Early bulls meet the butcher

- Bitcoin price continues to move sideways after the 16% selloff that occurred last week.

- Ethereum price edges near a key level of interest. More upside should not be ruled out.

- Ripple’s XRP price is likely to liquidate bulls that entered the market at the beginning of the summer.

The crypto market is showing concerning signals under the hood as retail traders place their bets on the next directional move. Based on analysis on the chain, a further drop is highly likely. For this reason, being an early bull is bad.

Bitcoin price needs work

The Bitcoin price is currently auctioning at $21,561 as a sideways range follows the 16% selloff that occurred on Friday 19 August. The Volume Profile Index remains sparse, signaling that high-cap players lack confidence. It is likely that the current trading selection is retail traders looking to latch on to the next directional move.

Bitcoin price hovers above the 50% Fibonacci level around the entire bull run achieved this summer. Traders who see this have a legitimate reason to want to engage in an early buy, but based on the lack of volume and weak price action, it’s bad to be an early bull.

Traders from last week’s bearish trade setup are still profitable and the initial target of $18,900 has yet to be breached. Shifting the risk to profit would be very risky, as a fractal wave of Bitcoin’s past performance could result in a liquidity hunt tag as high as the $23,000 price level. Invalidation of the bearish trend remains at $27,000.

BTC/USDT 4-hour chart

In the following video, our analysts dive deep into Bitcoin’s price action, analyzing key levels of interest in the market – FXStreet Team

Ethereum price is worrying

The Ethereum price is currently auctioned at $1,671. Traders have been keeping a close eye on the smart contract giant as a nice pullback is speculated after the steep 25% decline since the highs of $2,030. Since the August 20 low of $1,523 was established, the ETH price has already rallied 10% .

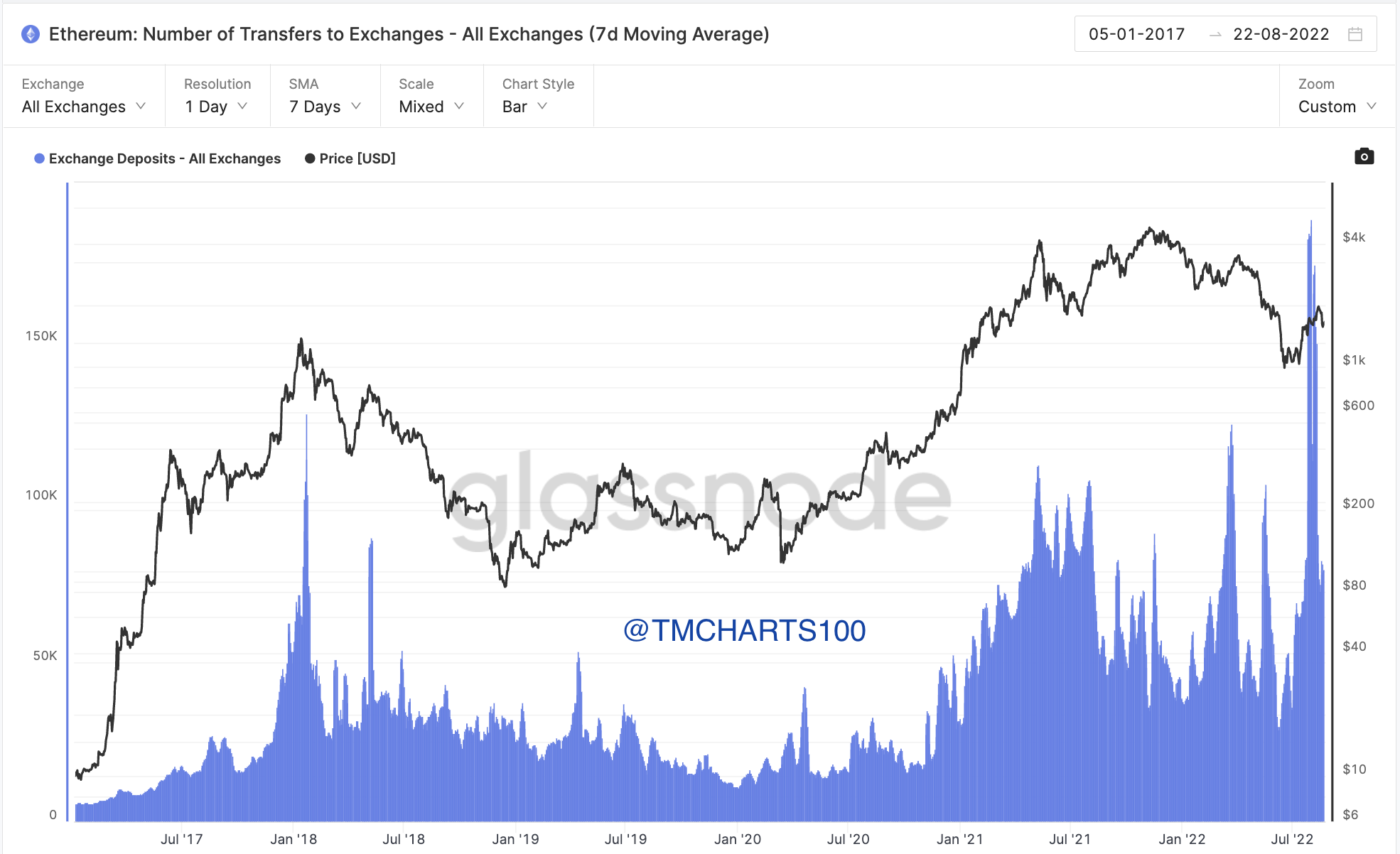

Glassnode’s indicator of the number of transfers to exchanges has witnessed the largest influx of deposits in the past four years. At 174,549,000, the influx of transfers is almost double the amount deposited compared to the previous influx of deposits when Ethereum was trading near record highs of $4,000 in May 2021.

Due to the massive influx of transfers, the Ethereum price is a very risky knife to capture. Invalidating the bullish impulse wave is a breach of the $1250 level. The invalidation breach could set up a sweep-the-lows event targeting $970 in the near term.

Glassnode’s number of transfers to exchange indicators

ETH/USDT 4-hour chart

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key levels of interest in the market – FXStreet Team

The XRP price is disappointing

Ripple’s XRP price is currently auctioned at $0.34. The bears seem to be in full control of the digital remittance token as the sideways consolidation continues below the 8- and 21-day simple moving averages.

XRP price is likely to head south as the volume profile dictates bearish force. In addition, the relative strength index went through fairly bought territories on intra-hour time frames. A retest-and-rejection signal from the 21-day moving average currently positioned at $0.354 could act as the catalyst to induce a further 15% decline to $0.29 in the near term.

XRP/USDT 4-hour chart

In the following video, our analysts dive deep into the price action of Ripple, analyzing key levels of interest in the market – FXStreet Team