Enter bags of $25 million to fight financial fraud with AI • TechCrunch

Conor Burke spent much of his career in the back office of a major bank in Ireland. His team was tasked with digitizing the onboarding process—especially document-heavy manual review workflows—that were costing the bank millions of dollars each year and failing to catch fraud. According to him, the biggest challenge was figuring out how to remove the human element without compromising risk and fraud control.

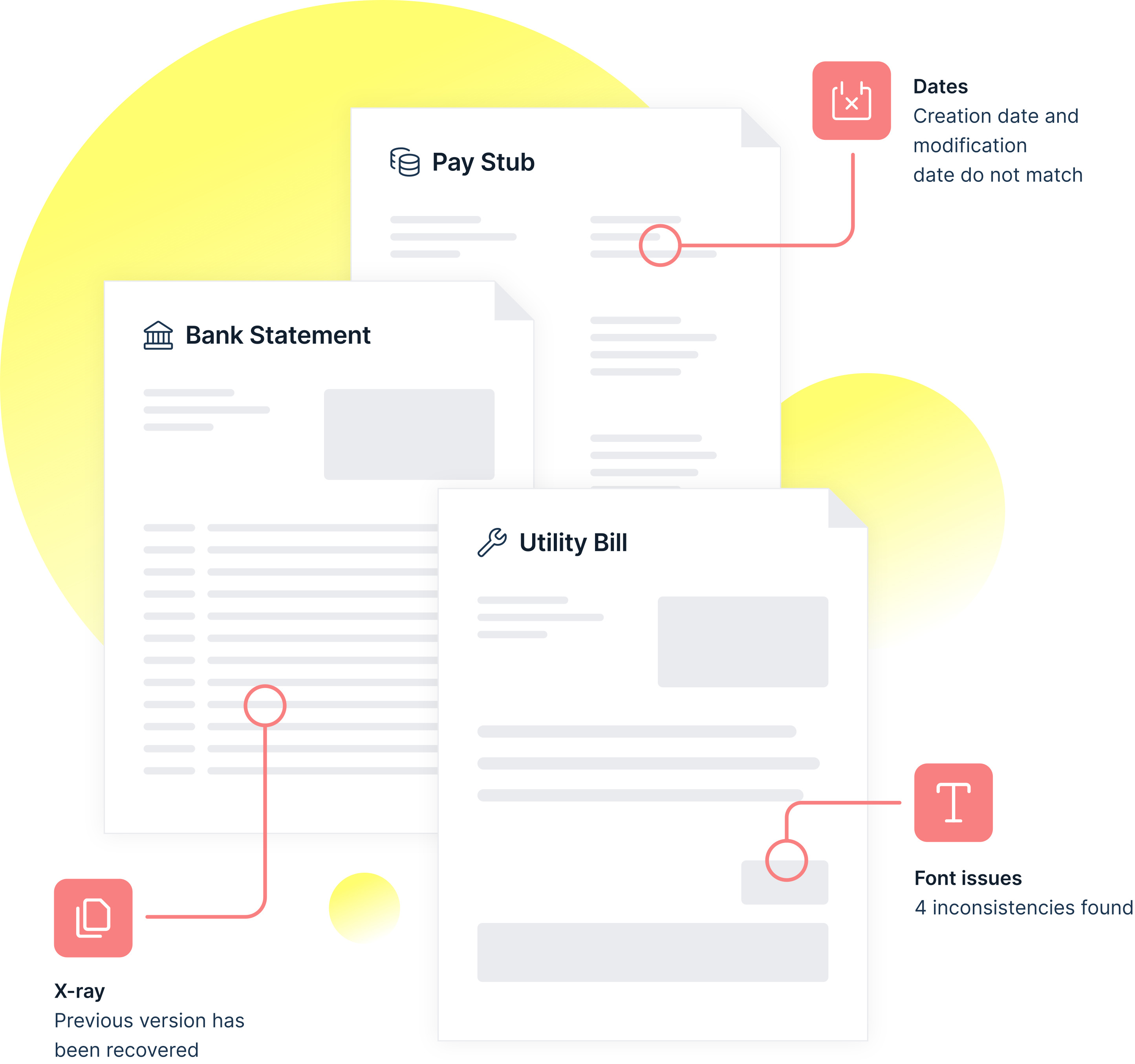

Inspired by this, Burke and his twin brother, Ronan Burke, launched Inscribe, an AI-powered document fraud detection service. Built for fraud, risk and operations teams in the fintech and finance industries, Inscribe taps AI trained on hundreds of millions of data points to return results, says Ronan.

