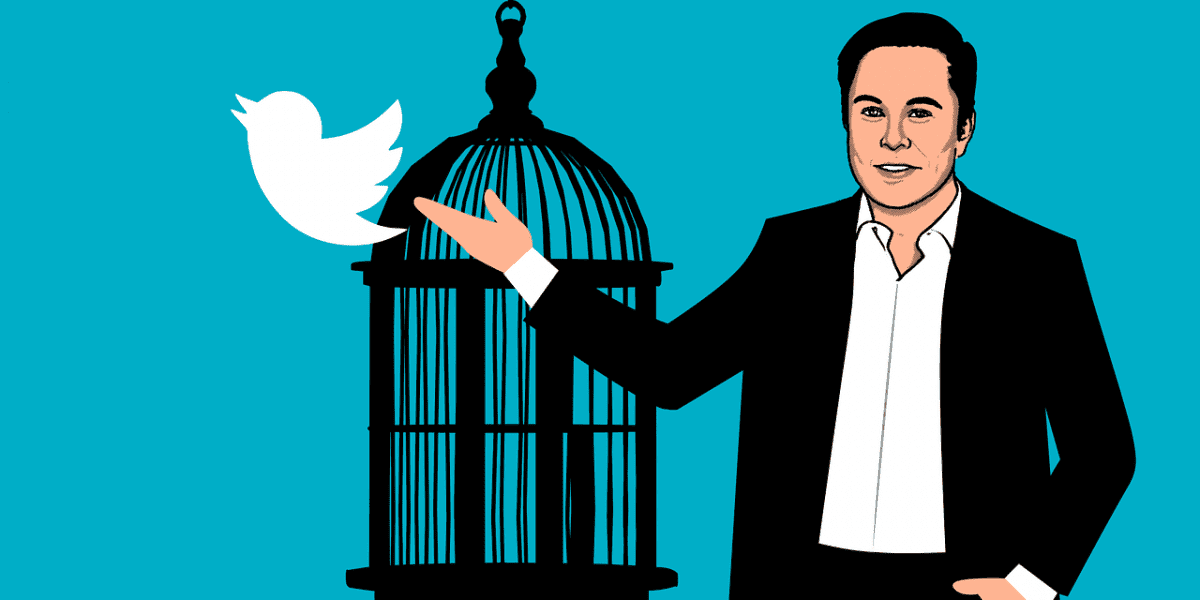

Elon Musk buys Silicon Valley Bank as Bitcoin bounces back

- Following the closure of the Silicon Valley bank, a prominent tech entrepreneur has proposed that Twitter buy the bank and turn it into a digital bank.

- Elon Musk, the current CEO of Twitter, has welcomed the proposal with open arms, revealing that he is very open to the idea.

The cryptocurrency and fintech industry recorded alarming events from various sectors this week. The response to the collapse of various platforms has reflected bullish and bearish sentiments from market observers.

Most recently, a prominent figure in the technology industry has sparked a conversation about what will follow the downfall of one of the leading US-based banks, which is making rounds in the market after it recently closed down.

Min Liang Tan, CEO and founder of Razer started what now looks like a debate about whether Silicon Valley Bank (SVB) can be revived when he suggested that Twitter should look into buying the bank.

Tan also suggested that Twitter should consider taking the bank from a traditional brick-and-mortar bank and turning it into a digital platform. Although he did not elaborate on why taking the bank digital would be beneficial, digital banks are generally known to provide more accessibility and transparency, while maximizing losses.

Twitter can buy Silicon Valley Bank, Elon Musk reckons

Elon Musk, CEO of Tesla, and current head of the microblogging platform Twitter has responded positively to the founder’s comments. Musk welcomed the proposal with open arms and said he was open to the idea.

I am open to the idea

— Elon Musk (@elonmusk) March 11, 2023

In the coming months, it will come as no surprise if Elon Musk moves forward with the idea of buying and revamping the bank. However, for now, the market is still expressing concern about the decline of fintech and crypto-related firms.

The closure of SVB comes not long after Silvergate bank collapsed. Although SVB prioritized technology, it was not entirely pro-crypto.

However, the bank was reported to have bankrolled cryptocurrency hedge fund and venture capital firm Castle. island investment, Pantera, Blockchain Capital and Dragonfly.

The Silicon Valley bank crashed on Friday after it experienced a 48-hour bank run and failed as depositors quickly moved their money out of the bank following SVB’s balance sheet spread.

On Friday, the authorities in the United States cracked down on SVB. The move would lead to a decline in global banking stocks as market participants reacted negatively to the new development.

No spam, no lies, just insight. You can unsubscribe at any time.

The assets of Silicon Valley Bank were seized by US regulators and are now overseen by the US Federal Deposit Insurance Corporation.

SVB was the 16th largest bank in the country. Handelsbanken was headquartered in Santa Clara, California. SVB was branded as a lender to many technological startups before the collapse.

Crypto News Flash does not endorse and is not responsible or liable for the content, accuracy, quality, advertising, products or other materials on this site. Readers should do their own research before taking any action related to cryptocurrencies. Crypto News Flash is not responsible, directly or indirectly, for any damages or losses caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned.