ECB asks EU banks to adopt new crypto risk policy

The European Central Bank has told EU banks with crypto exposure to hold capital reserves according to crypto’s risk assessment before crypto-related bills become law.

Banks must comply with draft standards until at least 2025

The ECB says member banks wishing to engage in crypto business before guidance from the Basel Committee on Banking Supervision (BCBS) becomes law must comply with the risk framework.

According to the central bank, these business enterprises must be in line with the bank’s risk threshold and corporate goals determined by the board.

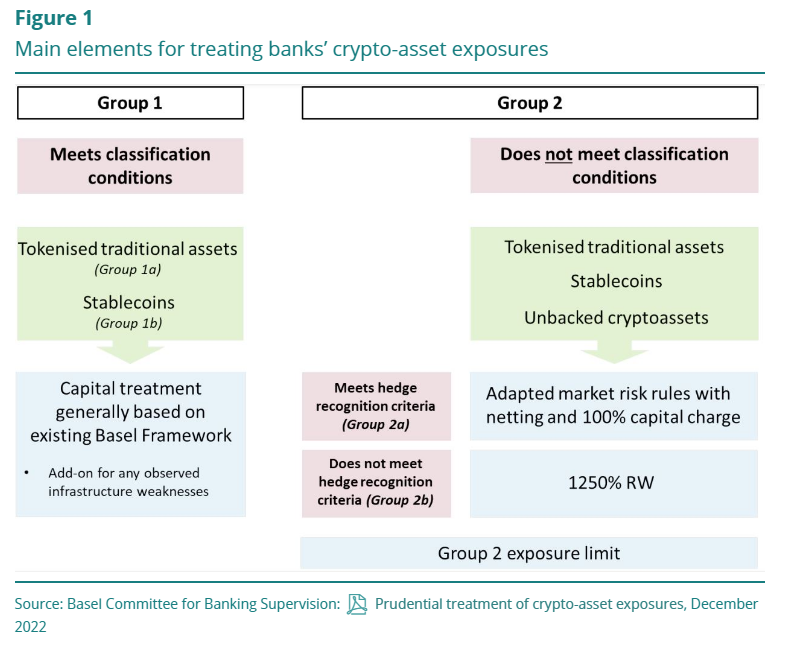

The new Basel standards encourage EU banks to only hold so-called unsupported crypto assets worth 1% of their Tier 1 capital and ask them to include crypto in their stress test analyses.

Non-backed assets include stablecoins that are not backed by reserves, tokenized real-world assets, and private crypto assets such as Bitcoin.

The Basel framework assigns unbacked crypto the highest risk score of 1,250%, increasing the capital requirements for banks to do business with them.

The European Union and other Basel jurisdictions will codify the requirements of the Basel supervisory framework into law by January 1, 2025. Until then, however, banks looking to branch into crypto must comply with the draft standards.

“The BCBS standard is not yet legally binding pending transposition in the EU. However, should banks wish to engage in this market, they are expected to follow the standard and take it into account in their business and capital planning,” the ECB said.

The new Markets-in-Crypto-Assets bill defines crypto business lines that EU banks can engage in, among other things. After a translation delay, the final draft of the bill will be available in February 2023.

EU launches Blockchain Sandbox to connect innovators with regulators

The European Commission recently launched the Blockchain Regulatory Sandbox on February 14, 2023, to support banks’ experimentation with Distributed Ledger Technologies (DLT). Blockchains are a type of distributed ledger technology. The new sandbox will connect technology innovators with regulators to ensure new projects are legal.

The projects will span multiple disciplines, including supply chains, identity verification and finance. Up to 20 projects will be selected annually on the basis of their business case, legal relevance and compliance with EU guidelines. Applications for the first wave of projects will be open until 14 April 2023.

According to the ECB, several banks have already tried DLT to improve efficiency, reduce costs and offer new products to customers.

On January 31, 2023, the European Investment Bank issued a £50 million ($53 million) digital bond denominated in pounds sterling on a permissioned blockchain.

Although not a bank, German manufacturing giant Siemens recently launched a tokenized euro-denominated bond on the Polygon blockchain. According to Siemens, this type of issuance eliminates central clearing and allows the firm to sell bonds directly to customers.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.