ETH may become a deflationary asset after the update. According to ultrasound.money, if Merge is sent on September 19, the ETH supply will reach a peak of 120.2 million and slowly begin to drain over time.

With the Merge story beginning to take hold following the latest Ethereum Foundation call, the market can now praise the impact of the update despite the months-long downturn that has hit ETH and other cryptocurrencies this year.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.