Economist says high prices are fooling Fed hikes and investors

Corbu LLC chief economist Samuel Rines says companies that drive inflation by testing consumers’ tolerance for price increases could make hawkish Fed policy toothless.

On the Bloomberg Odd Lots podcast, Rines said investors who read too much into U.S. economic data for decisions may be following a false narrative.

Companies use macro events to increase prices

Rines added that price increases that contribute to US inflation are caused by companies using macroeconomic events to test consumer tolerance.

He claimed that PepsiCo used its 4% Russian revenue loss from the Ukraine war to excuse double-digit price increases. Competitors Coa-Cola, Dr. Pepper and Snapple soon followed.

According to Rines, flight-themed chicken wing chain Wingstop used rising chicken wing prices to drive up food costs. They pushed for increases even when commodity prices fell 50%, testing how much the consumer would pay. He said Central American businesses, such as Cracker Barrel, are testing consumers with wages and higher menu prices.

While the occupancy of hotels and cruise ships has not returned to pre-pandemic levels, Rines points out that the price per room and booking volume has increased significantly.

Are crypto investors being spooked by a false narrative?

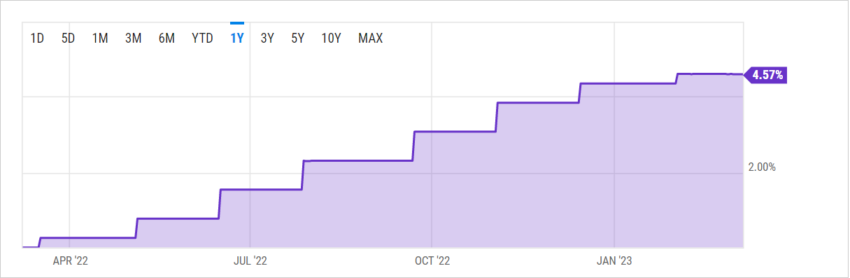

Speaking to congressional committees earlier this week, Federal Reserve Chairman Jerome Powell said the Fed may need to revise its terminal rate to get inflation back to 2%, with CME’s Fed Watch tool raising the likelihood of a 50 basis point hike in March. 2023.

He also added that the Fed may adjust the pace of interest rate increases if inflation defies rising interest rates.

However, Rhines argues, ignoring rampant for-profit crime may mean the Fed never gets out of the rat race. Consequently, even crypto investors can adjust their portfolios based on a mirage. The reaction is seen in market dumps when the inflation figures come in.

“Because it’s going to be very difficult in my mind for the FOMC to get out of, we call it 25 [basis points] for life, until they actually start seeing companies reduce prices, he told hosts Joe Weisenthal and Tracy Alloway.

“It’s going to be easy to read into CPI and PCE readings a little bit over the next few months and be really excited that maybe the Fed doesn’t have to go to 550, 575, and then suddenly get caught up a little bit on guard as companies continue to push prices,” he warned.

Bitcoin critic Peter Schiff also argues that interest rate hikes are pointless if they don’t encourage people to keep saving.

Chairman Powell had previously said that the US consumer price index and the index for personal consumption will influence by how many basis points the Federal Reserve will raise the federal funds rate at the next meeting of the Open Markets Committee.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.