Ever since Celsius stopped withdrawing on June 12, the company has been in focus due to the lender’s financial difficulties. One month later, Celsius filed for bankruptcy in the United States by exploiting the Chapter 11 lawsuit. Two days after filing for bankruptcy, a report revealed that two people familiar with the case claim that the private lending platform that owes Celsius $ 439 million is Equitiesfirst.

FT sources claim private lending platform that owes Celsius $ 439 million is shares first

In recent weeks, bankruptcies, liquidations and insolvencies have been a very hot topic in the crypto world. Three well-known crypto companies have filed for bankruptcy protection which includes the digital currency exchange Voyager Digital, the crypto lender Celsius and the crypto hedge fund Three Arrows Capital (3AC). Celsius filed for bankruptcy on July 13, 2022, or 31 days after the company froze withdrawals.

Before the bankruptcy petition in July it was speculation during the second week of June which said that Celsius had funds locked into specific decentralized financial protocols (defi) that needed immediate adjustment or significant collateral would be phased out. A few days before Celsius filed for bankruptcy, the company’s wallets will have transfered million USD (USDC) different times to pay down loans in Compound and Aave.

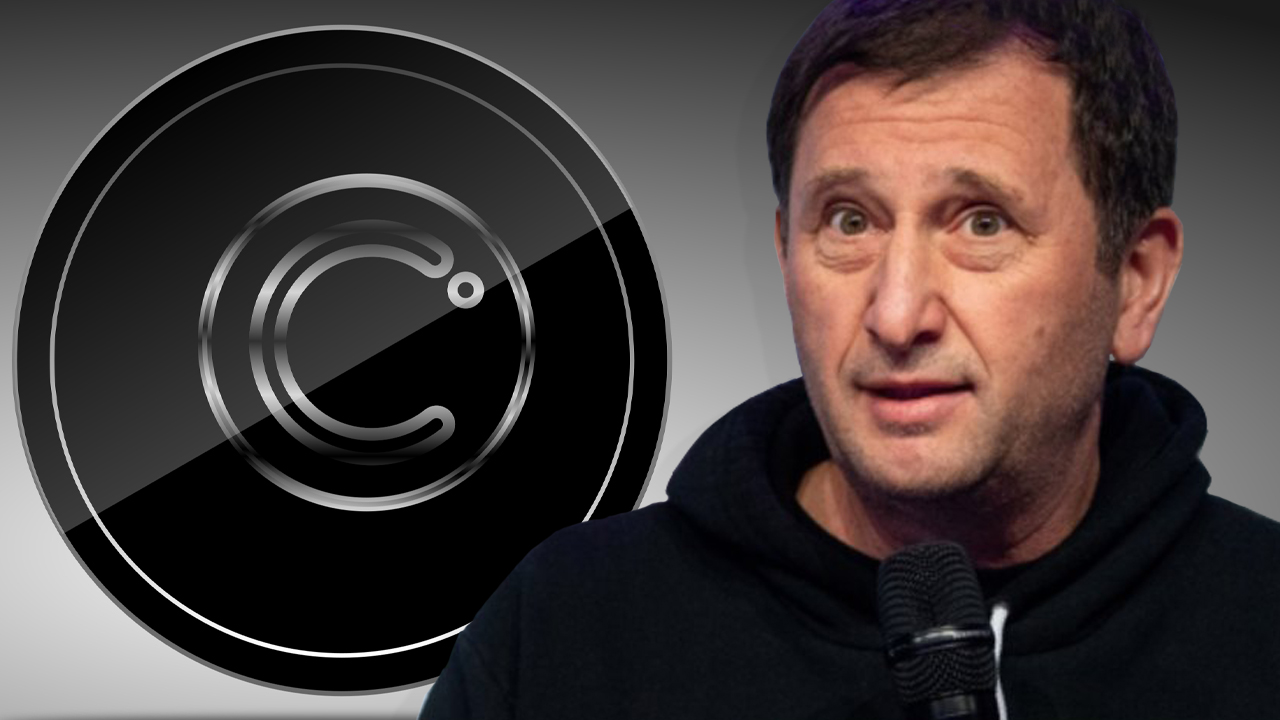

When Celsius requested bankruptcy protection, the submission described that Celsius owed a large sum of funds. July 15, Financial Times (FT) reported reported at «Equitiesfirst [has been] revealed as [the] mysterious debtor to the troubled crypto company Celsius. ” The report claims that two people familiar with the matter revealed that Equitiesfirst is the apparent borrower who owes the crypto lender $ 439 million.

Founded in 2002, Equitiesfirst is an investment company that “specializes in long-term capitalized financing,” according to the company’s website. While Equitiesfirst manages equities, it has also traded in selected cryptocurrencies since 2016. CEO and head of Equitiesfirst Singapore, Johnny Heng, talked about cryptocurrencies in April 2022.

“We used to be pure stocks, until six years ago we started offering loans against cryptocurrency as well, and that activity has really taken off. [in] the last year or two, “said Heng hubbis.com in an interview. A spokesman for Equitiesfirst told FT: “Equitiesfirst is in [an] Ongoing discussions with our client and both parties have agreed to extend our obligations. “

Meanwhile, Celsius Network (CEL) token investors tried to short squeeze the company’s original token well before the company went bankrupt. After the bankruptcy notification, however, CEL fell by 58% against the US dollar before recovering. Statistics recorded July 16, 2022 indicate that despite CEL’s market volatilityFor example, cryptocurrencies have increased by more than 30% in the last 30 days.

Tags in this story

Aave, Bankruptcy, Bankruptcy Protection, CEL, Celsius, Celsius 3AC, Celsius Bankruptcy, Celsius Chapter 11 Bankruptcy, Celsius Network, Celsius Network (CEL), Celsius Restructuring, Celsius Voyager, Chapter 11, Compound, DeFi, Equitiesfirst, Equitiesfirst Times, FT, Reports

What do you think of the report that says that Equitiesfirst has been revealed as the mysterious debtor who owes Celsius millions? Tell us what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is a news editor at Bitcoin.com News and a financial engineering journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 5,700 articles for Bitcoin.com News about the disruptive protocols that are emerging today.

Photo credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the Company nor the author is liable, directly or indirectly, for any damage or loss caused or alleged to have been caused by or in connection with the use of or reliance on the content, goods or services mentioned in this article.