“Tedious document reviews add friction to account opening and underwriting processes, but automation alone is not the answer,” Ronan told TechCrunch in an email interview. “We believe automation without fraud detection is reckless, which is why Inscribe is the total package that helps companies detect fraud, automate processes and understand creditworthiness so they can approve more customers faster.”

Enter analyzes, classifies and data-matches financial onboarding documents, highlighting any differences between the documents delivered and documents recovered using the AI-powered fraud detection. Document details, including names, addresses and bank statement transactions, are automatically digitized to generate individual customer risk profiles that include snapshots of bank statements and transactions.

Last September, Inscribe launched a credit analysis and bank statement automation component that provides most of the data points needed to make lending decisions, including cash flow details from bank statements, transaction analysis and payslip parsing. Ronan claims Inscribe can extract and then return key details including names, addresses, dates, transactions and salaries in seconds.

Image credit: write in

In the features it offers, Inscribe is similar to many of the other anti-fraud tools out there, such as Resistant AI (which raised $16.6 million in October 2021) and Smile Identity (which raised $7 million in July of the same year). However, Ronan argues that it is differentiated by its AI-first approach, which depends on original data collected through previous partnerships with customers.

“We had seen fraud detection and document automation companies in our area try to build a perfect solution right out of the gate without talking to customers – but they have since shut down. They were unable to overcome the cold start problem; they weren’t able to build a product from the ground up because they didn’t have access to the data their customers were using,” said Ronan. “This goes back to the first rule of machine learning: Start with data, not machine learning. If you don’t have a good data set, you’re wasting your time. You’ll end up either choosing the wrong model or training a model on data that doesn’t will work as you expect.”

AI is by no means perfect – history has shown that much to be true. For example, during the pandemic, fraud detection systems familiar with abnormal behavior were confused by new shopping and spending habits. Elsewhere, automated algorithms developed to detect welfare fraud have proven to be error-prone and designed in ways that essentially punish the poor for being poor.

But putting aside the truth of Ronan’s claims, there’s clearly something about Inscribe’s platform that attracts high-profile clients. TripActions, Ramp, Bluevine and Shift are among the start-up’s customers.

Investors, for their part, have been won over. Just this week, Inscribe closed a $25 million Series B funding round led by Threshold Ventures with participation from Crosslink Capital, Foundry, Uncork Capital, Box co-founder Dillon Smith and Intercom co-founder Des Traynor. The infusion brings the startup’s total funding to $38 million, including a $10.5 million Series A round that closed in April 2021.

Perhaps it’s the comparative ease with which Inscribe’s solution can be deployed. As Ronan rightly notes, Inscribe solves the problem of building an in-house fraud detection solution or hiring a large data science team.

“AI and machine learning models benefit from as much data as possible, but each company is limited to only its own data set. So a homegrown solution simply cannot be as effective as one that pulls from a variety of data sources,” said Ronan. “That’s why companies are partnering with document fraud detection solutions instead: Criminals commit fraud in different ways, and these solutions pull data from the entire customer base to identify coordinated attacks and emerging trends more quickly.”

Fear appeals probably help too. A recent survey suggests that the average US fintech loses $51 million to fraud each year, a stat Ronan quoted to me during our interview.

“An increasingly digital, geographically dispersed and faster-paced world makes it harder than ever to know who you’re doing business with – leaving businesses unsure of which potential customers are trustworthy,” Ronan said. “Fintechs have been able to build for an online world, but traditional financial institutions face the challenge of moving away from legacy systems and embracing true digital transformation. And they must do it all while reducing fraud and friction in order to have competitive customer experiences.”

Asked about expansion plans, Ronan says Inscribe will likely double the size of its 50-person workforce in the next 12 to 18 months.